Greggs‘ (LSE: GRG) shares have fallen 13% in the past month. This flaky run comes after the FTSE 250 bakery chain reported a slowdown in sales in the third quarter.

Despite this pullback, the stock’s still returned 78% over five years, including dividends. That market-beating gain’s been driven by a 75% increase in the firm’s revenue and a more than doubling of profits.

But what about the future? Here are the latest growth forecasts for the next few years.

City estimates

If forecasts prove correct, Greggs’ revenue and earnings will keep chugging higher. This could lay the foundations for further share price growth.

| Year | Revenue | Annual Growth |

|---|---|---|

| 2024 | £2.03bn | 12.2% |

| 2025 | £2.23bn | 9.9% |

| 2026 | £2.44bn | 9.4% |

| 2027 | £2.69bn | 10.2% |

We can see that Greggs is expected to grow its top line around 10% on average over the next few years. Most retailers would snap your hand off if you offered them that steady growth outlook.

City analysts also anticipate that earnings per share (EPS) will also experience healthy growth, leading to adjustments in the forward-looking price-to-earnings (P/E) ratio.

| Year | EPS | P/E ratio |

|---|---|---|

| 2024 | 135p | 20.4 |

| 2025 | 149p | 18.5 |

| 2026 | 161p | 17.1 |

| 2027 | 183p | 15.0 |

The baker rolls on

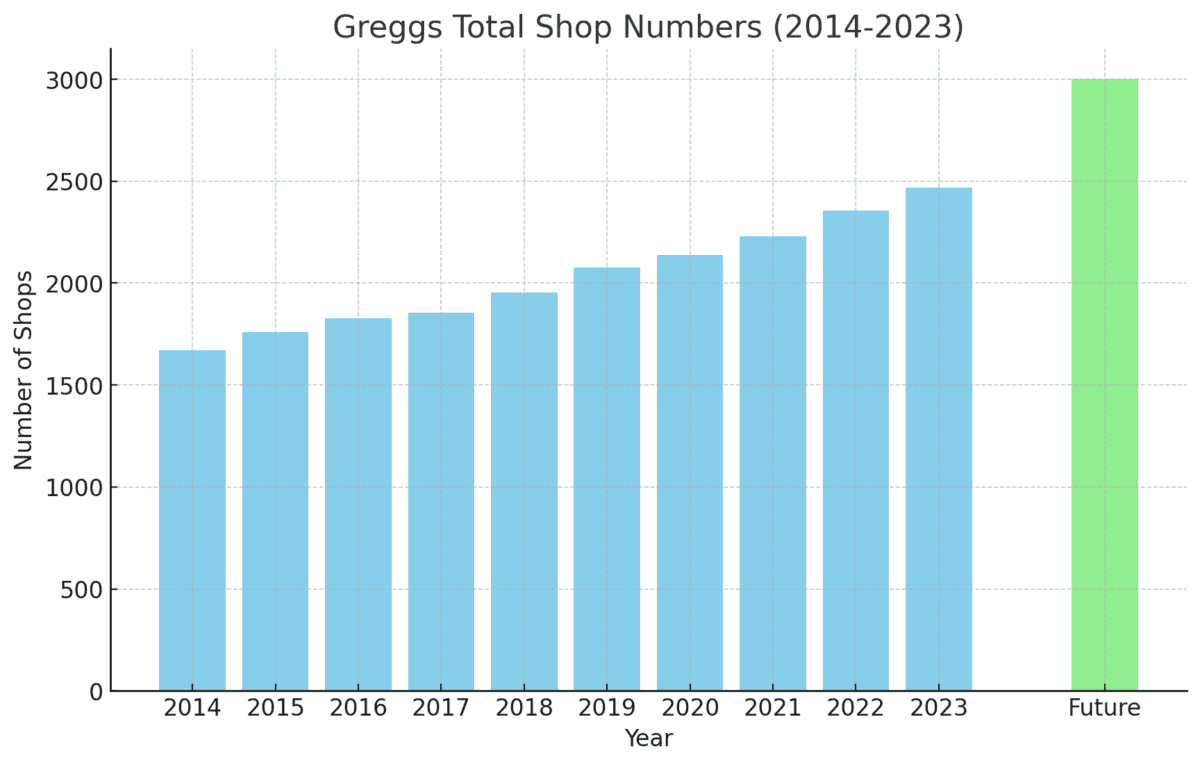

The growth story for Greggs centres around its march towards 3,000+ retail locations. It’s on track to open 140-160 net new shops in 2024, including around 50 relocations.

As of 28 September, it had 2,559 shops trading (comprising 2,016 company-managed stores and 543 franchised units).

CEO Roisin Currie said the weather in July and riots across England in August didn’t help sales in the third quarter. Yet like-for-like sales still rose 5% in company-managed shops, despite this “challenging” market. Management maintained confidence in its full-year outlook.

Looking ahead, Greggs is well-positioned to serve the evening market through both walk-in and delivery via Just Eat and Uber Eats. It continues to expand its presence inside supermarkets and some Primark stores.

The stock’s trading at around 21 times earnings, which is in line with its average over the past few years. City analysts have a 3,332p consensus share price target, about 19% higher than the current 2,790p. Of course, there’s no guarantee it will ever reach this target.

A shift in eating habits?

As a shareholder, I do see a couple of risks on the horizon. The biggest is that we suddenly reach peak Greggs in the UK. That is, a saturation point that leads to the firm’s growth slowing to a crawl (or worse). We’ve seen in the past month how quickly the share price can pull back if growth disappoints.

Another risk is a potential rise in healthier eating. This could be given a shot in the arm by weight-loss drugs that reduce cravings for the treats that Greggs sells. While the firm’s introduced healthier menu options like salad boxes and rice bowls, a change in eating habits would present challenges.

My takeaway

Weighing things up, I reckon there’s a lot to like about the stock. The company has a unique brand, underappreciated pricing power, and a high return on capital (meaning it’s solidly profitable).

There’s also a dividend, which has consistently risen like a Steak Bake in the oven. Nothing’s guaranteed of course, but the firm also has a track record of generously serving up the occasional special dividend.

If Greggs shows any further price weakness, I might snap up a few more shares.