I’m looking for great stocks to buy this month for a winning passive income. Of course, I’m not just seeking dividend stocks that currently have the biggest yields. Instead, I’m searching for businesses in good shape to grow shareholder payouts over time.

The following dividend shares would give me the best of both worlds, I believe.

| Stock | 2024 dividend per share | Dividend yield | 2025 dividend per share | Dividend yield |

|---|---|---|---|---|

| Tritax Big Box REIT (LSE:BBOX) | 7.64p | 4.7% | 8.09p | 5% |

| Primary Health Properties (LSE:PHP) | 6.9p | 6.8% | 7p | 6.9% |

Here’s why I think they’re worth a close look this October.

Tritax Big Box REIT

Tritax’s merger with UK Commercial Property REIT in May opened the door for promotion to the FTSE 100. And it enters the index as one of its biggest dividend payers. As the table above shows, dividend yields sail above the 3.5% average for the broader Footsie for the next two years.

Real estate investment trusts (REITs) like this can be great choices for income investors. This is because they’re obliged — in exchange for tax perks — to pay at least 90% of annual rental income out in the form of dividends.

It’s also because they tend to have tenants locked down on long-term contracts, providing them the with the essential cash flows (not to mention the confidence) to pay a large and usually growing dividend over time.

At Tritax, the weighted average unexpired lease term (WAULT) for its core Foundation assets was 14 years as of June.

This bodes well for future payouts, as does its place in a fast-growing market. Demand for the modern logistics hubs it specialises in should steadily grow as e-commerce volumes rise, supply chains are optimised, and companies invest to improve their ESG credentials.

Higher-than-normal interest rates have put property stocks like Tritax Big Box under pressure more recently. This remains a threat going forward. But receding inflation means the Bank of England looks poised for a flurry of rate cuts, providing a sector-wide boost.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Primary Health Properties

Like Tritax Big Box, Primary Health Properties is categorised as a REIT, giving investors the same dividend benefits. But over the next two years at least its dividend yields are more impressive approaching 7%.

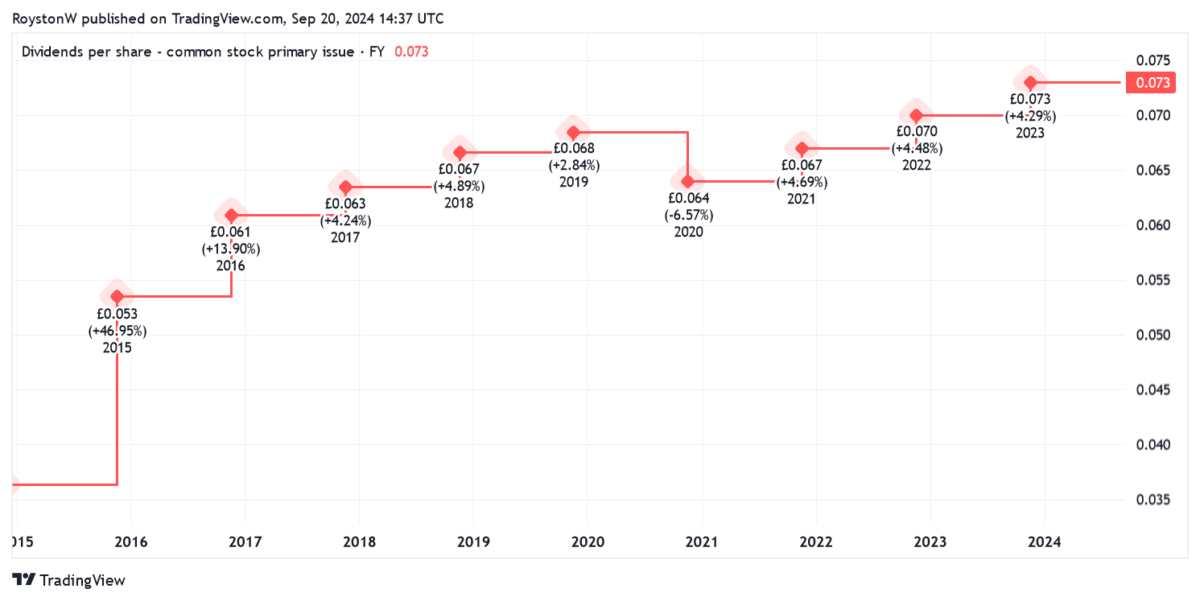

Furthermore, its record of dividend growth’s also better. Shareholder payouts have risen every year all the way back to 2009.

Like its sector peer, it has its tenants signed into long-running contracts. Its WAULT sits at a meaty 9.8 years as of June.

Primary Health also has an ace up its sleeve that makes it a reliable dividend payer. The firm’s focus on healthcare properties (such as GP surgeries) means that rents are essentially guaranteed by local authorities and the NHS.

As with Tritax, the future direction of interest rates creates uncertainty here. Earnings may also come under pressure if healthcare policy changes in the UK. Yet, on balance, I think Primary Health Properties is a great income share to consider.