Rolls-Royce‘s (LSE:RR.) earnings have rocketed since the depths of the pandemic, driving the value of its shares skywards. At 526p, the FTSE 100 engineer’s share price has grown almost 290% in the past three years alone.

If City forecasts are correct, profits are tipped to continue rising strongly over the next few years at least, too. This could lay the foundations for further significant share price growth.

| Year | Earnings per share | Annual growth | Price-to-earnings (P/E) ratio |

|---|---|---|---|

| 2024 | 17.98p | 31% | 29.3 times |

| 2025 | 21.16p | 18% | 24.9 times |

| 2026 | 25.62p | 16% | 21.4 times |

The big question, of course, is how realistic these profits estimates are. It’s not unusual for corporate earnings to significantly beat or fall short of what analysts are predicting.

Should you invest £1,000 in AstraZeneca right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if AstraZeneca made the list?

So what are the growth prospects for the Footsie firm? And should I buy Rolls-Royce shares for my portfolio?

The case for

Rolls’s profits recovery has been driven by the post-pandemic rebound in the civil aviation sector. Pent-up demand for travel has continued to fuel plane ticket sales long after the end of Covid-19-related fleet groundings.

This is significant given the firm’s role as one of the world’s biggest aviation engine suppliers. The company makes around half of its revenues from activities like servicing the power units on large planes.

But Rolls’ rebound is also thanks in part to strength elsewhere. While Civil Aerospace sales rose 27% in the first half of 2024, Defence revenues improved 18%, reflecting strength at its air combat and submarines segments.

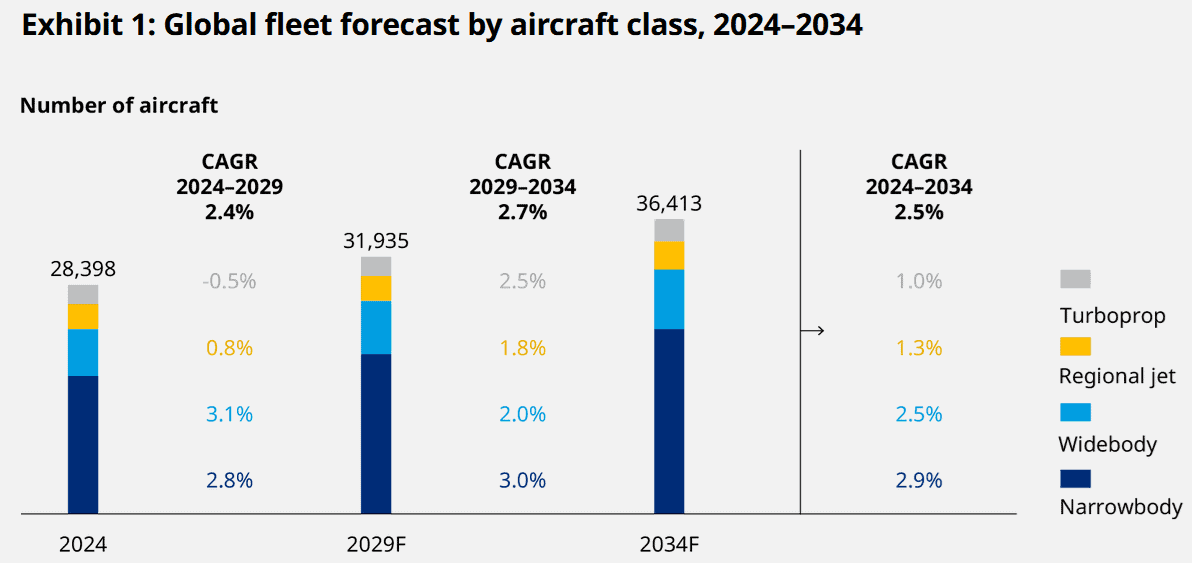

Encouragingly, the outlook for both civil and defence markets remains strong over the near term and beyond. Here you can see forecasts for civilian aircraft numbers as the global tourism boom continues.

Earnings could also balloon as Rolls’s successful transformation programme rolls on. Margins have improved considerably (they hit 18.6% in the first half) thanks to measures like job reductions and contract renegotiations.

The case against

Having said that, there are threats to Rolls-Royce and its shares in the short term and beyond.

One is the threat of declining or stagnating sales if the global economy weakens. Given a relatively steady raft of weak data coming from the US, this scenario can’t be discounted.

There’s also the problem of ongoing supply chain issues in the aerospace industry. Rolls warned of a “challenging supply chain environment” in its half-year results, and cautioned that this could last for up to 24 months.

I’m also concerned about a major hardware fault that could result in lost sales and large financial penalties. In recent weeks, Cathay Pacific has grounded a number of its aircraft due to a fuel nozzle issue inside the Trent XWB-97 engine.

The verdict

There are certainly reasons to remain optimistic about Rolls-Royce and its share price outlook. But there are also considerable dangers that could blow the engine builder off course.

With a forward P/E ratio of nearly 30 times, I think that — all things considered — much of the good news is baked into the company’s share price. In fact, I fear this lofty valuation could cause its shares to plummet if news flow around the business starts to weaken.

This is why, despite its bright growth forecasts, I’d rather buy other FTSE 100 shares today.