The IAG (LSE:IAG) share price has slumped 10% over the past five days, marking an end to the broad upward trajectory of the last six months. So what’s going on?

Airlines are sensitive

Airlines are particularly sensitive stocks when it comes to geopolitical events, wars, and oil price fluctuations. As we’ve seen with recent and ongoing conflicts, tensions and wars often lead to airspace closures, route disruptions, and decreased travel demand, directly affecting airline revenues.

Western airlines are still having to avoid Russian airspace, while Iran’s ballistic missile barrage on Israel caused more temporary disruptions. I was one of those sad people watching flightradar24 as airlines diverted and Iranian assets flew out of harm’s way on Tuesday (2 October) evening.

Should you invest £1,000 in Relx right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Relx made the list?

Meanwhile, apart from the dreadful human cost, wars tend to have a profound impact on oil prices, in turn, severely impacting airlines’ bottom lines. Fuel accounted for around 25% of IAG’s expenditure last year.

So what happen here?

Iran’s ballistic missile attack on Israel is bad for many reasons — most of them have nothing to do with investing. For one, this represented an arguably expected but tragic escalation of the ongoing conflict between Israel and Iran’s proxies.

But this is also a concern because Iran remains a notable oil producer — representing around 3% of global output — and exporter with over 1.7 million barrels a day leaving the country — much of it heading to Chinese refiners that don’t recognise US sanctions.

We can speculate as to how Israel might retaliate. However, US President Joe Biden said publicly on 3 October that Israeli strikes on Iranian oil facilities were being considered.

The result is oil spiked. At the time of writing, Brent Crude — a benchmark for oil — is up 8.9% over the week at $78 a barrel. Some analysts have even begun forecasting $100 a barrel by the end of the year.

Fuel hedging

It goes without saying that as oil becomes more expensive, so does jet fuel. And that would impact the bottom line of airlines like IAG.

However, European airlines practice hedging. This involves fixing a fuel price for a set period, which can help companies improve cost management.

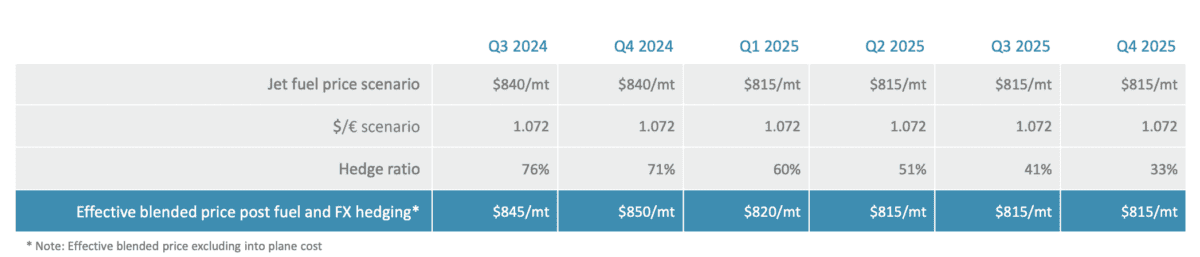

IAG, the owner of British Airways and Iberia, has a strong hedging position, with just 24% of Q3 fuel — the current quarter — purchased at live or near-live prices.

As we can see from the above, IAG’s hedged around 74% of fuel costs through to the end of the year. This should put it in a strong position to manage costs even if oil spikes.

However, looking further into 2025, the company’s more exposed to market prices. This means that while IAG has secured a level of price stability for its fuel costs in the immediate future, it faces greater uncertainty and potential risk from oil price fluctuations as we move into 2025.

My take

Investors are always looking for good entry points as stocks fall. And it’s possible the market’s overreacted to the escalation possibility, something we all fervently hope doesn’t happen.

There’s a lot to unpack here, including OPEC’s spare capacity, slowing oil demand, Iran’s ability to block key oil supply routes, and IAG’s valuation.

This could be an opportunity for investors, but there are risks attached.