Investing in penny stocks is a high-risk but potentially high-reward strategy. And share pickers can reduce the hazards associated with these small-cap stocks by investing in cheap companies.

The margin of safety that low earnings multiples provide can limit losses and reduce the scale of any price volatility. And over the long run, investors can enjoy substantial returns if the market corrects itself and share prices take off.

So I’m seeking top penny shares that are currently trading at bargain prices. My focus is on companies that seem undervalued based on one or more of these key indicators:

- Price-to-earnings (P/E) ratio

- Price-to-earnings growth (PEG) ratio

- Price-to-book (P/B) ratio

- Dividend yield

Based on this criteria, here are two of my favourite penny stocks.

Serabi Gold

Gold stocks are naturally sensitive to price movements of the yellow metal. Even the best run miner like Serabi Gold (LSE:SRB) can see profits collapse if bullion values recede.

But then the opposite is also the case. And with gold prices on the charge, now could be a good time to consider investing in it. It’s soared since mid-2023 in line with the booming metal price, as the chart below shows.

I like this miner on account of its all-round cheapness. The Brazil-focused company trades on a forward-looking P/E ratio of 3 times. This is built on City predictions that earnings will soar 300%-plus in 2024.

As a consequence, Serabi shares also trade on a PEG ratio of below 0.1. A sub-1 reading suggests that a stock is undervalued.

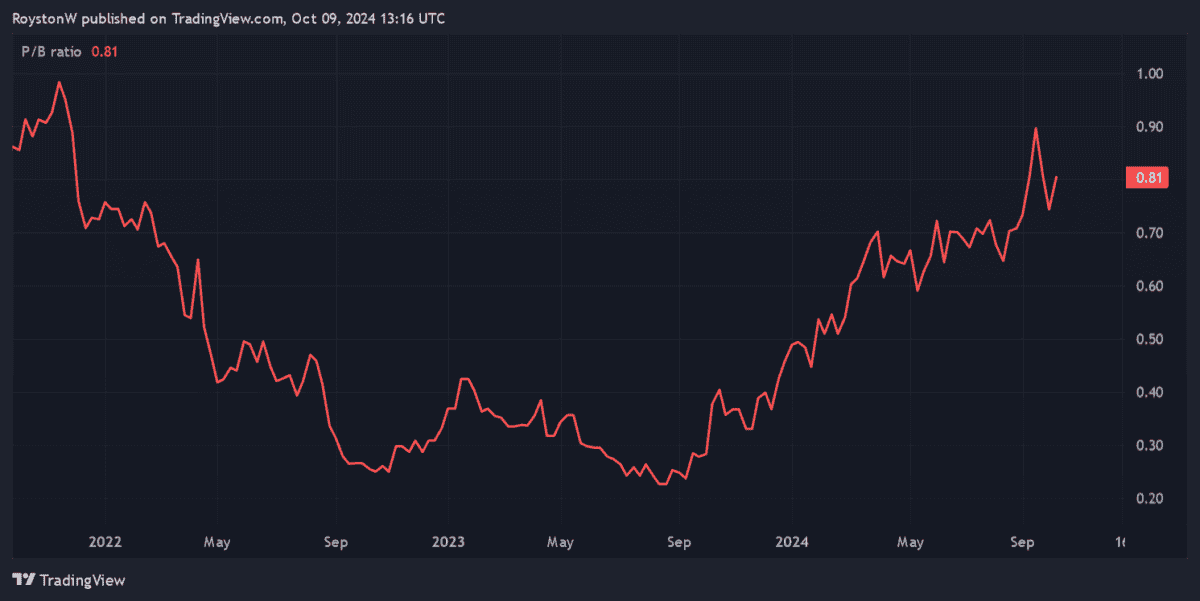

Finally, the company’s P/B ratio also sits below the bargain watermark of 1, as the chart here indicates. This shows that Serabi trades at a discount to the value of its assets.

Profits will also be boosted by plans to increase production through to 2026. Its exploration projects in Brazil’s gold-rich Tapajós province could deliver impressive growth well beyond this period too.

Topps Tiles

Home improvement companies like Topps Tiles (LSE:TPT) face uncertainty in the near term as Britain’s economy splutters. But could this be baked into this penny stock’s current valuation?

I think the answer may be yes. It trades on a forward P/E ratio of 10.9 times, while its PEG ratio for this year sits at just 0.1. These figures reflect expectations that earnings will jump 82% year on year.

The Topps Tiles share price has struggled for momentum in 2024. News that like-for-like revenues dipped 8.2% in the 12 months to August hasn’t done it any favours in this time either.

But with Britain’s housing market steadily improving, I think it could be on the cusp of a sharp rebound. Indeed, government plans to build 300,000 new homes a year through to 2029 might deliver a sustained recovery.

I’m also expecting Topps Tiles to enjoy strong demand from the repair, maintenance and improvement (RMI) sector, given the advanced age of Britain’s housing stock.

With Topps Tiles also carrying a 6.6% dividend yield, I think it’s a top value stock to consider.