The FTSE 100 has some quality dividend shares. And while there are never any guarantees, several have impressive track records when it comes to returning cash to shareholders.

This can be a sign that a company has seen it all before and can cope with setbacks. This can be extremely valuable for investors looking for long-term passive income.

Tesco

Tesco (LSE:TSCO) is the UK’s biggest supermarket company. And that’s a good thing from an investment perspective – demand for food tends to be resilient even in a recession.

The big challenge for the company is the rise of budget retailers. There’s always a risk of customers switching to cheaper alternatives and investors need to be aware of this.

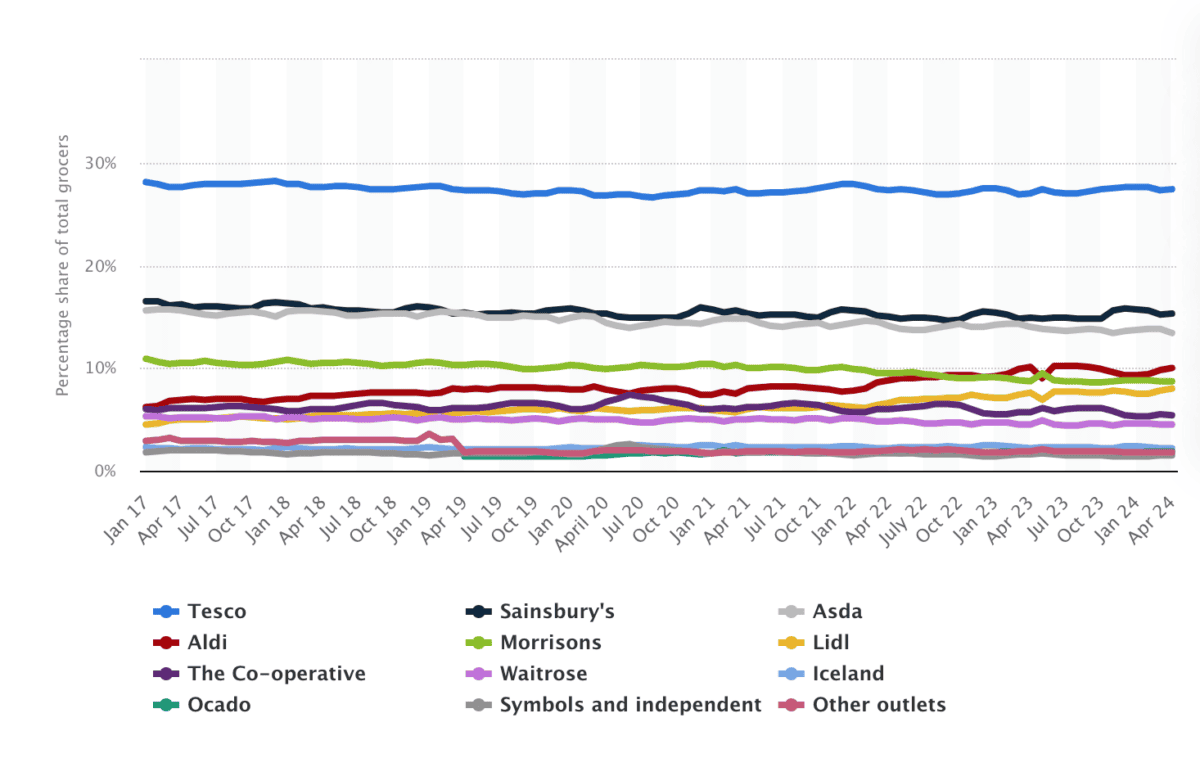

UK grocery market share 2017-24

Source: Statista

Tesco has actually managed to defend its position quite well against the likes of Lidl and Aldi, though. Its market share has been relatively stable over the last few years.

The supermarkets that have been under pressure have been the ones that don’t compete as well on price. Tesco, by contrast, has done a good job of matching competitors.

At today’s prices, the stock comes with a 3.3% dividend yield. And while that has been higher in recent years, with interest rates falling, I think it could still be attractive.

Diageo

By contrast, Diageo (LSE:DGE) has been having a tough time lately. As a result, the dividend yield has reached 3% – which is unusually high for the stock.

The last year or so has shown one of the key risks for the company. Its focus on premium brands can leave it exposed to economic downturns in the countries it does business in.

But there are indications things are starting to improve. Diageo has been shifting its strategy to cope with changing conditions and it’s starting to report positive signs.

Moreover, despite cyclical downturns in the past, the general trend in the alcohol industry has been towards premium products. If that continues, it’s a good thing for the business.

Given the company’s 37-year history of consecutive dividend increases, I think the stock looks attractive. And if things keep going, this could be a good time to own the shares.

British American Tobacco

It’s probably fair to say British American Tobacco (LSE:BATS) shares are an eye-catching proposition for income investors. The dividend yield is currently 8.5%.

A high yield can be a sign investors are concerned about a business. And the outlook for cigarette volumes is an obvious risk with a tobacco company.

While this is an issue, I think the market might be underestimating the resilience of the firm’s dividend. There are a couple of reasons for this.

One is British American Tobacco’s payouts are well below its earnings. This means it won’t be forced to cut its dividend immediately if earnings fall slightly.

Another reason is the development of new products, notably nicotine pouches. As these grow, they might help the company maintain its shareholder distributions for some time.

Durable dividends

It’s worth reiterating that nothing is guaranteed when it comes to dividends. Companies aren’t required to pay them and they aren’t always able to.

Nonetheless, the stocks highlighted here are worth considering as they’ve been great sources of passive income in the past. And I think there’s a decent chance this continues.