The FTSE 100 remains a popular place to go hunting for dividend stocks. Investors are able to access some delicious dividend yields, some of which are in double-digit territory.

What’s more, UK blue-chip shares have market leading positions, strong balance sheets, and multiple revenue streams. And so they can deliver a solid passive income whatever the weather.

However, the index’s superiority for dividends has eroded in recent years. And it’s possible that buying small caps for a second income might be a better idea. Here’s why.

Better yields

According to Octopus Investments, investors can acquire a better dividend yield by casting their net outside the FTSE 100 and FTSE 250 indexes.

According to the investment giant, the yield on UK small-cap shares for this year sits just below the Footsie average just shy of 4%. However, for 2025, the yield improves to 4.33%.

This beats the averages of 3.97% and 3.88% for the FTSE 100 and FTSE 250* respectively.

Superior cover

Of course there’s more to sensible dividend investing than just thinking about yield. Dividend yields matter for little if brokers’ payout projections are built on sand.

Yet based on dividend cover, dividend forecasts for small-cap shares actually look more robust than those of the broader FTSE 100 and FTSE 250. Dividend cover measures how many times predicted payouts are covered by expected earnings.

Dividend cover for British small caps is above three times for 2024, and moves above 3.5 times for next year, according to Octopus. Both figures comfortably surpass the widely regarded safety benchmark of two times.

A top small-cap stock

Interesting data, I’m sure you agree. But I for one don’t believe investors should simply consider buying small-cap shares for dividends. Payouts at businesses like these can be more vulnerable during economic downturns.

They can also experience extreme share price weakness on the basis of company-specific news, or adverse industry or economic conditions. As always, creating a diversified portfolio can be the best way to go.

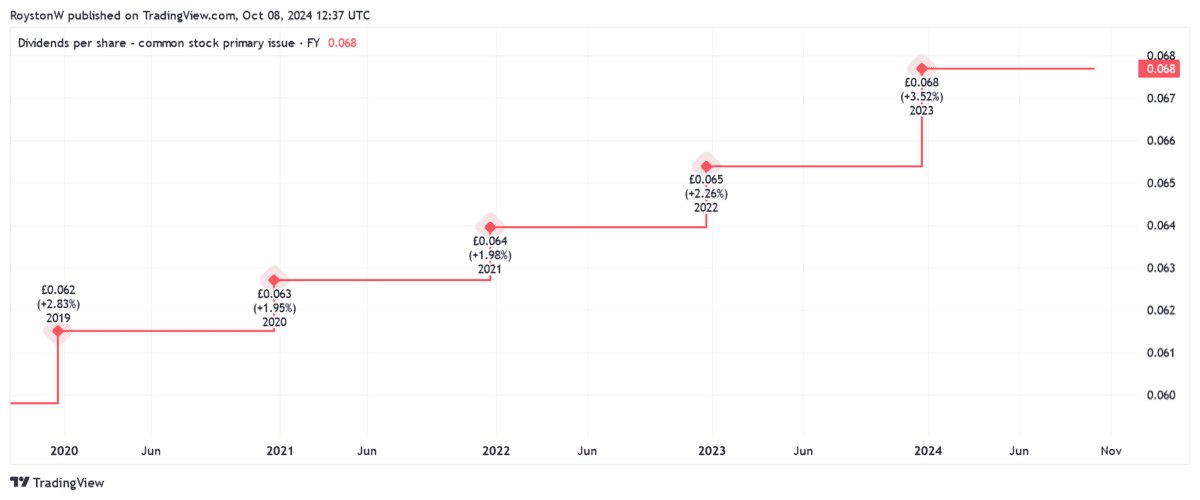

One small-cap dividend share attracting my attention today is Impact Healthcare REIT (LSE:IHR). At 7.8% and 8.2% for 2024 and 2025, respectively, its dividend yields are truly gigantic.

Like any property stock, the company is vulnerable to changes in interest rates. Higher rates impact net asset values (NAVs) and push borrowing costs skywards.

But on balance, I think Impact — which owns and lets out residential care homes — is a rock-solid dividend stock to consider. Not only does it operate in a highly defensive market. The business also has its tenants locked down on long rental agreements (its weighted average unexpired lease term is above 20 years).

Under real estate investment trust (REIT) rules, it is also obliged to pay at least 90% of annual rental profits out in dividends. This can make it a reliable and generous dividend supplier over time.

* Figures refer to the FTSE 250, excluding information technology stocks.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.