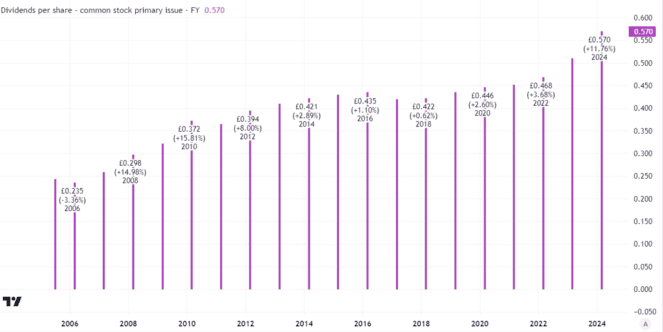

Different investors each have their own objectives and risk tolerance. Many, especially as they get older, like shares that are set to generate stable earnings over the long run and offer a beefy dividend. National Grid (LSE: NG) at first seems to fit that bill well. After all, a nationwide power grid is hard to replicate and benefits from long-term customer demand. National Grid shares yield 5.5% and have a solid history of growing the annual payout. Last year, the dividend per share grew 6%.

Created using TradingView

I understand the appeal of that dividend. National Grid aims to grow its dividend each year in line with a measure of inflation and has successfully achieved that over the past few years. That appeals to many investors – including me – as it helps to protect the real value of the payout.

Should you invest £1,000 in Phoenix Group Holdings Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Phoenix Group Holdings Plc made the list?

The basis of success – and a challenge

However, maintaining dividend growth here is not as easy as it may first seem. National Grid’s strength is also a source of financial weakness, in my view.

If customer demand was not as strong and resilient as it is, it could become a cash cow, investing the bare minimum on infrastructure and increasing prices, generating large cash flows to fund the dividend.

But prices are regulated. Demand for power is set to remain high for the indefinite future, meaning National Grid needs to keep spending money just to keep the lights on (so people can keep their own lights on). Not only that, recent years have seen big shifts in where some power is generated and also where it is needed.

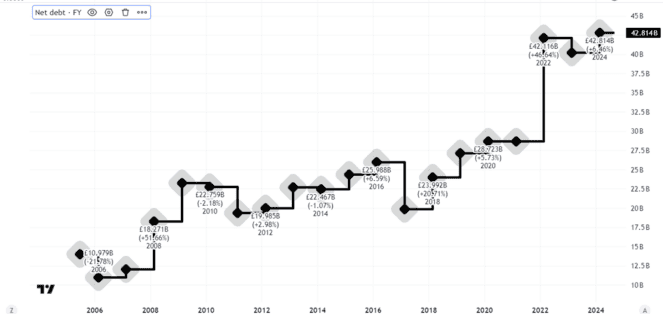

The upshot is that the company, like similar firms in other markets, is having to spend heavily to keep its network updated to meet current and likely needs. That has led to a long-term increase in borrowing, as this chart of National Grid’s net debt illustrates.

Created using TradingView

Where things might go from here

That threatens the ability of this dividend share to maintain let alone grow its dividend, in my view. The company raised around £7bn in a rights issue earlier this year, helping to bolster the balance sheet, which I see as positive for the dividend outlook.

But it came at the cost of diluting existing shareholders. I see a risk of more of the same in future if National Grid’s capex costs remain stubbornly high.

Given that, I think the risk profile of National Grid shares is higher than suits me.

I also have doubts about how long the firm’s chunky dividend can be sustained in the absence of more fundraising or changes to the business model. For now, as a risk-averse investor, I have no plans to buy.