Aston Martin (LSE: AML) stock was sticking out like a sore thumb in the FTSE 250 today (30 September). It fell by as much as 27%!

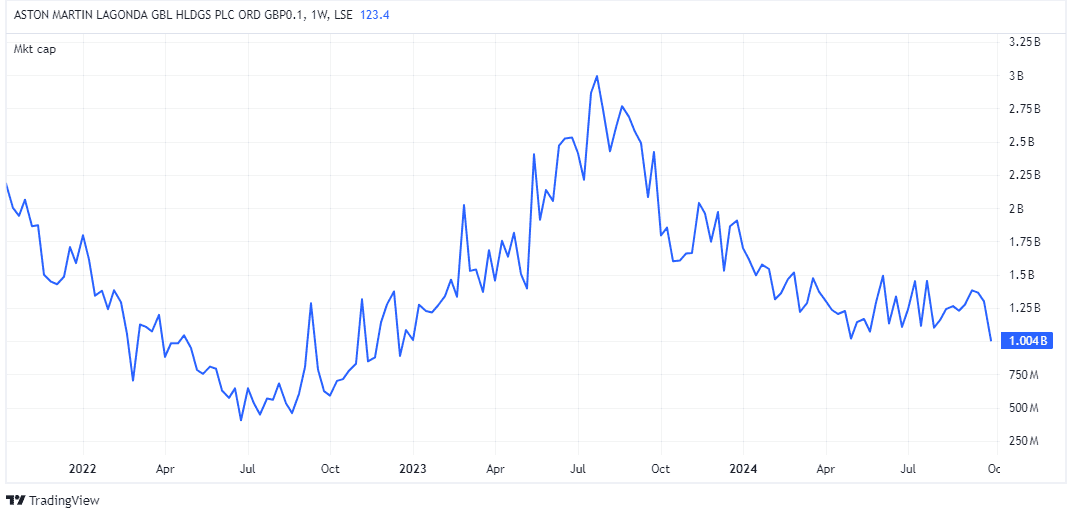

As I write, it’s started to tentatively rise, narrowing the decline to ‘just’ 22%. Nevertheless, this is turning out to be (another) bad day for long-suffering shareholders. The stock is down 89% in five years.

Are Aston Martin shares now in bargain-basement territory? And if so, should I buy them?

Should you invest £1,000 in Aston Martin right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aston Martin made the list?

Why has the stock tanked?

Today’s sell-off was sparked by an unexpected profit warning from the luxury carmaker. In this update, it flagged up supply chain problems and weak demand in China.

As a result, it lowered its 2024 production guidance by 1,000 units.

This means adjusted underlying earnings will be slightly below last year’s figure, while it no longer expects to achieve positive free cash flow in the second half. The full-year gross margin will dip below 40%, it said.

Weak auto market

There were a couple of brighter spots in the update, however. One is that targets for 2025 remain unchanged (at least for now). The other is that Aston Martin says it will now be in “the enviable position of commencing the new year with a fully reinvigorated portfolio of ultra-luxury high performance models“.

To be fair, concern around weak demand in China is being echoed by most other car companies. Stellantis, for example, just lowered its financial outlook amid a “deterioration in global industry dynamics“.

Overall, though, this is yet more disappointing news for Aston Martin shareholders. A ramp-up in production of its new models was supposed to be driving revenue and profit growth right now.

Balance sheet issues

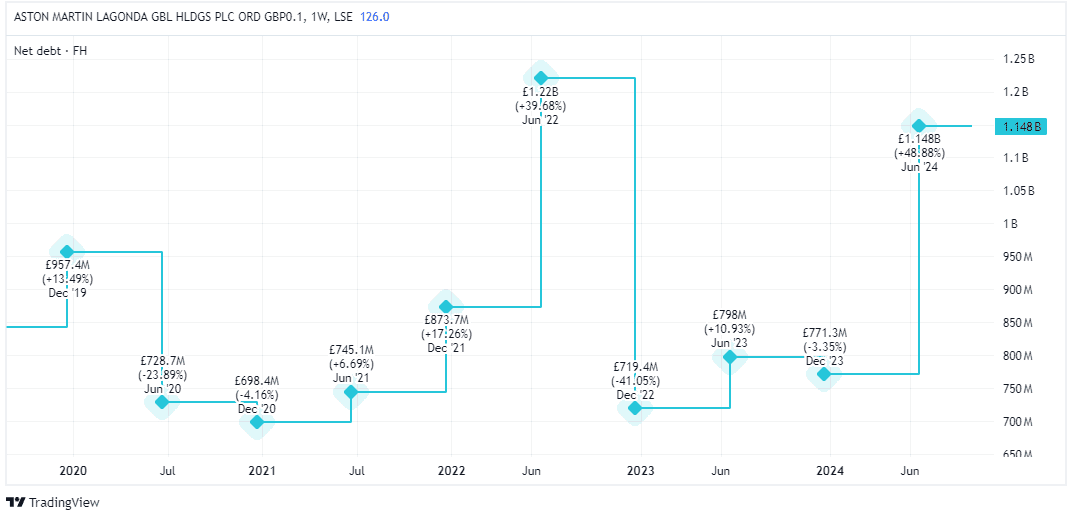

The main risk here is the firm’s significant debt. At the end of June, net debt stood at more than £1.1bn.

That’s more than its current market cap, which has now fallen to just £1bn.

Another thing I don’t like here is the constant turnover of executives. Aston Martin has had four different CEOs in as many years. I tend to look for more stability when I consider investing in companies.

Will I buy Aston shares?

It’s hard to know whether this is a bargain or not. I mean, the firm’s losses are mounting and it has massive debts. The brand is iconic, for sure, but we currently have no idea about future sales demand.

Then there’s the eventual transition to electric vehicles, which still looks uncertain for Aston Martin, to put it mildly.

Perhaps it’s unfair to compare the firm to Ferrari (a stock I do hold). But Aston Martin has long sought to convince investors that it could improve its margins by adopting strategies similar to the Italian automaker, such as expanding its luxury offerings and reducing volumes to maintain exclusivity.

Perhaps it will one day. But as AJ Bell‘s Russ Mould colourfully put it back in May: “The company’s valuation is a fraction of what it was when it listed back in 2018, rendering initial comparisons with Ferrari as ridiculous as setting a park jogger up against an Olympic middle-distance runner.”

Ferrari stock is far from cheap today. But I’d prefer to have the Olympic runner in my portfolio over the next few years.