When we look back in a few years, I think this will prove to be a great time to invest in small-cap growth stocks. Many of these smaller UK firms are trading at low valuations, despite having tonnes of potential.

Looking ahead, investor sentiment could get a boost as inflation and interest rates fall. So I think now is an opportune time to consider snapping up UK small-cap stocks.

Analysts are bullish on this one

One that’s recently caught my eye is Kooth (LSE: KOO). This is a digital mental health provider with a market cap of just £114m.

Should you invest £1,000 in Reckitt Benckiser Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Reckitt Benckiser Group Plc made the list?

Since going public in 2020, the stock has risen 36%. However, its down 19% from a high reached three years ago.

On 17 September, Canaccord Genuity reaffirmed its ‘buy’ rating on the stock and issued a 580p share price target. On the same day, Berenberg Bank also reissued its ‘buy’ rating, with a 590p target.

If these are realised, they’d represent gains of up to 81% from the current 326p price. Naturally, this isn’t guaranteed to happen. But when there’s such a big discrepancy, my ears prick up.

What does the firm do exactly?

Kooth works with the NHS, local authorities, charities, and businesses to provide digital mental health services to children and young people. It’s one of the largest and most trusted providers in the UK.

Last year though, Kooth won a contract with the California Department of Health Care Services worth at least $188m. It will offer digital mental health care to 13- to 25-year-olds across all 58 counties in the state until mid-2027.

In the first half, the firm’s revenue surged 179% year on year to £32.5m. This was driven by the expansion in the US, which now accounts for approximately 70% of total annual recurring revenue.

The gross margin expanded to 82.4%, up from 68.8%, while adjusted EBITDA was £7.8m. Post-tax profit came in at £3.9m, up from £0.5m.

While Kooth is growing nicely, it doesn’t have a long track record of profitability. This increases the risk to the investment case.

Mental health epidemic

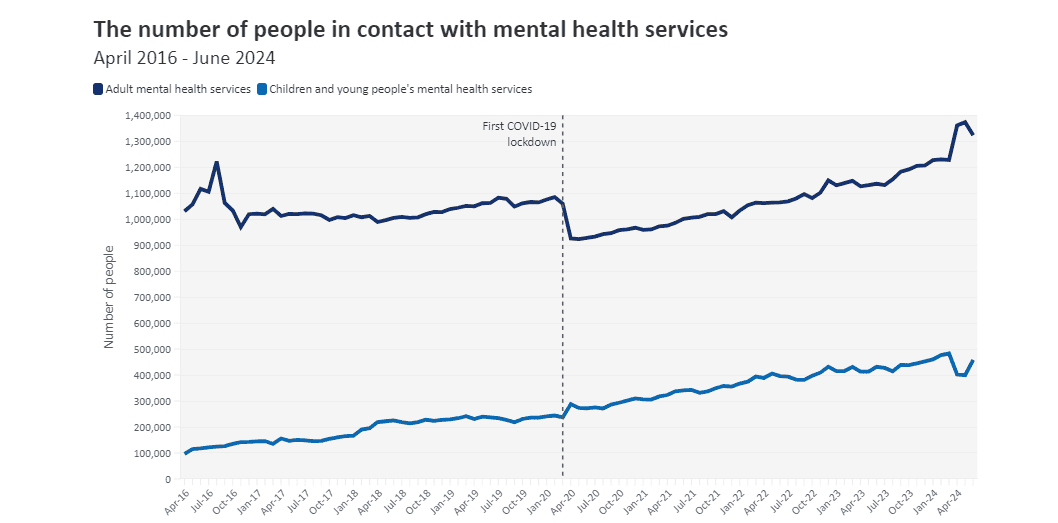

Stepping back, this (sadly) seems like a large and growing market. Social media is leading to rising levels of anxiety and depression among young people.

According to the British Medical Association, the rate of people aged 17-19 likely experiencing a mental health disorder rose by approximately 150% between 2017 and 2022.

Shockingly, Kooth says that 22% of high school students in the US have seriously considered suicide in the past year.

These issues aren’t likely to go away in the digital age, which should result in rising demand for the company’s online mental health platform.

My decision

There are a number of things I like here from an investment perspective:

- Growing revenue, most of it recurring

- Strong purpose at its core (robust ESG)

- Strong balance sheet, with net cash of £14.9m

- Likely expansion into other US states (it’s also won a contract in Pennsylvania)

- Entering the $30bn Medicaid market

The firm is only just turning profitable, so the P/E ratio is of little use. But the stock is trading at about 1.7 times forecast sales. That’s very cheap for a growing business, in my opinion.

I’ll consider buying Kooth shares with spare cash in October.