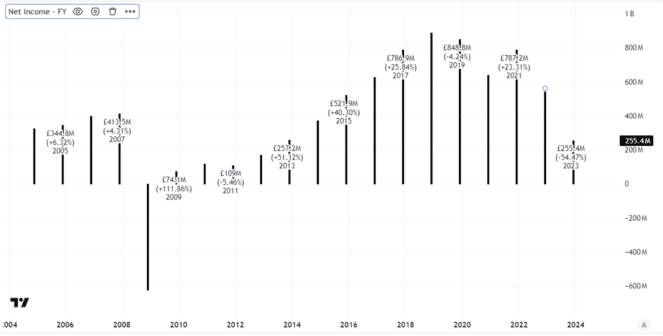

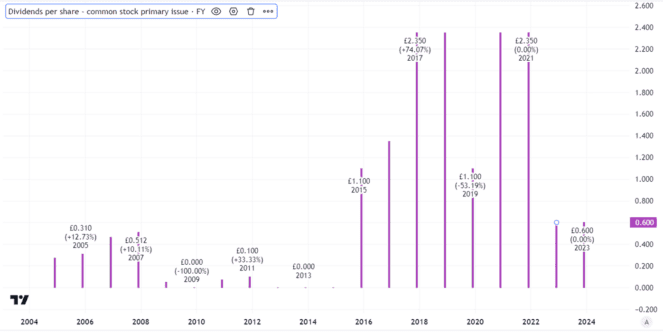

It has been a mixed few years for housebuilder Persimmon (LSE: PSN). Revenues and profits last year were the lowest they have been for many years. The dividend per share was barely a quarter of what it had been a couple of years previously. Little surprise, then, that the Persimmon share price has tumbled 20% over the past five years.

In fact, the decline was far worse than that until recently. But the share has been rallying handily and has leapt up 30% since the start of May.

With the housebuilding sector sounding more positive than it has for a while, could the shares still be a cheap addition for my portfolio even after that jump?

Potential for demand growth

The bullishness is easy to understand.

With a housing shortage in the UK, there has long been the opportunity to build large volumes of new homes. That has moved up the political agenda this year. Combined with a more attractive interest rate outlook than we have seen at some points over the past several years, that could help boost demand.

Standing on the supply side, Persimmon could benefit. It is a well-run business that has historically been among the most profitable listed housing builders.

Created using TradingView

That is not by accident, but rather by design.

Persimmon has been an innovator in its field and has a vertically integrated business model. It seeks to maximise its own financial benefit from the houses it builds and sells, as well as offering efficiencies to the business. With the prospect of a stronger housing market in coming years, that model is set to prove its worth once again.

Room for further possible growth

How well might the company do?

It currently trades on a price-to-earnings (P/E) ratio of 21. I see that as high for a cyclical and sometimes highly unpredictable market such as housebuilding.

Then again, if the business can match its strongest basic earnings per share from recent years again, the prospective P/E ratio is only around seven. If a housing boom means it does even better, that prospective valuation could be even cheaper.

On top of that, if the business does well, I expect the dividend to rise. Historically, Persimmon was a generous dividend payer. Although it cut its dividend several years ago, that seemed prudent to me as earnings fell.

Created using TradingView

If profits increase again in future, as I think they will, I expect the board will revisit the dividend level and I would not be surprised to see a meaningful increase.

Potential for ongoing increase in share price

Given the improving business outlook and what that could mean for earnings – basic earnings per share in the first half was already slightly higher than in the equivalent period last year – I see scope for the Persimmon share price to keep growing from here.

However, I continue to see risks as it is unclear whether political ambition to ramp up housebuilding translates into substantially more custom for Persimmon.

A weak economy continues to cast a shadow over the housing market, so for now I do not plan to buy Persimmon shares for my portfolio.