Legal & General Group‘s (LSE:LGEN) been one of the FTSE 100‘s hottest dividend shares in recent years.

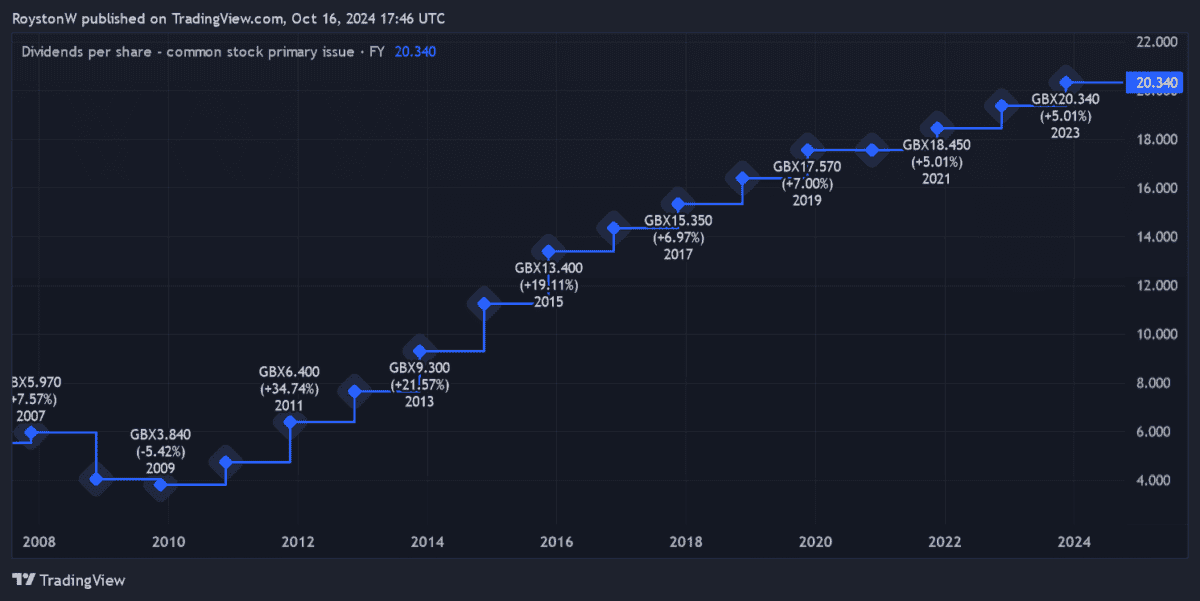

The financial services giant hasn’t just hiked annual payouts almost every year since the 2008/2009 financial crisis (as shown below), but its dividend yields have also trounced the Footsie average over the period.

Dividends are never, ever guaranteed. But there’s good news for owners of Legal & General shares like me. City analysts are tipping the company to pay a large and growing dividend through to 2026, at least.

Using a £10,000 investment today, how much passive income could I generate?

9.8% dividend yield

As an asset manager, life insurer and retirement product provider, earnings here can disappoint when consumers cut back and interest rates rise. Indeed, these factors contributed to double-digit earnings declines in both of the past two years.

However, the company’s rich balance sheet means it’s been able to keep hiking dividends. In 2023, the annual dividend on Legal & General shares rose 5% to 20.34p per share.

Encouragingly, City analysts think cash rewards will keep rising through to 2026 at least, as indicated in the table below.

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 21.32p | 5% | 9.3% |

| 2025 | 21.83p | 2% | 9.5% |

| 2026 | 22.36p | 2% | 9.8% |

These forecasts are in line with Legal & General’s plans. And as you can see, dividend yields sail above the historical FTSE 100 forward average of 3-4%.

I’m expecting dividends to continue rising over this period too. But even if dividends fail to grow beyond 2026, a £10,000 lump sum investment could still provide me with a monthly passive income above £600.

£623 a month

If broker estimates are accurate, I’d make £980 in dividend income in 2026, and £9,800 over a decade. Over 30 years, I’d enjoy a £29,400 passive income.

But I could make even more if I were to reinvest these shareholder payouts. Thanks to the mathematical miracle of compounding, after 10 years, I’d have generated £16,539 in dividends.

And after 30 years, I’d have made a total passive income of £176,913, more than six times the £29,400 I’d have made without reinvesting.

After adding my £10,000 initial investment, my portfolio would be worth £186,913 (assuming no share price growth). If I then drew down 4% each year, I’d have an annual passive income of £7,477 and a monthly one of £623.

A top pick?

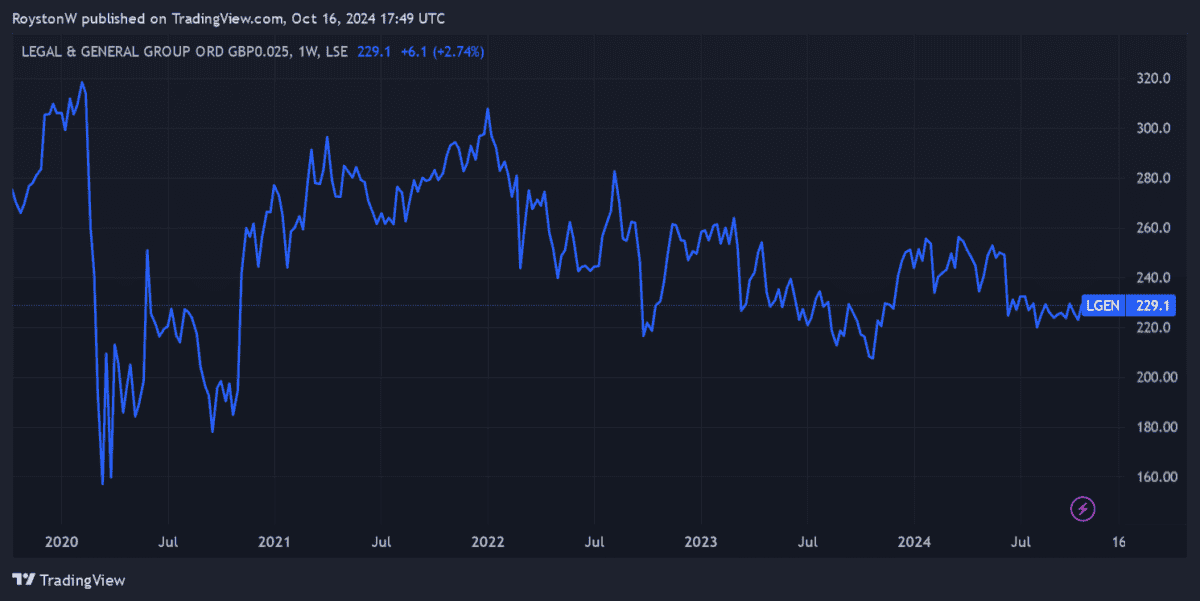

Legal & General’s share price has struggled for traction since late 2022, as shown above. This reflects the impact of higher interest rates — which remain a threat going forwards — on its trading performance.

However, over the next 30 years, I’m expecting the business to deliver healthy share price gains and abundant dividend income, driven by changing demographics. And so I might have an even bigger passive income to live off than that £623 mentioned above.

As long as Legal & General’s balance sheet remains robust, it’ll be able to continue paying large dividends and invest for growth. Things certainly look good right now, with the firm targeting £5bn-£6bn worth of operational surplus cash generation between 2025 and 2027.

I think Legal & General shares are worth a serious look from dividend investors.