During my time investing in the stock market, I’ve experimented with many different strategies. Some of these include dividend investing, penny stock investing and dollar-cost averaging.

More recently however, I’ve been introduced to an approach known as ‘quality’ investing. Evidence suggests this strategy has the potential to deliver excellent long-term returns. I just wish I’d known about this strategy 10 years ago!

Quality investing in a nutshell

The genius of quality investing is outmatched only by its profound simplicity. All it requires is investing in high-quality businesses with reasonable valuations. It’s the type of strategy that would make billionaire investor Warren Buffett proud.

The trick is identifying the right stocks, which is where it gets a bit more complex. A solid balance sheet and high growth potential are obvious but other characteristics to look for include:

- Competitive advantage (a wide ‘moat’)

- Managers who are invested

- Smart capital allocation

Key metrics to check are return on capital employed (ROCE) and gross margins. ROCE should be greater than 15% and margins above 40%.

Identifying stocks

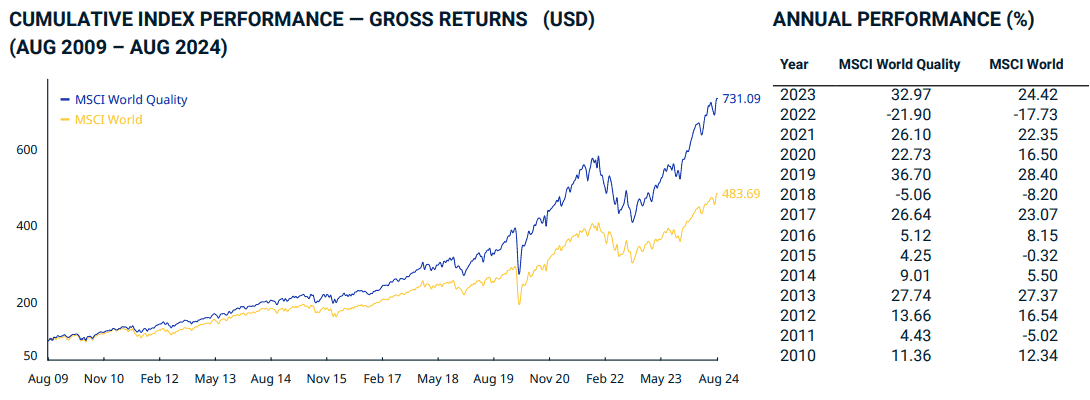

The MSCI World Quality Index is specifically designed to provide investors exposure to high-quality growth stocks. In the 10 years between 2013 and 2023, it outperformed the standard MSCI World Index eight times.

The index leans heavily towards US tech stocks such as Nvidia, Apple, and Meta but also includes some finance and health stocks including Eli Lilly and Visa.

In terms of UK stocks, I think AstraZeneca (LSE: AZN) fits the bill well. While there’s certainly competition in the biomedical industry, it’s a leader in its field and very well established.

At 13%, its ROCE is slightly below the recommended amount but has more than doubled since 2022. More impressive is its gross margin, at 82.6%. It brought in almost $50bn in revenue in 2023, retaining a net profit of $6.4bn.

Considerations

As ever, there are some risks and concerns. Firstly, the pharma giant has quite a lot of debt, which isn’t a typical characteristic of a quality company. For now, its manageable but worth keeping an eye on.

More worrying is the ever-present patent cliff that all pharma companies face. If a patent expires on one of AstraZeneca’s biggest money spinners, revenue could plummet as competitors flood the market with generics. Expiry dates differ based on region and drug composition so rather than one big drop, it could experience sporadic losses.

Two of its biggest sellers, Lynparza and Symbicort, face patent expiries this year.

Recently, the shares have fallen quite sharply, which could be a result of shareholder jitters ahead of those patent expiries. However, this also presents an attractive buying opportunity.

Looking long-term, the shares are up 165% in the past 10 years, representing an annualised return of 10.2% a year.

Final thoughts

Quality investing is a low-risk, long-term strategy aimed at building wealth for the future. As such, beginner investors might feel underwhelmed by the slow progress it delivers. However, it’s one of the most reliable and proven methods practised by some of the world’s most famous investors.

Still, I enjoy the excitement of identifying risky small-cap stocks with high growth potential. But with a better understanding of this strategy, I plan to allocate a larger percentage of my portfolio to high-quality stocks.