International Consolidated Airlines Group (LSE: IAG) suffered a painful hit last week that shed 10% of its share price. The global aviation conglomerate, which owns British Airways, Iberia, Vueling, and Aer Lingus, has been making headlines recently. The company has benefitted from a surge in demand for air travel as the world recovers from the pandemic.

This resurgence had significantly boosted IAG’s financial performance and positioned it for growth. On 27 September, the stock hit a yearly high of 212p – up 36% year-to-date. But as markets opened Monday (7 October) morning, it was trading below 192p.

Why the sudden fall?

Fuel is one of the largest expenses for airlines, accounting for a large portion of their operating costs. Subsequently, they’re highly susceptible to fluctuations in oil prices. Rising fuel costs can reduce their profitability and lead to higher ticket prices for passengers. Conversely, falling prices can improve their financial performance and potentially result in lower ticket prices.

Since the Middle East is a major oil-producing region, geopolitical events in the region can significantly impact global oil prices. Last week, the escalating conflict between Iran and Israel sent shockwaves through the market, hurting its share price.

What does this mean for investors?

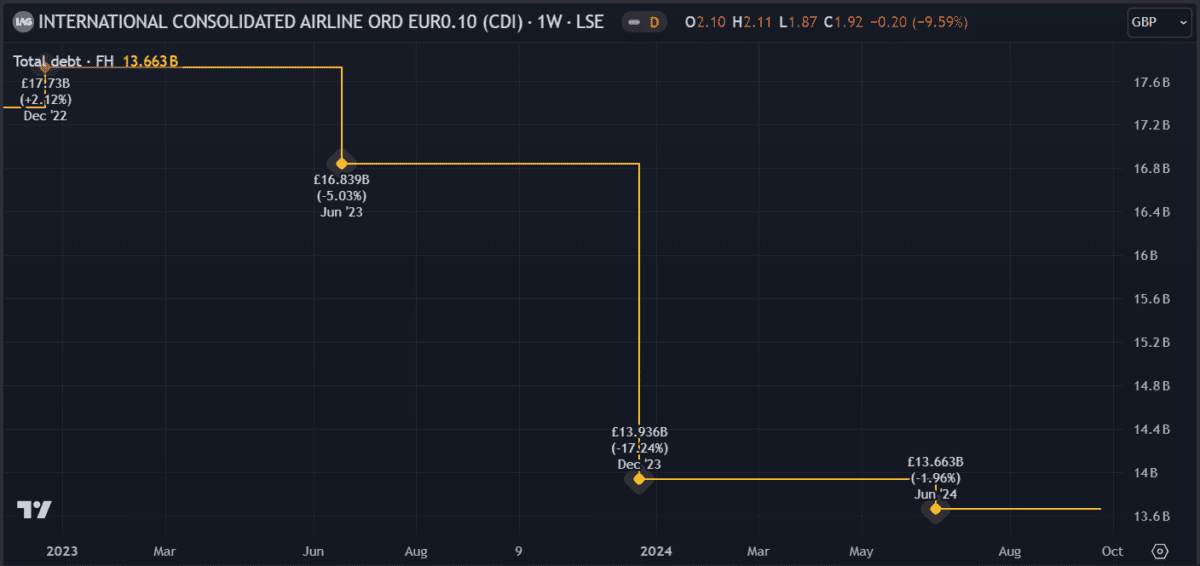

IAG remains an attractive investment proposition for several reasons. First, the company’s strong financial position is a sign of its resilience. Despite the challenges in recent years, it has managed to not only perform well but also reduce its debt levels. This financial stability provides a solid foundation for future growth.

Second, it benefits from a diversified business model. With a portfolio of airlines that operate across different regions, it’s at less risk from economic downturns in specific areas. This diversification could enhance the company’s overall profitability and stability.

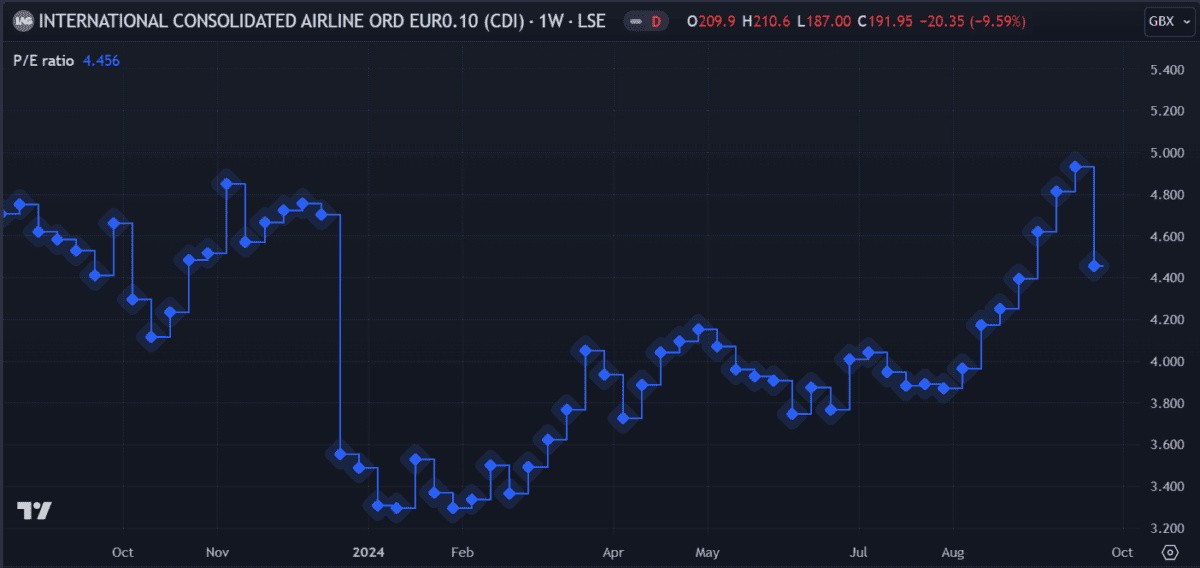

And IAG’s valuation appears attractive relative to its peers. The company’s trailing price-to-earnings (P/E) ratio of 4.45 is well below the industry average, suggesting that it may be undervalued. This could offer investors a favourable entry point into the stock.

Overall, analysts appear optimistic about it. Bank of America and Bernstein issued Buy and Outperform ratings on the stock in the past month, citing factors such as the recovery in air travel, cost-reduction initiatives, and potential mergers and acquisitions.

Risks to consider

While IAG presents several compelling investment opportunities, it’s important to consider the risks involved. One being the volatility of the airline industry. Factors such as fuel prices, economic downturns, geopolitical events, and natural disasters can have a substantial impact on airline profitability.

Additionally, its business model faces threats from labour disputes, regulatory changes, and technological advancements. These factors could negatively affect the company’s operations and financial performance.

Moreover, the company faces stiff competition from low-cost carriers like Ryanair and easyJet. It may need to adapt its business strategies if it hopes to remain competitive and hold its market share.

My verdict

IAG offers a combination of growth potential, financial stability and what I think is an attractive valuation. The company’s strong financial position, diversified business model, and positive analyst sentiment suggest that it may be a worth considering.

However, there are risks to take into account that affect both the airline and the wider industry. I’m not planning to buy more stocks this month but if I were, this one might make it onto my list.