Looking for rock-solid stocks to buy for a second income? Here are two I’d buy with spare cash to invest. And I’d expect them to pay big dividends, regardless of economic conditions.

The PRS REIT

The PRS REIT (LSE:PRSR) share price has gone gangbusters on rising hopes of large and sustained interest rate cuts. At 97.8p per share, it’s now trading at its most expensive for two years.

Real estate investment trusts (REITs) like this can be dividend lifeboats in troubled times. They typically have their tenants locked down on long-term contracts. And so they can expect a steady stream of income at all points of the economic cycle.

PRS REIT offers an extra layer of protection to investors. Okay, rental contracts might not be as long. But it specialises in the ultra-defensive residential property market, where rents are even more secure. Collection here was 100% between April and June, while occupancy was an impressive 96%.

One other reason I like REITs is that they’re obliged to pay a minimum of 90% of rental profits out in dividends. They do this in exchange for certain tax advantages (like exclusion from corporation tax).

As a consequence, PRS REIT carries large dividend yields of 3.5% and 4.5% for the next two financial years.

On the downside, residential rental growth in the UK’s cooling. This dropped to three-year lows of 5.4% in September, according to Zoopla. It may moderate further in the years ahead if government plans to build 300,000 new homes a year to 2029 don’t live up to expectations.

However, the rate of population growth means PRS should continue paying a large and growing dividend, in my opinion. And it’s building its property pipeline to keep earnings and dividends on an upward slant (it’a a pipeline that sits at roughly £3bn).

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Pan African Resources

Purchasing gold’s a classic strategy during tough and uncertain economic periods and times of high inflation. Demand for the safe-haven asset tends to pick up considerably in these conditions.

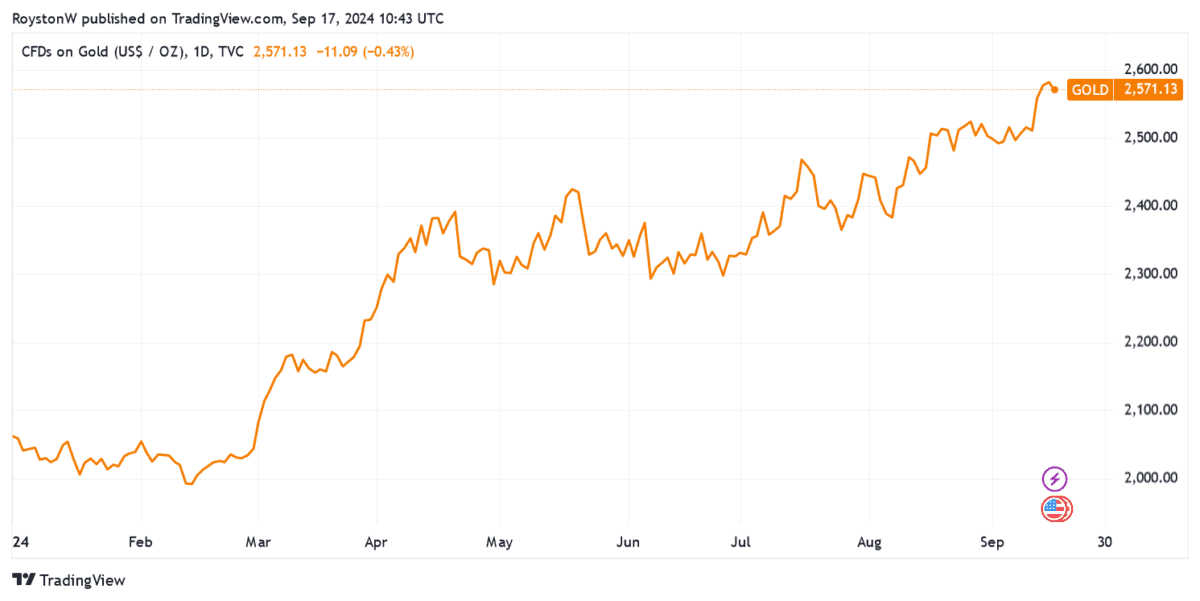

This has certainly been the case in 2024. The yellow metal has hit repeated record highs, and has touched another peak around $2,600 per ounce in recent days.

I wouldn’t buy physical metal or a gold-tracking exchange-traded fund (ETF) to capitalise on this though. By buying a mining stock instead, I might also have a chance of receiving a dividend.

This is why Pan African Resources (LSE:PAF) would be at the top of my own shopping list. For the next two years predicted dividends actually sit at eye-popping levels. These are 3.6% and 6.6% for the financial periods to June 2025 and 2026 respectively.

Investing in miners can carry extra dangers. Namely, Pan African Resources’ share price may plummet if it experiences production problems at its South African operations.

However, I believe this threat’s baked into the company’s rock-bottom valuation. At 32.5p per share, it trades on a forward price-to-earnings (P/E) ratio of just 6.5 times.