With mining on the up, I’m considering which shares to buy in this burgeoning industry.

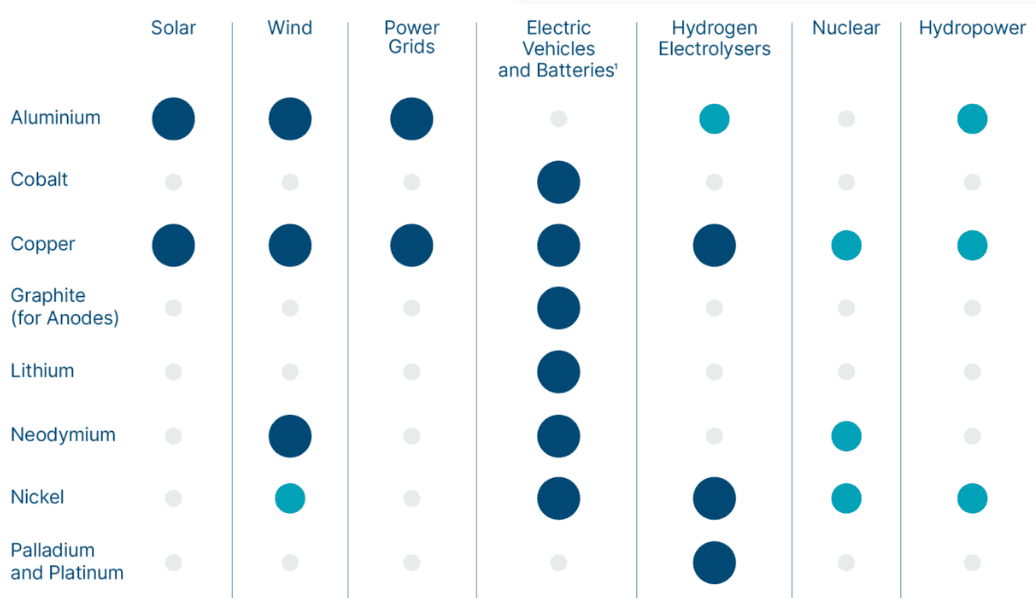

The transition to clean and renewable energy continues to drive the demand for critical minerals. Lithium, nickel and cobalt are the core components used to manufacture batteries for electric vehicles (EVs) and solar panels. Meanwhile, platinum is used to reduce the harmful waste products from internal combustion engines. Copper remains the most efficient electrical conduit.

These are just some of the minerals produced by the major mining companies Antofagasta (LSE: ANTO) and Anglo American (LSE: AAL).

Should you invest £1,000 in Renalytix Ai Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Renalytix Ai Plc made the list?

Here’s my take on which of the shares looks most attractive today.

Antofagasta

The Antofagasta share price struggled a bit in the past few months but recovered in September. It’s now up 24% this year. Based in Chile, the miner is one of the largest copper suppliers in the world, having produced 660,600 tonnes in 2023. Its Los Pelambres mine is estimated to hold 4.9bn tonnes of ore grading 0.65% copper.

Despite a 2.3% rise in revenue, performance this year has been underwhelming. In the first-half results, earnings per share (EPS) missed analyst expectations by 4.5% and net income fell 21%. This could be due to less demand in China, which brought the price of copper down below $9,000 a ton.

Still, its prospects look good. Earnings are forecast to rise 33% to $1bn by 2026, which could bring its price-to-earnings (P/E) ratio down to 24. It’s still a lot higher than the industry average but a move in the right direction.

Since it only produces copper, Anto is at risk of losses if demand declines or competitors corner its market. But for now, global demand seems unlikely to subside as copper is widely used in electronics.

Anglo American

Anglo is involved in mining a wide range of minerals, including platinum group metals, copper, iron ore, and diamonds. This puts it in a more lucrative position than Anto, as it could benefit from various economic cycles. It has a strong focus on sustainable mining practices and aligns with growing environmental concerns, making it attractive to socially responsible investors.

The stock was tipped as a buy by Deutsche Bank in early September, and last week JPMorgan put in an overweight rating on the stock. It pays a dividend but has made several large cuts in the past two years, reducing the yield from 7.5% to 2.6%. Coupled with a 30% price decline since early 2022, the stock hasn’t been kind to investors.

It’s currently unprofitable and estimated to be undervalued by 17% based on future cash flow estimates. But given that Anglo American is a market leader in a high-demand industry, I suspect the recent losses are cyclical. Analysts seem to agree, with earnings forecast to grow at an annual rate of 45% in the coming years.

The winner?

All things considered, I believe Anglo American is the stock I’d buy today if I decide to add one of these blue-chip mining stocks to my portfolio.

Of course, there’s no guarantee it will outperform Antofagasta in the coming years. But I’d be more confident buying it today given its broader portfolio of minerals and focus on sustainability.