I’m searching for the best FTSE 100 bargain shares to buy this month. I’m looking for companies that look cheap based on several, or all, of the following metrics:

- Price-to-earnings (P/E) ratio

- Price-to-earnings growth (PEG) ratio

- Dividend yield

- Price-to-book (P/B) ratio

Based on these criteria, here are my three favourite Footsie shares right now.

Standard Chartered

With respect to the above metrics, Standard Chartered (LSE:STAN) provides almost a full house.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

City analysts think the bank will enjoy an 82% earnings rise in 2024. And so it trades on a forward price-to-earnings (P/E) ratio of 7.1 times, below the Footsie average of around 15 times.

Furthermore, StanChart’s corresponding PEG multiple stands at 0.1. Any reading below 1 suggests a stock is undervalued.

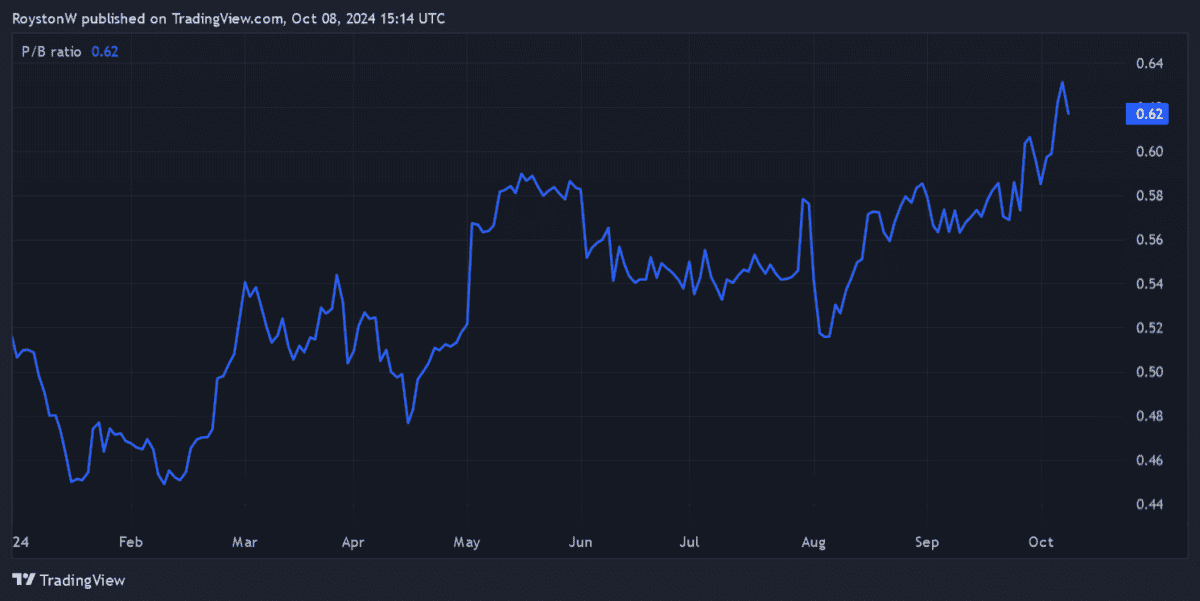

Finally, the bank trades on a P/B ratio of 0.6. Like the PEG metric, a sub-1 ratio is desirable.

Owning this banking stock can be risky during economic downturns when revenues fall and impairments tend to rise.

But an attractive long-term outlook still makes Standard Chartered appealing to me. I think its focus on Asia and Africa could deliver strong profits expansion over time, as rising populations and growing wealth levels drive financial product demand.

Legal & General Group

Like me, investors looking for value from a dividend perspective might want to give Legal & General Group (LSE:LGEN) a close look.

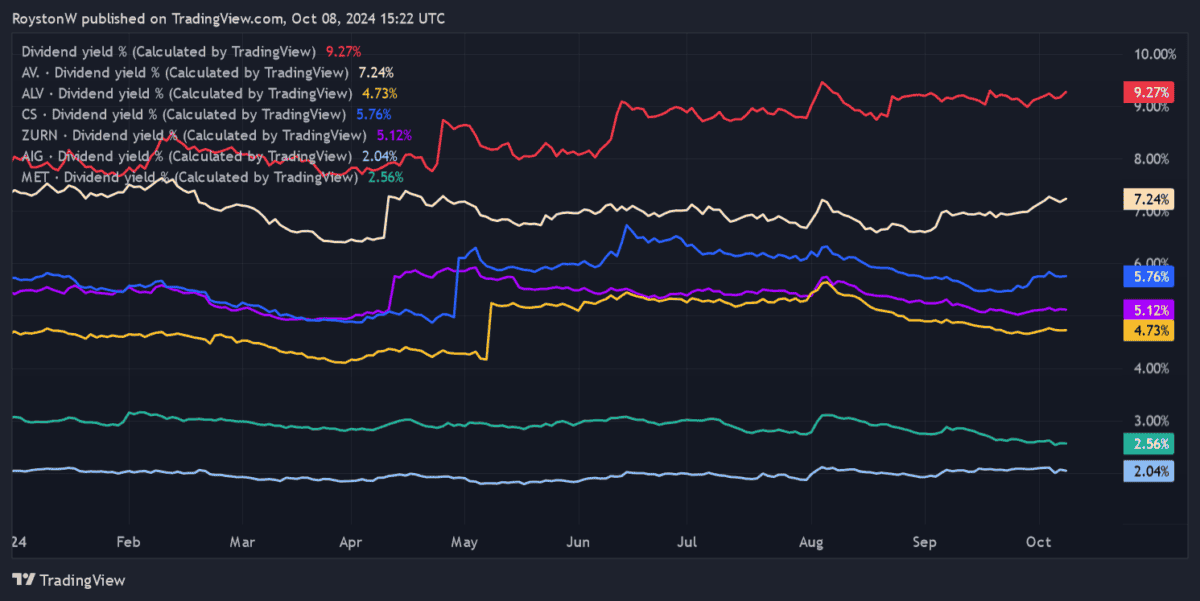

At 9.3%, the financial services giant’s forward dividend yield smashes the 3.8% average for FTSE 100 shares. But this isn’t all, as the chart below shows.

The yield on Legal & General shares is also far higher than those of its major industry rivals. In descending order these are Aviva, AXA, Zurich, Allianz, MetLife and AIG.

Allied to this, Legal & General’s share price also looks cheap from an earnings perspective. Its PEG ratio for 2024 sits at a fractional 0.1.

And its P/E ratio sits at an index-beating 11.5 times.

Like Standard Chartered, I think Legal & General’s in great shape to capitalise on demographic changes in its markets. More specifically, I’m expecting sales of its wealth and retirement products to increase as populations steadily age across its markets.

Legal & General faces intense competitive pressures from the companies mentioned above. But I still see it as a top buy for me.

Vodafone Group

Telecoms giant Vodafone Group (LSE:VOD) ticks all the main value boxes for me. It looks cheap based on predicted earnings, dividends and the value of its assets.

The business trades with a P/E ratio of 10.9 times for the 12 months to March 2025. Meanwhile, its dividend yield, despite being slashed for this financial year, still stands at an impressive 6.1%.

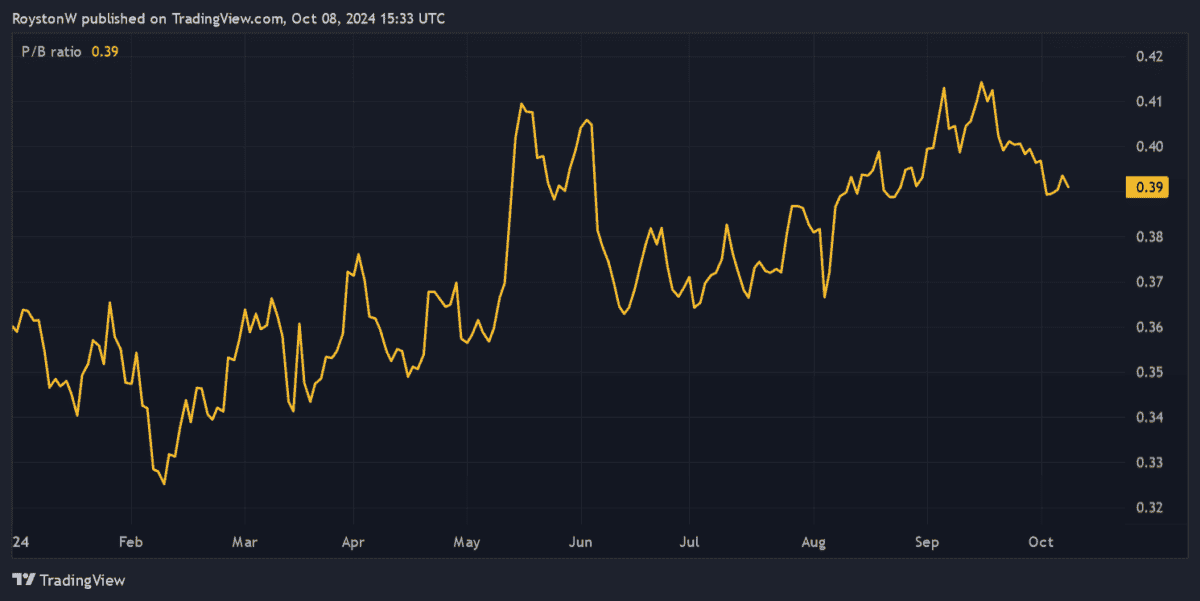

Finally, the P/B ratio for Vodafone shares is a rock-bottom 0.4.

Telecommunications is capital intensive, and this in turn can take a big bite of earnings and dividends. As I say, the company rebased this year’s dividends to give itself “sufficient flexibility to invest in the business for growth“.

The shares have improved their performance in 2024 after years of price falls. I think Vodafone has enormous long-term investment potential as the digital revolution pushes broadband usage higher. I like Vodafone because of its large exposure to Africa too, through both its telecoms and mobile money operations.