Looking back 12 months, Rentokil (LSE:RTO) has the dubious honour of being the worst performing stock on the FTSE 100. Since 8 October 2023, its share price has fallen 39%.

Much of the damage was done on 11 September, when the pest control, hygiene and wellbeing group issued a trading update to investors.

Blaming problems in North America, it issued a warning that adjusted pre-tax profits for the year ending 31 December (FY24) would be around £700m. This is lower than the £766m reported in FY23.

It’s the third time in a year the company’s reported problems in the region, which contributed 61.6% of revenue in FY23.

The latest update identified lower than anticipated sales and higher costs — including additional wages due to over-resourcing — as the principal reasons for the disappointing news.

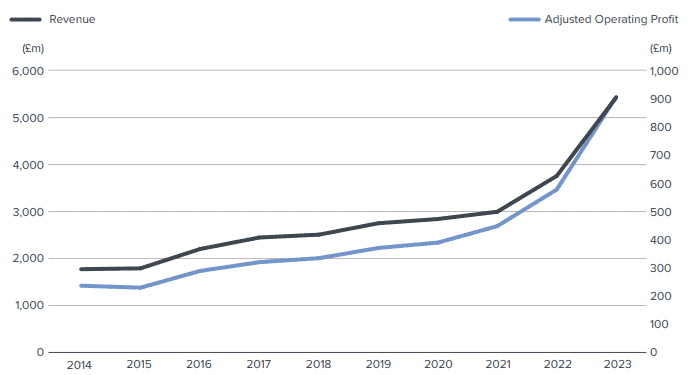

But as the chart below illustrates, Rentokil has an impressive track record of growing both revenue and earnings.

Also, pests will continue to be a problem irrespective of how the global economy performs. This means the business is more likely to cope with an economic downturn than most.

It’s also attracted the attention of activist investor Nelson Peltz who has a reputation for improving the performance of struggling companies.

So taking advantage of the recent fall in its share price, could now be a good time to buy?

The big picture

In my view, the investment case rests on whether the problems in North America are a short-term blip or a sign of something more fundamental.

Of concern, the company’s update said: “While we saw some positive momentum in North America sales activity at the end of the second quarter, the trading performance in July and August was lower than anticipated“.

In other words, at the time of releasing the statement, the issues still hadn’t been satisfactorily resolved. And this gives me cause for concern. To try and find out more, it’s therefore necessary to look at the bigger picture.

When it comes to pest control, Rentokil’s largest rival in the United States is Rollins. And it appears to be doing much better. Its second quarter update for 2024 reported “healthy growth across all major service lines“. And a 9% increase in revenue, compared to the same period in 2023. Earnings per share were up 23%.

My opinion

I don’t know whether Rentokil’s problems are due to Rollins taking some of its customers but the US company’s performance suggests there isn’t a downturn in the market. I therefore think it would be prudent to wait and see whether the FTSE 100 company can get its house in order before considering taking a stake.

Also, I don’t think the company’s dividend is particularly generous. I’d therefore need to be more confident about its growth prospects before investing.

For FY23, it paid a dividend of 8.68p. Based on the current (7 October) share price of 359p, this suggests a yield of 2.4%.

Of course, dividends are never guaranteed.

Although I believe Rentokil’s a solid company with an excellent brand, I don’t think now would be a good time to invest. There’s too much uncertainty over its most important geographical market for me to be comfortable owning some of its shares.