Investing in growth stocks can be a good idea as they offer the potential for significant capital appreciation. Over time, their share prices can experience spectacular growth as earnings shoot through the roof.

These shares also come with a higher level of risk and chance for volatility, however. So investors need to take care when choosing what to buy.

With this in mind, here are two investments I think are worth serious consideration this October.

TBC Bank Group

Investors have an array of banking shares to choose from. But I’d steer away from UK high street operators such as Lloyds and NatWest given the mediocre outlook for the British economy.

Instead, I’d spend my money on TBC Bank Group (LSE:TBCG). Earnings here have soared thanks to strong economic growth in Georgia, its core territory. Between 2018 and 2023, the company’s gross loan portfolio grew at an annual rate of 15% as financial services demand expanded.

Encouragingly, Georgia’s economic boom is tipped to carry on, too. The World Bank estimates GDP growth of 5.2% in 2024. And it predicts expansion to remain around 5% for the following two years.

By comparison, the World Bank thinks Britain’s economic growth will come in closer to 1% over the period.

Reflecting these forecasts, City analysts think TBC Bank will rise 10% this year before accelerating to 20% in 2025.

Mounting political instability in the country poses a potential threat to future earnings. But I think this is baked into the bank’s ultra-low valuation. It trades on a forward price-to-earnings (P/E) ratio of just 4.6 times.

In fact, with TBC Bank also carrying a huge 7.6% dividend yield, I think it has significant appeal as an income stock as well as a growth share.

Vanguard Growth ETF

Investing in individual shares carries higher risk than spreading cash across a multitude of companies. It’s why we at The Motley Fool recommend building a portfolio of different companies.

However, individuals can also do this easily (and more cheaply) by buying an exchange-traded fund (ETF). These are financial instruments that hold a basket of stocks or other assets.

I have holdings in several ETFs. And I’m considering adding the WisdomTree US Quality Growth ETF (LSE:QGRP), which was founded earlier this year, to my portfolio.

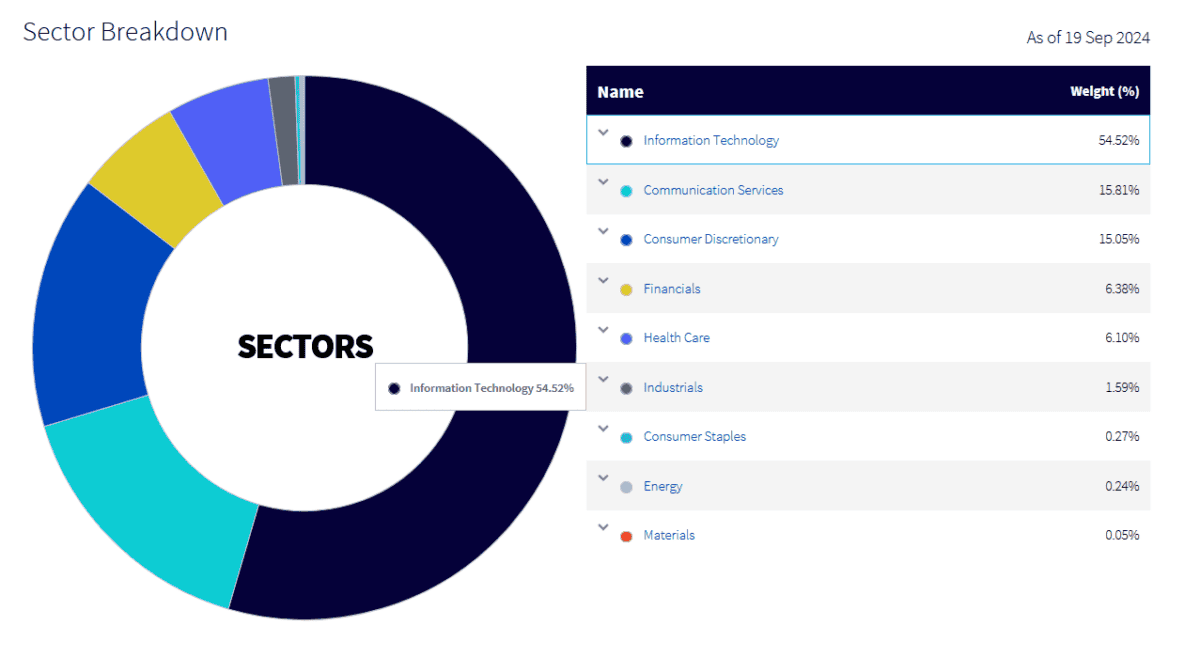

The fund currently holds 100 stocks including US tech giants Microsoft, Nvidia and Apple. Indeed, technology features heavily in its makeup, giving investors exposure to hot growth opportunities like artificial intelligence (AI), autonomous vehicles, and quantum computing.

While ETFs help reduce risk, they aren’t (like any investment) completely free of peril. In the case of this WisdomTree product, the average P/E ratio of the stocks its holds is a huge 37.7 times.

The problem is that high valuations like this leave a stock or fund at risk of a price collapse if investing confidence declines.

Having said that, elevated valuations are common among growth stocks. And, on balance, I think the fund could be an excellent addition to my portfolio.