Looking for top growth stocks and exchange-traded funds (ETFs) to buy next month? Here are two possible star buys that have recently grabbed my attention. I think they’re worth considering.

HSBC

Banking giant HSBC (LSE:HSBA) has enjoyed double-digit earnings growth in recent years. And despite China’s slowing economy, it’s tipped to follow this up with a 9% bottom-line rise in 2024.

This consequently leaves the FTSE 100 share on a forward price-to-earnings (P/E) ratio of 7.1 times. It also trades on a price-to-earnings growth (PEG) ratio of 0.8.

A reminder that any reading below 1 suggests a share’s undervalued.

On the one hand, I can understand the low valuation on HSBC shares. China’s economy’s locked in a period of low growth. And as in previous years, this may continue despite fresh monetary stimulus.

In addition, with interest rates steadily falling, margins across the banking sector could face increased downward pressure.

However, I also believe HSBC has considerable growth potential that isn’t reflected by its current cheapness. So I think long-term bargain hunters should give the bank serious consideration.

Driven by a mix of population growth and improving personal wealth, demand for financial services is tipped to boom across its Asian marketplaces. The outlook’s especially bright for the bank’s wealth management division, an area where it’s been investing heavily.

HSBC strong balance sheet gives it a platform to keep spending for growth too. Its CET1 ratio was 15% in June, ahead of the bank’s 14-14.5% target.

VanEck Rare Earth and Strategic Metals ETF

Growth investors with higher risk tolerance may also wish to consider the VanEck Rare Earth and Strategic Metals ETF (LSE:REGB).

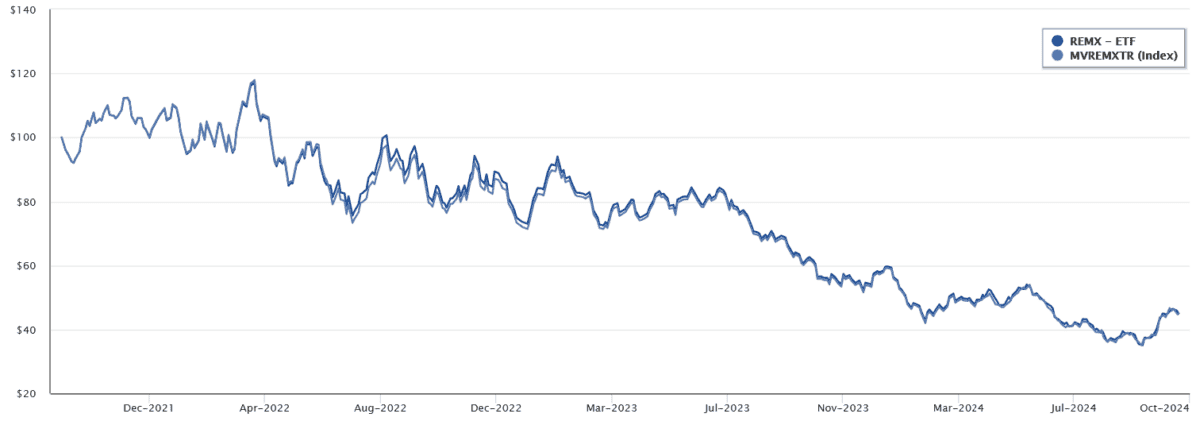

As the chart shows, the fund’s slumped in value as disappointing electric value (EV) sales more recently have clouded the industry’s growth outlook. It means that, since its inception in 2021, the ETF has delivered a negative return of 23.3%.

The EV industry uses a vast amount of rare earths, where they’re used to manufacture engine magnets and batteries. This explains the fund’s disappointing performance.

However, I think it could be on course to rebound. Many rare earth producers (and especially lithium stocks) look oversold, which could lead to a sharp re-rating when market confidence improves. Fund holdings such as Albemarle and MP Materials for instance look cheap to me.

Demand for so-called strategic metals is tipped to soar over the next decade which, in turn, could pull the ETF higher. McKinsey & Company analysts expect consumption of rare earth elements to surge 125% between 2023 and 2035.

Lithium demand meanwhile, is expected to boom 475% over the period.

Demand growth won’t just be driven by the EV industry either. The consumer electronics, renewable energy, aerospace and robotics segments will also all suck up huge amounts of metals.

With diversification across 24 mining shares, VanEck’s ETF means its investors can spread their risk. There may be more volatility in the short term, but over the long haul it could deliver excellent returns so is worth researching now.