UK shares have performed strongly over the past year. Since October 2023, the FTSE All-Share index, which accounts for 98% of equities (by value), has risen 9%.

But I’ve noticed a few warning signs that this might not last. And as someone who’s heavily invested in the UK stock market, this makes me nervous.

Disappointing earnings

For example, last week (11 October), Hays (LSE:HAS) — “the world’s leading recruitment experts” — issued a downbeat trading update.

During Q3 2024, net fees were down 15%, compared to the same period in 2023. The fall was 20% in its UK/Ireland division. Worse, permanent employment income suffered a 21% drop.

Market conditions were described as “tough”, with companies taking longer to hire.

And even though I don’t own shares in Hays, I believe its results are a warning sign that the UK economy might not be in a good state. I think the performance of recruitment agencies is a barometer for the health of the wider economy. If business leaders don’t have confidence they’re not going to hire new staff.

Of course, it may be the case that Hays is unrepresentative of the market.

However, Page Group — another FTSE 250 recruitment company — painted a similar picture in August, when it reported its half-year results to 30 June 2024. It said the market was “tough” and reported a 13.1% fall in revenue. Basic earnings per share fell 61%.

Falling out of fashion

The luxury goods market is also showing signs of struggling.

This is often the first to be affected when there’s trouble ahead. Burberry issued a profits warning in July and replaced its chief executive. Aston Martin Lagonda has cut its sales forecast this year by 1,000 cars.

If that wasn’t enough, the nation’s finances appear to be in bad shape.

According to the Institute of Fiscal Studies, the Chancellor might need to fill a ‘black hole’ of anything up to £25bn, when she delivers her first budget on 30 October.

The Guardian claims that the Treasury is modelling an increase in capital gains tax of up to 39%. But this could encourage investors with deeper pockets to take their money elsewhere.

To add to the gloom, the Prime Minister’s refused to rule out an increase in employer’s national insurance contributions. There’s even talk of a ‘windfall tax’ on Britain’s banks. Whatever the rights or wrongs of these policies, they’re not going to boost investor sentiment.

To compound matters, figures released on 11 October show that the UK economy is growing, but not by very much.

There’s too much despondency around for my liking.

Does it really matter?

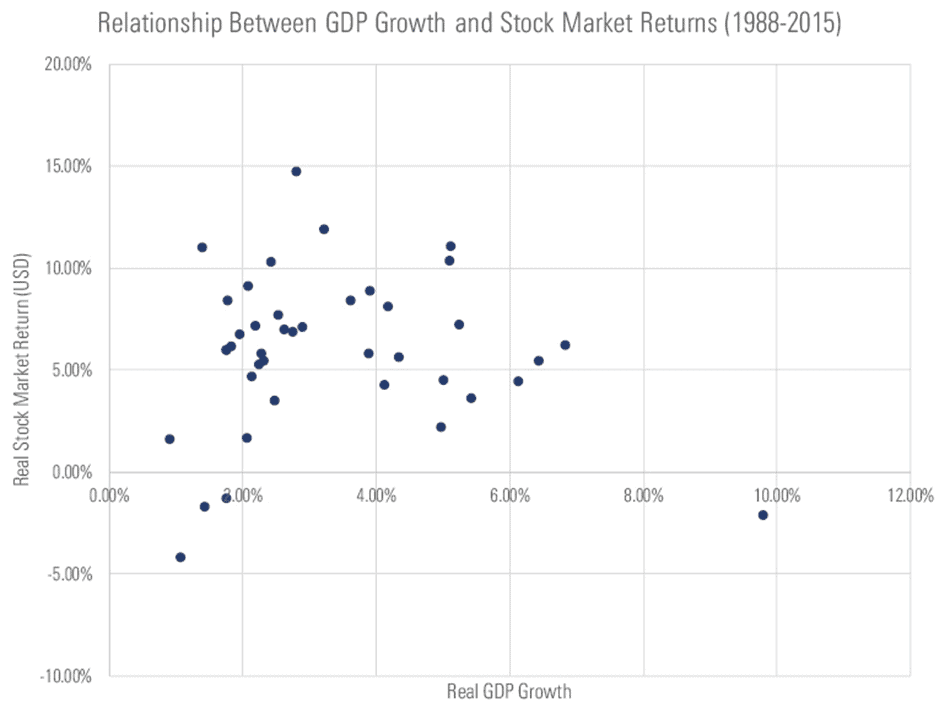

However, many academic studies have found there’s little correlation between economic growth and the performance of the stock market. In fact, Jay Ritter of the University of Florida, found an inverse relationship.

Alex Bryan looked at returns from 1988 to 2015, in 41 countries. His findings support Ritter’s conclusion (see chart below).

Indeed, UK equities are dominated by the FTSE 100, whose members earn approximately 70% of their revenue from overseas. This helps mitigate any issues caused by problems back home.

It sounds as though I’m guilty of over-thinking things. I need to remind myself that successful investing requires taking a long-term view and ignoring the ‘lumps and bumps’ that come along from time to time.