Passive income is the holy grail for many of us. It’s something that could give us the opportunity to take more time off work and spend more time with our families. It’s also something that could simply help us pay bills and get by in life.

Regardless of our reasons, passive income can be achieved by investing in stocks and shares. Compared with the passive income ‘hacks’ I see pushed on social media, investing allows us to achieve our goals in a relatively low-risk environment.

So, what if I had £20,000 stashed aside? While that might sound like a good chunk of money, could I invest that and turn it into £20,000 of annual passive income? Let’s take a look.

It pays to be boring

It’s only come to my attention recently that my proclivity to put money aside and spend very little on myself is a little boring to some. However, it’s the basis of a strategy that has served many successful investors well.

So, let’s imagine I decide to invest all of this £20,000 into stocks and shares through an ISA — an ISA is simply a wrapper that protects our investment from tax and is available on all major investment brokerages.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

I could then look to build a portfolio using my £20,000 as starting capital and by making small monthly contributions.

Sound investments

Many novice investors are drawn in by the prospects of big returns on volatile stocks. But that frequently leads to losses.

However, when we make investment decisions based on strong fundamentals, quantitative analysis, and macroeconomic data, we stand a much better chance of growing our portfolios.

Novice investors may look to make high single-digit returns every year, while more experienced investors may aim for double-digit returns.

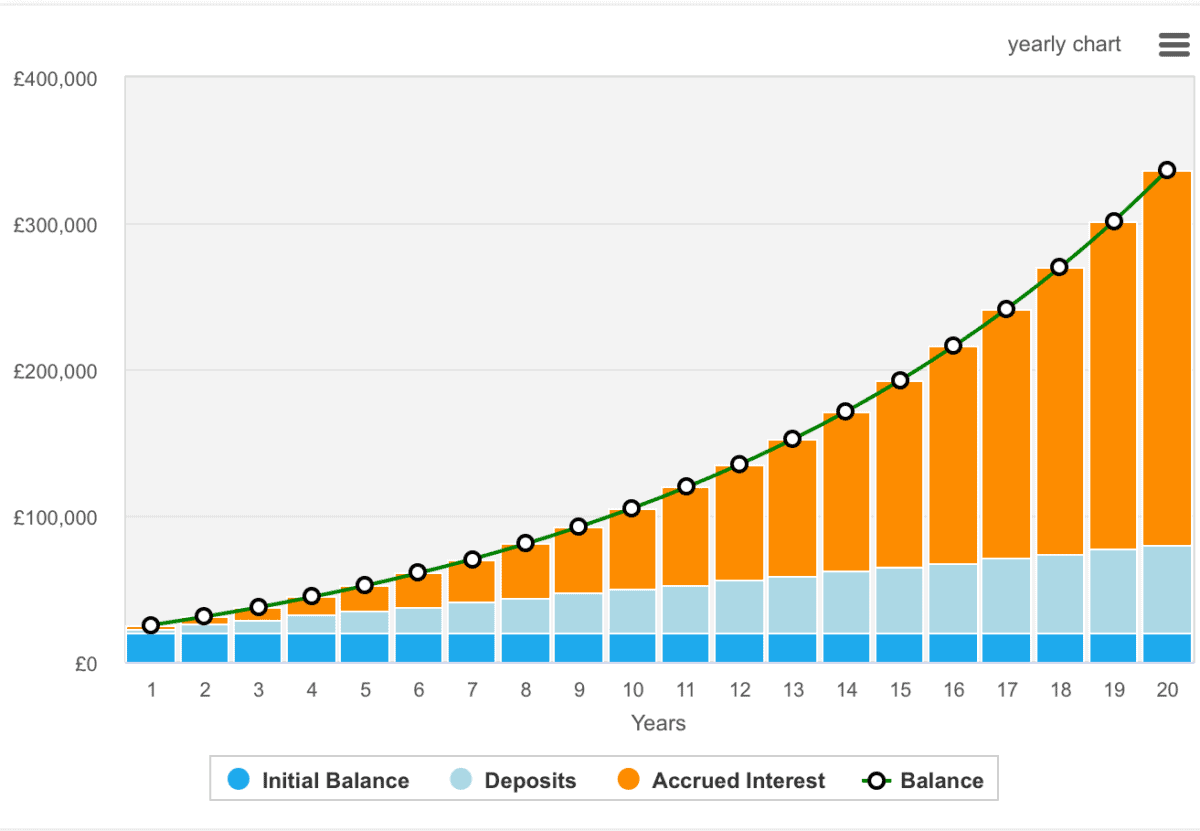

The above example shows how £20,000 could grow if I achieved 10% annualised growth and contributed at additional £250 monthly from my salary.

In short, in less than 20 years, my portfolio would grow by more than 10 times. And towards the end of this period, I’d suggest that by investing in high-yielding dividend stocks, I could earn more than £20,000 annually in passive income.

Where to invest

Investors with more time on their hands might like to pick all of their own investments. And this can be particularly time consuming as diversification is always important.

However, for those of us seeking a slightly more hands off approach, a fund or ETF, such as the iShares US Technology ETF (NYSEMKT:IYW), might be a good place to start.

The fund invests in some of the biggest US companies in the tech space, and it’s traded like any other stock, meaning we can buy more or sell at any time.

US tech stocks have certainly seen a lot of attention over the past 12 months, and they’re becoming more expensive given growth expectations. This presents some degree of risk, especially with a major event like the US election just round the corner.

However, let’s think about the long run. US tech has outperformed its global peers decade after decade, and these mega-cap companies like Meta and Nvidia are in pole position to dominate the artificial intelligence revolution.

Very few people bet against US tech and win.