The BP (LSE: BP.) share price has had a torrid 12 months, losing over a quarter of its value. But for me, now’s not the time to be bearish on the stock.

Industry-leading shareholder returns

BP’s top priority is shareholder returns. In its latest quarterly update, it hiked its dividend per share (DPS) 10% to 8 cents per share. Indeed, over the past three years, DPS has increased over 50%. Today’s 6% forward dividend yield’s considerably higher than what any cash savings account offers.

Driving bumper dividends is strong free cash flow generation, which reached $8.1bn in Q2. But a growing dividend represents only one part of the distribution to shareholders.

Share buybacks continue at pace. For FY24, it expects to buyback $7bn of its own shares. With continuing share price weakness, I view this as a good move. In total, it plans buybacks of at least $14bn through 2025.

Demand for energy

I don’t invest in businesses purely based on shareholder returns. I need to have confidence that a business will continue to generate healthy free cash flow into the future. For BP, this all revolves around demand for its products.

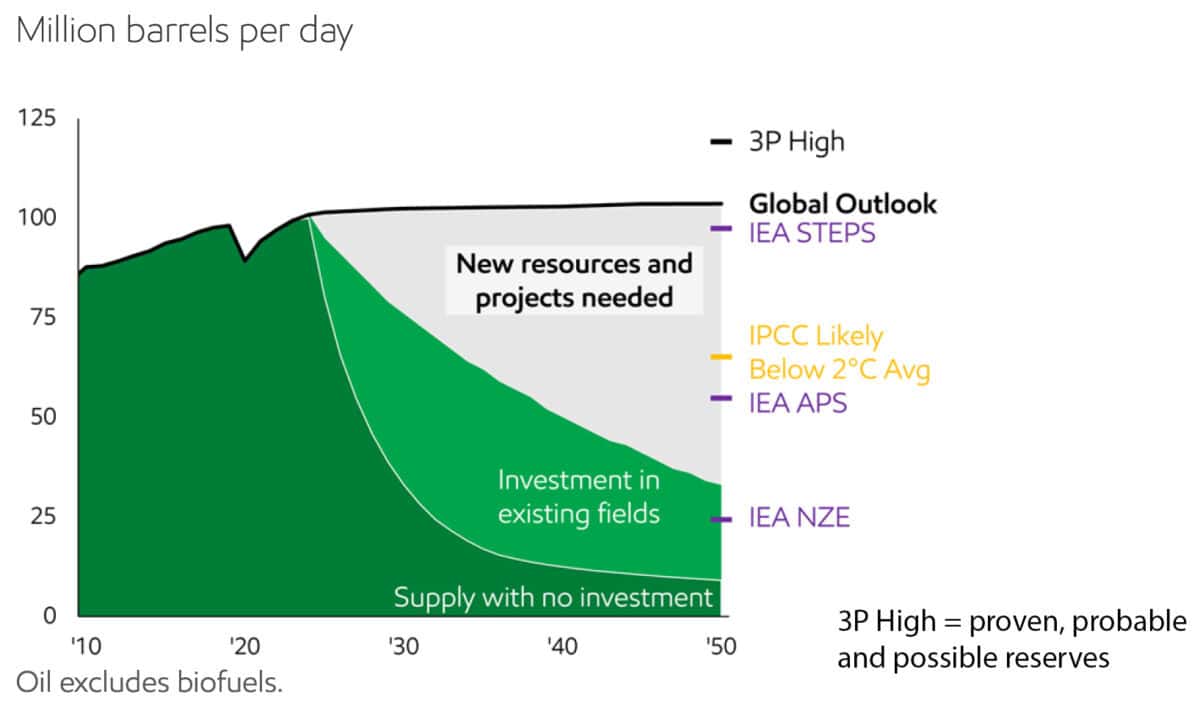

In August, ExxonMobil published its updated global energy outlook out to 2050. The following figure illustrates its future expectations for oil demand.

Source: ExxonMobil

Over the next 25 years, they see demand for oil flatlining. This is due to the acceleration of the energy transition.

What’s really telling about this chart though, is that expected demand using the existing International Energy Agency’s default STEPS (Stated Policies) scenario, as well as the more ambitious Announced Pledges Scenario (APS) can only be met with new supply. Its chart of natural gas paints a very similar picture.

This is where the opportunity in oil and gas lies, in my opinion.

What characterised the bull markets leading up to the global financial crisis in 2008, and again in 2014, was that the industry was investing like drunken sailors. Today, nothing could be further from the truth.

Currently, for a whole host of reasons, the industry’s characterised by conservatism and a lack of risk-taking. This is setting up a supply-and-demand mismatch in the years and decades ahead, which will be very favourable to the likes of BP.

Net debt

One area of concern for me is the company’s high net debt position. It currently stands at $22.6bn. Indeed, net interest stands at 80% of its dividend. This is likely to be unsustainable if interest rates don’t fall dramatically in the years ahead.

But this fact also speaks to a wider point that I raised above. Namely, it’s more interested in allocating capital to the buyback of its own shares than to investing in discovering new oil fields. But this fact isn’t unique to BP, as it’s prevalent across the industry.

I wouldn’t say that the opportunity in oil is as obvious as it was in 2020, when prices went negative. But given a choice between ridiculously overvalued tech stocks, like the ‘Magnificent 7’, or cheap commodities businesses, who are simply gushing free cash flow, then I know which one I’d choose.

That’s why I recently bought more BP shares for my Stocks and Shares portfolio.