Last night (10 October), Tesla (NASDAQ: TSLA) held its highly anticipated robotaxi event. At the Hollywood event, CEO Elon Musk revealed the company’s plans for self-driving taxis. Should I rush to buy Tesla stock for my ISA now that we know what its plans are? Let’s discuss.

Robotaxis are the future

As a growth investor who’s looking to capitalise on long-term technological trends, I’m excited about robotaxis. Looking 10-20 years out, I reckon that they’re the future of mobility (they’re far safer than human-driven cars).

Already, I have a large position in Alphabet – the owner of Waymo (which has self-driving taxis on the road in the US today). I’ve also been building up a position in Uber (which partners with Waymo), as I reckon it has the platform that a lot of robotaxi companies will operate from in the future.

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

As for Tesla, I was waiting for the robotaxi event to see what the company’s plans are. My research led me to believe that Tesla would reveal one or more Cybercab prototypes, an app for consumers, and an update to its Full Self-Driving (FSD) technology that would allow its cars to drive by themselves.

What did Tesla reveal?

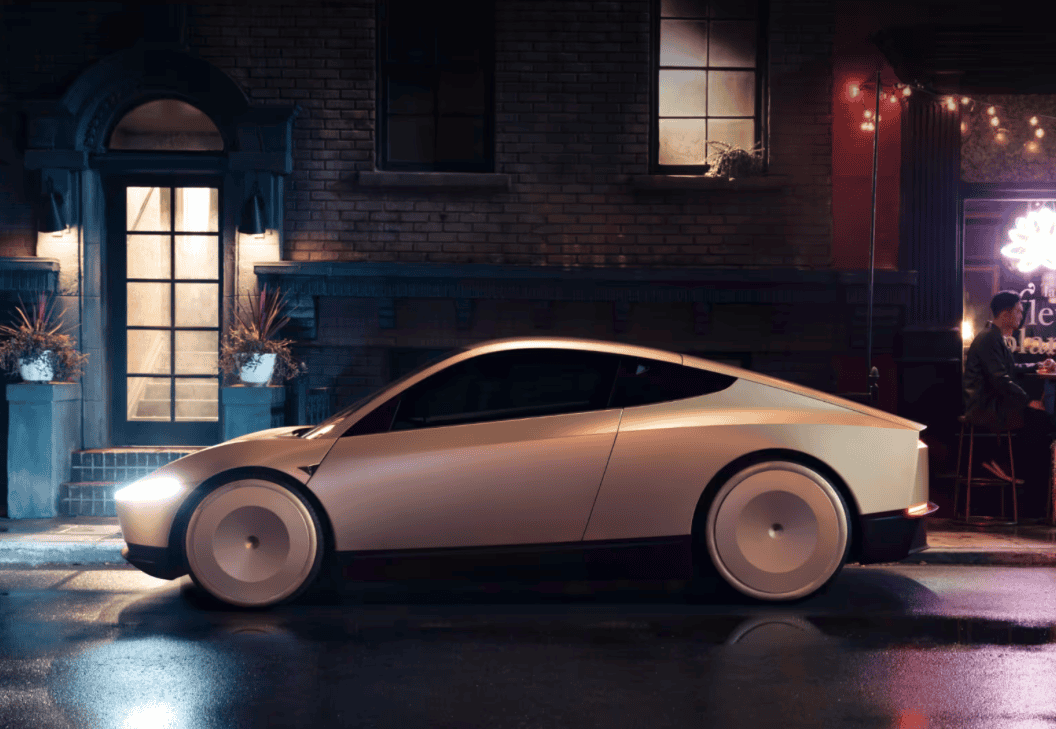

In the end, I thought the event last night was a little bit underwhelming (given the hype). The company did show off a new Cybercab prototype that will be available for less than $30k. Futuristic in design, it had no steering wheel or pedals.

It also revealed a ‘Robovan’ that can transport 20 people. Musk said this could be ideal for transporting sports teams.

But there was no app for consumers. And the timelines for robotaxi roll-out were a bit disappointing. Currently, Tesla doesn’t plan to start Cybercab production until 2026 or 2027. Given that Musk has a history of over-promising and under-delivering when it comes to timelines, it could be years until these self-driving taxis are actually on the road.

It’s worth noting that Tesla plans to launch fully autonomous driving in Texas and California next year. However, the company hasn’t secured regulatory approval yet so, again, it may actually be years before we see this.

Should I buy?

Given that Tesla isn’t likely to have robotaxis on the road for a while, I’m not in a rush to buy the stock today. Recently, it has rallied hard. And for me, the valuation is too high right now.

At today’s share price, the forward-looking price-to-earnings (P/E) ratio’s 105. That’s about 5 times the P/E ratio Alphabet’s trading on.

As for its market-cap, it’s around $750bn. That compares to $160bn for Uber.

Comparing those market-cap figures, Uber seems a much safer bet on self-driving taxis to me. Ultimately, hundreds of billions of dollars of Tesla’s market-cap’s based on robotaxi optimism and I’m not convinced that’s justified when it’s likely that there will be many companies with autonomous taxis in the future (Waymo, Mercedes-Benz, Cruise, etc).

Now, I may end up buying Tesla stock one day. It seems that the company’s pivoting to robotics and AI and this is exciting.

But for now, I’m going to keep it on my watchlist. And I’m going to continue building up my position in Uber, as I think it has tons of potential.