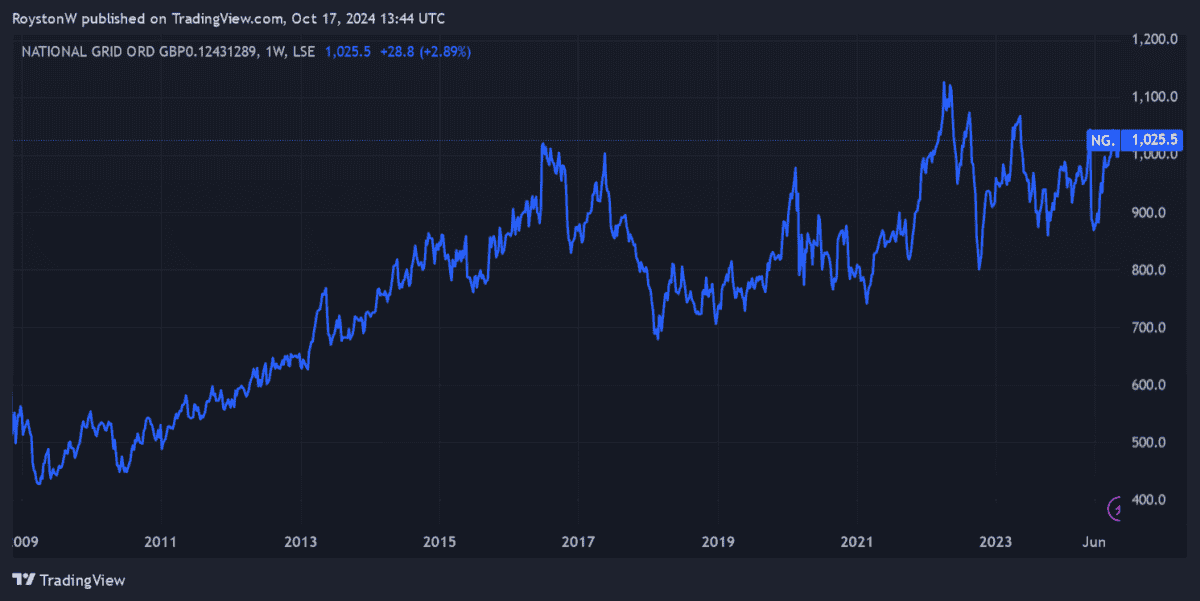

National Grid (LSE:NG) offers one of the largest dividend yields on the FTSE 100, above 4.5%. Utilities stocks like this are often popular with income seekers, as their defensive operations give them excellent earnings visibility, and therefore the means to pay a stable dividend over time.

However, this hasn’t been the case with National Grid more recently. More specifically, it’s been forced to cut cash rewards for this financial year (to March 2025) to raise funds for future investment.

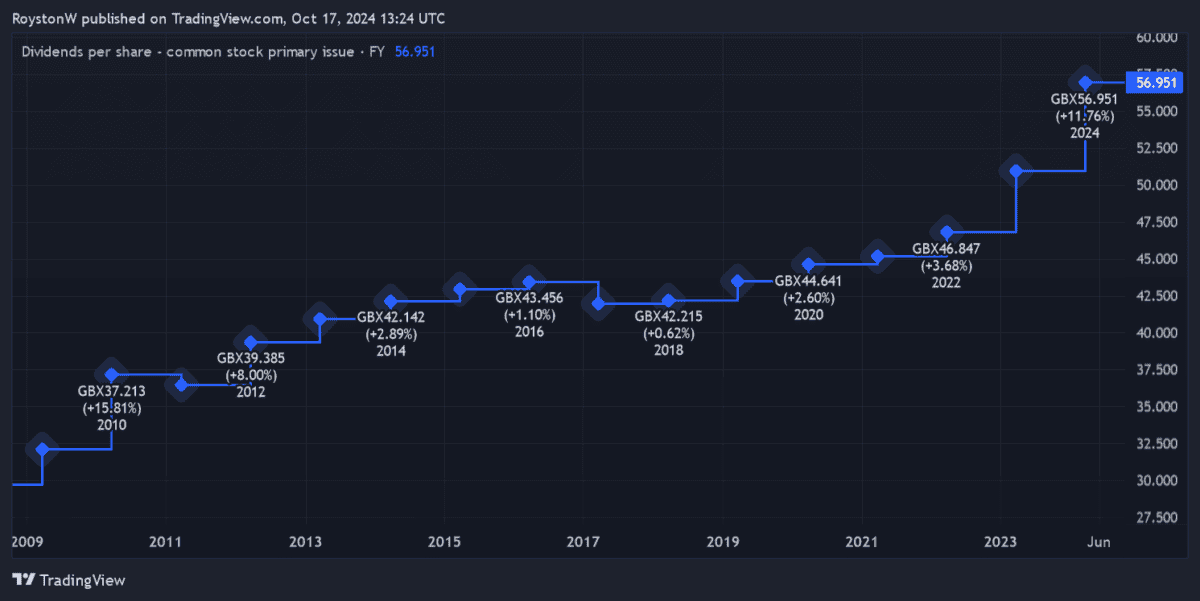

In fact, the power grid operator’s planned dividend reduction this year means it would have cut payouts three times since 2010, as the chart below shows.

The good news, however, is that City brokers think dividends on National Grid shares will rebound immediately following this year’s cut.

With this in mind, how much passive income could I make with a £10,000 investment today?

Growing yields

To quickly recap, National Grid’s dividend per share for this year will drop following its £6.8bn share placing in May. It issued new shares to help it fund a £60bn five-year growth drive to decarbonise the UK’s power network.

City analysts think the total dividend will fall 20% year on year, to 46.78p per share. But they also believe dividends will rise thereafter, in line with National Grid’s plans. The company intends to increase payouts in line with the rate of consumer price inflation including owner occupiers’ housing costs (CPIH).

| Financial year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 46.78p | -20% | 4.6% |

| 2026 | 47.78p | 2% | 4.7% |

| 2027 | 49.18p | 3% | 4.8% |

Even if dividends fail to rise again beyond 2026, I could make a healthy passive income with a £10,000 investment today, if these estimates are correct.

A £1,683 second income

If I invested that lump sum today, I should make £480 in the 12 months to March 2026.

This would become £4,800 over a 10-year horizon. And over 30 years I could net a very healthy £14,400.

However, I may have a chance to make an even better second income over that time. How? By reinvesting any dividends I receive, and thus growing my pot exponentially thanks to the mathematical miracle of compounding.

This strategy would make me £6,145 over 10 years, and £32,086 during the course of three decades. Added to my £10,000 initial investment, my portfolio could be worth a total £42,086, assuming that National Grid’s share price remains stable.

If I then chose to draw 4% of this amount down, I’d have an annual passive income of £1,683.

A solid pick?

Given National Grid’s growth plans, there’s no guarantee that dividends won’t fall again. The expensive nature of its operations also means future payouts could be in peril.

But over the long term, I’m optimistic that dividends could grow strongly, underpinned by the firm’s plan to grow its asset base by 10% a year. This could also lead to healthy share price gains and a robust overall return.

National Grid’s investors haven’t had an easy time of late. However, on balance, I still think it’s a dividend stock worth serious consideration today, underpinned by its excellent defensive qualities.