When considering dividend stocks on the FTSE 250, it might seem logical to invest in the one with the highest yield. However, the yield alone means very little.

Buying a stock with a 10% yield doesn’t guarantee it’ll pay out 10% on the investment. It might only pay 5% — or nothing at all. This is because yields fluctuate constantly but payments occur only a few times a year.

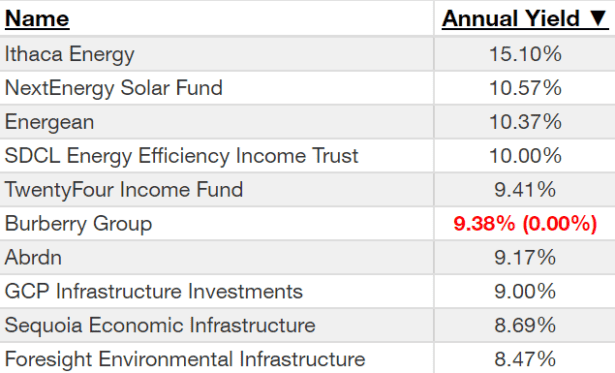

The table below shows the current top 10 yielders on the index.

Some investors aim to buy a stock on the ex-dividend date to secure a payout at that percentage. But the yield could be reduced or cut completely before the next one, negating the stock’s long-term value.

So a good dividend stock is one with a long track record of consistently paying dividends to its shareholders.

Other factors to consider

A good dividend stock isn’t only about the yield. Also consider:

- Payout Ratio: a sustainable ratio ensures the company can continue paying future dividends. Anything above 100% may not be sustainable

- Dividend Growth: the best companies have a long history of increasing annual dividend payments. Ten years or more is preferable

- Financial Stability: a strong balance sheet and consistent earnings are essential for a company to maintain its dividend payments

Identifying value

In the FTSE 250 top 10 by yield, only Burberry, Abdn, GCP Infrastructure Fund and TwentyFour Income Fund (LSE: TFIF) have a 10-year or longer history of payments. Burberry cut its dividends completely this year and Abdn reduced them significantly after Covid. GCP has a relatively stable payment history but a payout ratio of 406%.

That leaves TwentyFour Income Fund, which invests in securities backed by underlying assets like loans.

First and foremost, this presents some risks. If borrowers default on these loans, it could negatively impact the fund’s performance. At the same time, if borrowers repay their loans early, the fund may receive less income than anticipated. Additional risks include interest rate fluctuations that could hurt the price and low liquidity that could reduce selling power.

The fund’s price has been relatively stable for the past 10 years, fluctuating between 100p and 120p. It hasn’t provided any significant returns in terms of share price but has maintained a yield above 6% for most of that period. I think that makes it sufficiently reliable to consider as an addition to a passive income portfolio.

After a bad 2022, it posted positive full-year 2023 results in July. These included a NAV total return of 18.10% and a fourth-quarter dividend of 3.96p per share. This brought the total dividend for the year to a whopping 9.96 pence per share – a record-breaking high since its launch in 2013.

The company’s chairman attributed this success to its savvy investment strategy, focusing on higher-yielding, floating-rate, asset-backed securities in the then rising interest rate environment. Its commitment to sharing the wealth with shareholders is evident, as it consistently pays out virtually all excess investment income annually.

While TwentyFour appears to be the best in the top 10 dividend-payers on the FTSE 250 by yield, I think there are better options. If I were looking to buy dividend shares on the index, I’d consider Greencoat UK Wind, Primary Health Properties or TP ICAP — each reliable stocks with yields between 7% to 8%.