A SIPP is a Self Invested Personal Pension, and it offers individuals greater control and flexibility over their retirement savings compared to traditional pension plans.

It works in a very similar way to my Stocks and Shares ISA portfolio, with a few exceptions. One is that contributions receive tax relief, with the government adding £20 for every £80 contributed by a basic rate taxpayer. Higher and additional rate taxpayers can claim further tax relief through their tax returns.

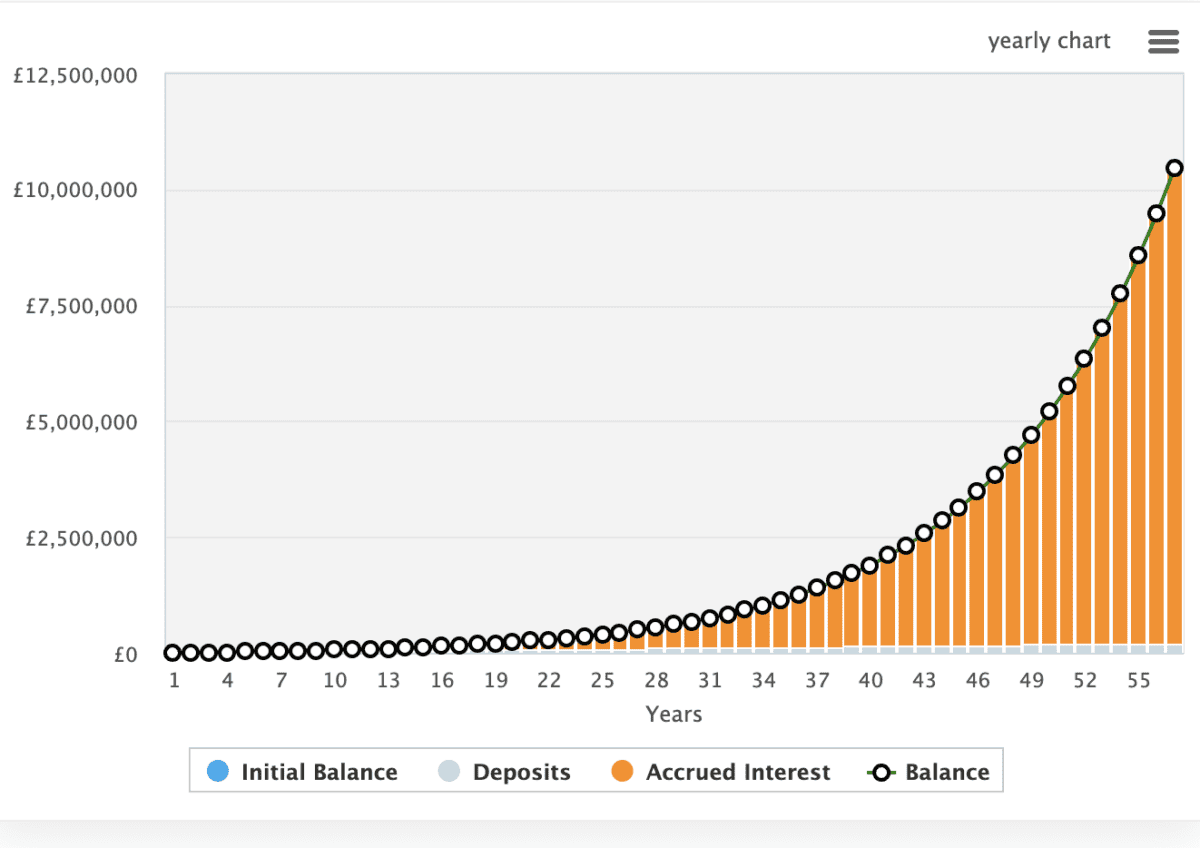

So, how can £240 a month turn into a £10m retirement portfolio?

Should you invest £1,000 in Supermarket Income Reit Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Supermarket Income Reit Plc made the list?

Well, I doubt my own portfolio will ever reach £10m, but my daughter’s might. Many Britons are unaware that they can open a SIPP for their children and the longer the SIPP has to grow, the larger it could become.

Let’s take a closer look.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The process

Opening a SIPP for my daughter was easy. I use the Hargreaves Lansdown platform, where I also have my daughter’s fee-free ISA and my portfolio.

You can pay a maximum of £2,880 per year into this, which becomes £3,600 through 20% tax relief.

So, we simply contribute £240 every month to her SIPP, and this is automatically topped up — with some delay — by the government’s tax relief.

From that point, I pick investments as I would elsewhere in my own portfolio.

Investing right

My daughter’s SIPP is smaller than her ISA and my ISA, and we’re also talking a lot more long term — as it stands, she wouldn’t be able to draw down her SIPP for 56 years.

As such, I’ve been allocating funds towards ETFs, trusts, and funds, whereby we can gain some degree of diversification, but also focus on growth areas of the market.

The first investment I actually made was the FTSE 100‘s Scottish Mortgage Investment Trust (LSE:SMT) — a UK-listed investment trust that invests primarily in growth-focused industries such as information technology and transportation.

Over the last 10 years, the stock has returned approximately 14.35% per year.

So, let’s assume I target and achieve 10% annualised growth for my daughter’s SIPP. How could it grow?

As the graph shows, the SIPP would see phenomenal growth as it compounds, reaching above £10m in the 57th year. This really highlights the power of compounding and the value of starting early.

Why Scottish Mortgage?

So, why was my first investment Scottish Mortgage? While shares in the trust have fallen by around 40% in the last couple of years, the long-term trajectory remains impressive.

The fund’s share price reflects the value of the companies in which it invests. The majority of its holdings are publicly listed like ASML and Nvidia, but some are unlisted like Space Exploration Technologies (SpaceX).

Interestingly, SpaceX is now its third-largest holding. Personally, I like the exposure to a company I wouldn’t normally be able to invest in, but it’s worth bearing in mind that SpaceX’s valuation is not determined by the market.

Likewise, from a risk perspective, we need to recognise that growth-focused businesses can fail, and when they do, the trust’s stock falls.

However, the team at Scottish Mortgage has an excellent record of picking the next big winners. That’s why I’m backing it to succeed over the long run.