Move aside Rolls-Royce and Fresnillo — this small-cap biotech share is skyrocketing past some of the UK’s leading growth stocks. Up 100% this year, OXB (LSE: OXB) is taking no prisoners as it fights to recover its losses from 2022.

Between November 2021 and October 2022, the share price crashed 78%, falling from a high of £16.78 to almost £3 per share. The price continued to fall through 2023 but has now recovered to £4.18 — the highest it’s been in over a year.

So what’s next for the stock?

Cutting-edge biotechnology

Previously known as Oxford Biomedica, OXB is a relatively small £442m stock listed on the FTSE All-Share index. The Oxford-based biopharmaceutical company focuses on cell and gene therapy, specialising in viral vector manufacturing. It has over 25 years of experience working with some of the leading pharmaceutical and biotech firms globally.

Recently it shifted to a pure-play contract development and manufacturing organisation (CDMO), aiming to position itself as a leader in viral vector services, helping other firms develop and commercialise gene therapies.

Over the past year, its portfolio grew to include 37 clients and 48 programmes, focusing on viral vector types like lentivirus and adeno-associated virus (AAV). The value of these contracts is approximately £94m as of 31 August.

Shaky financials

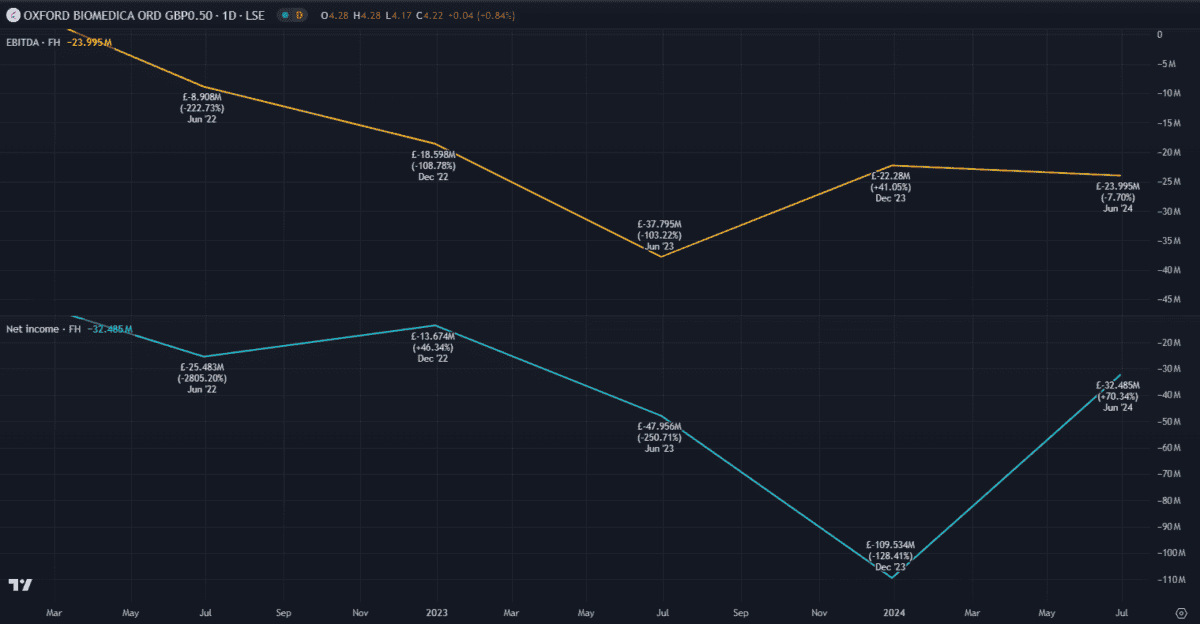

Last year was not kind to OXB, with the share price falling 50%. In the first half of 2023, it reported a 33% drop in revenues compared to the same period in 2022. The decline was primarily due to the non-recurrence of AstraZeneca Covid vaccine manufacturing. It also posted an operating EBITDA loss of £33.7m, higher than the £5.8m loss in the previous year. This was attributed to inflation combined with higher expenses related to its new Oxford Biomedica Solutions division.

Things seem to be improving in 2024, although first-half earnings were still somewhat disappointing. Both revenue and earnings per share (EPS) missed analyst expectations, by 4.7% and 110%, respectively. Although it posted a net loss of £32.5m, this was a 32% improvement on H1 2023.

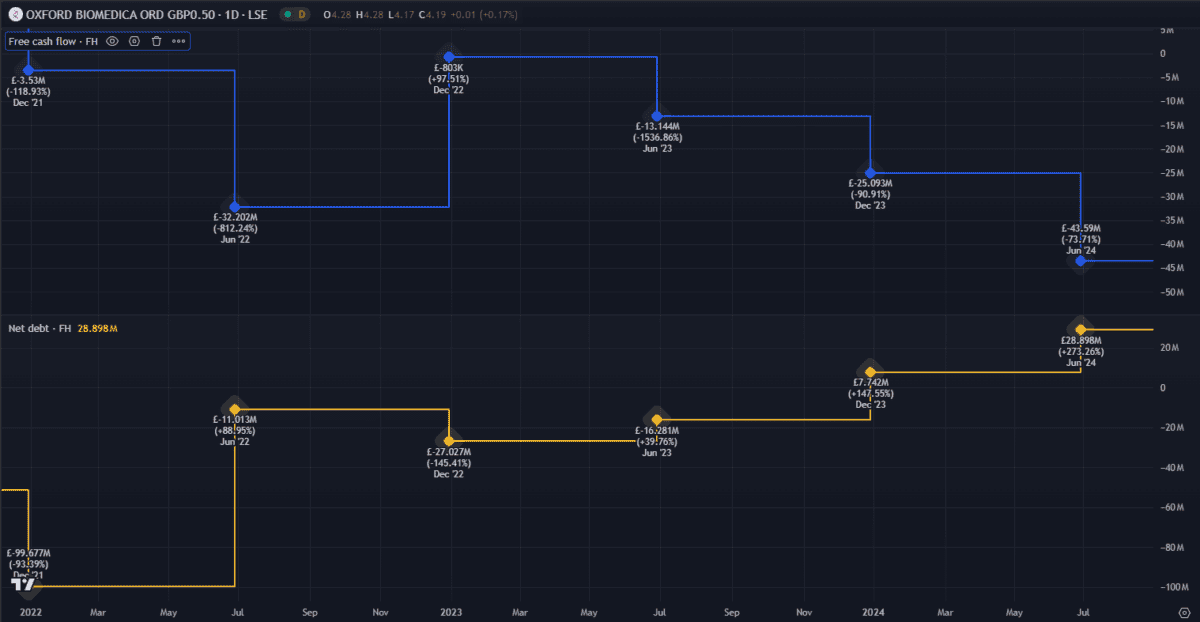

The balance sheet looks okay for now, with a debt-to-equity ratio of 55.8%. However, it’s burning through cash and piling on debt, possibly due to increased operational expenses and rising bioprocessing costs.

Cash and liquidity are key areas to watch as the company expects to break even in EBITDA by the end of 2024. In an announcement made in September during the rebranding to OXB, new CEO Dr. Frank Mathias said it aims to improve its financial standing by focusing on its role as a CDMO.

It’s unclear how well the change to a CDMO will pay off, but the price is already reacting positively. However, the loss of a large client like Novartis could easily turn things around. It already faces tough competition in the CDMO market — any drop in performance could result in lost contracts.

If things go well, the transition should provide more stable, long-term revenue as opposed to the volatile revenues from internal R&D. I expect it will continue to do well so if I weren’t already a shareholder, I’d happily buy the stock today.