Investing in a combination of FTSE 250 growth, value, and dividend shares can be a powerful strategy for achieving a strong and stable return.

Each type of share offers unique benefits, and combining them in a portfolio can help investors achieve a balance of capital appreciation and steady income while at the same time reducing risk.

Growth stocks can enjoy spectacular share price gains as earnings take off. Dividend shares supply a stream of income that can be reinvested to deliver substantial compound gains. And value stocks provide a margin of safety that can limit price drops during market downturns.

Should you invest £1,000 in Associated British Foods right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Associated British Foods made the list?

With all this in mind, here are two top FTSE 250 stocks I think are worth a close look.

The growth and value stock

Cybersecurity businesses have significant scope for growth as our lives become increasingly digitalised and the number of cyber attacks increases. This is certainly the case for NCC Group (LSE:NCC) whose bottom line is tipped to swell 120% this financial year, and by 25% and 21% respectively in the following two.

NCC provides two main services. Its Cyber Security unit helps companies detect online threats, simulate attacks and conduct risk assessments. And its Escode arm offers software escrow and verification services that protect data and critical software.

NCC’s share price is rebounding strongly as market conditions improve. Last month, it tipped a better-than-expected 4% revenues rise for the four months to September. Though investors should be mindful of a possible reversal if the US economy moves into recession.

That said, the cheapness of the firm’s shares could help limit any move to the downside. It trades on a price-to-earnings growth (PEG) ratio of 0.2. Any reading below 1 indicates that a share is undervalued.

The dividend stock

With a 10.7% forward dividend yield, NextEnergy Solar Income‘s (LSE:NESF) one of the biggest potential payers on the FTSE 250 today. In fact, its yield is more than three times larger than the index average.

Ultra-high yields like this can serve as red flags for investors. They can indicate an unsustainable dividend, with companies often paying out more than earnings. Massive yields can also be a result of a collapsing stock price that reflects mounting pressures on the company.

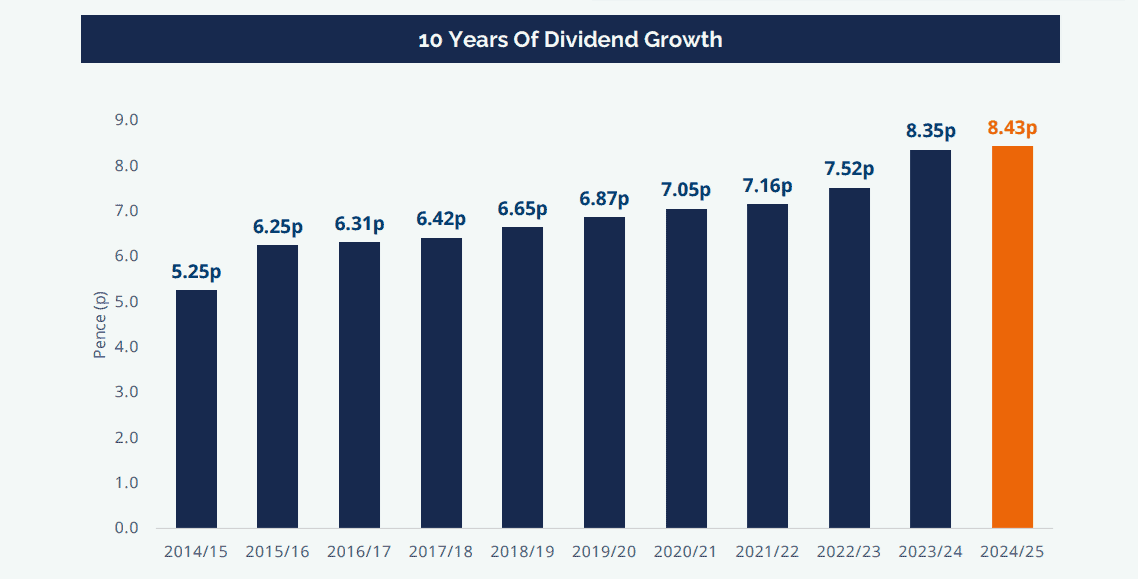

But neither of these apply to NextEnergy. It has a long history of paying a large and growing dividend, as the chart below shows. Indeed, it’s paid a whopping £345m in dividends since its IPO in 2014.

The energy producer has two main attractions for me. The defensive nature of its operations supports strong cash flows, and therefore solid dividends, across all points of the economic cycle. It also has a chance to deliver terrific long-term returns as demand for clean energy steadily rises.

Near-term returns may be impacted if interest rates remain around current highs. But on balance, I think it’s a great income stock to consider this October.