The FTSE 250 recently completed its quarterly review of which stocks to add or remove from the index based on changes in their market capitalisations. The reshuffle saw Burberry join the index after falling off the FTSE 100, and easyJet just barely escaping a demotion. A popular addition was that of micro-computer manufacturer Raspberry Pi, which rose into the index after going public only four months ago.

But today I’m looking at a lesser-known real estate investment trust (REIT) that joined the index last month. Its share price shot up 30% in Q3 of 2024, so I had to find out the story.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Should you invest £1,000 in The Prs Reit Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if The Prs Reit Plc made the list?

The PRS Reit

The PRS Reit (LSE: PRSR) is a close-ended investment trust with an aim to build single-family homes marketed to the private rented sector (PRS). Launched in 2017, it now has the largest build to rent portfolio in the UK. In total, over 5,600 homes are scheduled for completion by the end of Q1 2025, with rental value estimated to be around £66.5m once fully let.

Recent performance is impressive, with revenue up 17% year on year and earnings up 106%. Plus, it has a 4% dividend yield and a low forward price-to-earnings (P/E) ratio of 9.5. One concern is it has limited coverage for interest payments, so if earnings fall, it risks defaulting on debt.

Reliable earners

I’m a big fan of real estate investing so REITs are particularly attractive to me. For smaller investors who can’t afford to purchase entire properties, REITs can offer exposure to the market. The rules applied to them are also attractive. In exchange for favourable tax benefits, REITs must return 90% of their profits to shareholders in the form of dividends.

This makes them an excellent addition to a passive income portfolio. One I already own, Primary Health Properties, has a 6.7% dividend yield and a solid track record of payments. Like many REITs, it has grown in the past month as the new Labour government promises renewed focus on home building.

Real estate, real risk

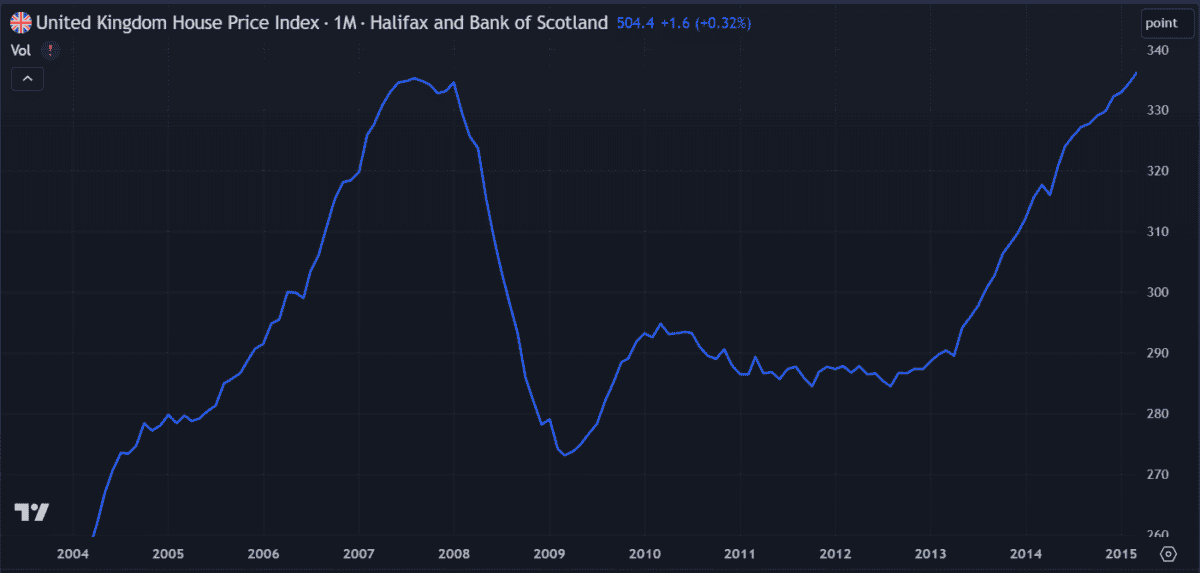

The events of the 2008 financial crisis are evidence of the risks associated with the housing market. The price chart of pretty much any global asset shows a significant dip that year but real estate stocks took the brunt of the losses, with many losing over 90% of their value over a 12-month period.

The crash was described as a ‘black swan’ event, suggesting it was unique and unpredictable. A one-off event or not, it highlights the fragility of the housing market. This is a key risk when it comes to REITs. Remember, they’re only required to return 90% of profits to shareholders — no profits, no dividends.

A favourable market

Right now, the housing market looks favourable to me. The year’s first interest rate cut has already increased mortgage approvals and more cuts may be coming. Plus, the new Labour government’s enthusiasm for property development is encouraging.

These factors have renewed my interest in REITs, particularly small, upcoming ones. That’s why I think PRS is a great opportunity and I plan to buy the shares soon.