The number of people using an Individual Savings Account (ISA) has jumped recently. I’m not surprised. These great products allow individuals to invest in a wide range of assets while saving them a boatload of money on tax.

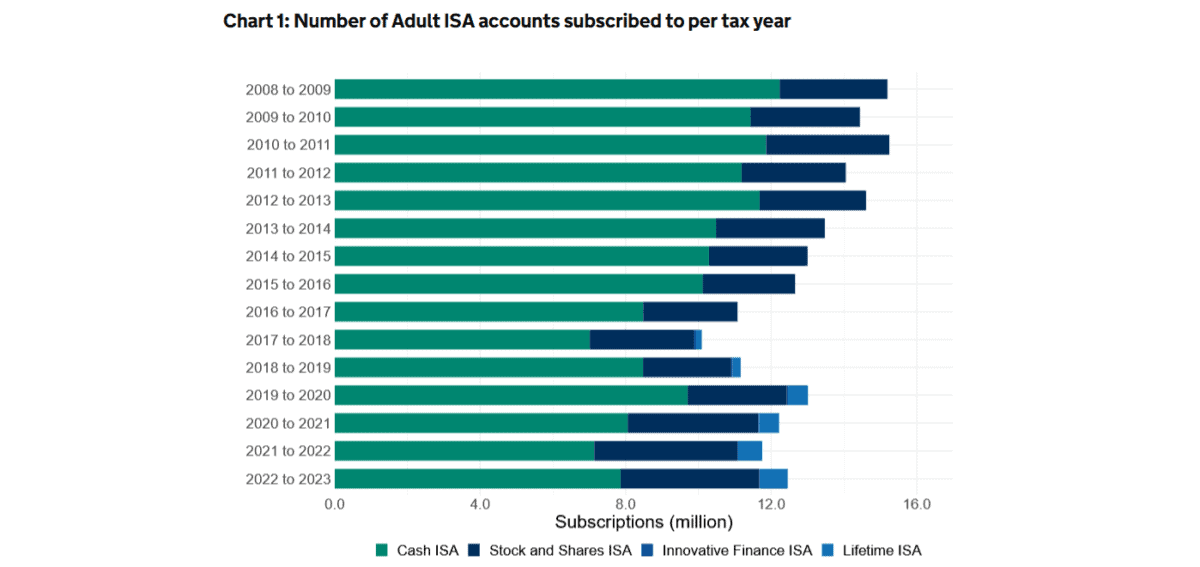

In the 2022/23 period, there were 12.5m adult subscribers to the ISA, according to HM Revenue and Customs. This was up from 11.8m in the prior year, and was driven by a 722,000 rise in Cash ISA subscriptions as people capitalised on strong savings rates.

I own several types of ISAs to target a life-changing passive income when I eventually retire. Here’s how they could help me live a life of luxury in my later years.

Should you invest £1,000 in Ishares Vii Public - Ishares Core S&p 500 Ucits Etf right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ishares Vii Public - Ishares Core S&p 500 Ucits Etf made the list?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A £44,000 saving

Any capital gains and dividends an individual receives in an ISA are protected from tax. And over time, this can add up to a considerable amount of money.

In a 2024 Financial Times article, asset manager Netwealth calculated that “an additional rate taxpayer investing £100,000 in a Stocks and Shares ISA would save £44,000 in taxes over 10 years“. This is based on an average yearly return of 5.9% and excludes trading costs.

One drawback with the ISA is that there’s a limit on how much an individual can invest each tax year. This puts it an obvious disadvantage to a general investment account (GIA). That’s in theory, at least. In reality, less than one in 10 people actually use their full £20,000 allowance each tax year, me included.

I currently own a Cash ISA alongside a Stocks and Shares ISA. I’m also one of a smaller number of people who invest in a Lifetime ISA each year.

With the latter product, the government provides a 25% bonus on top of any contributions I make. The maximum annual allowance here is £4,000, and I can’t draw on my money until I hit 60. But that tasty bonus is too good for me to ignore.

Targeting a million

In a Stocks and Shares ISA and Lifetime ISA, I can invest in a wide range of financial instruments. This includes exchange-traded funds (ETFs), one of which I’m considering is the iShares Core S&P 500 UCITS ETF (LSE:CSPX).

As its name implies, the fund invests in the 500 largest US-listed companies. This gives me as an investor exposure to serious quality, as well as excellent diversification across different sectors and regions of the world.

I also like it because it has significant capital tied up in the information technology sector. Holdings like Nvidia, Apple and Microsoft could disappoint if the global economy stagnates or contracts. But they might also deliver substantial returns as the digital revolution rolls on.

Since its inception in 2018, the ETF’s delivered an average annual return of 12.36%. If this continues, a £300 monthly investment could turn into £1,136,102 after 30 years.

This in turn, would give me a £45,444 passive income based on a 4% yearly drawdown. Added to the State Pension, this could allow me to enjoy a very comfortable lifestyle in retirement.