Dividend stock Phoenix Group (LSE: PHNX) is sporting a monster yield at the moment and UK investors are snapping it up as a result. Last week, it was the most bought stock on Hargreaves Lansdown.

Should I follow the crowd and buy the FTSE 100 stock for my portfolio? Let’s discuss.

Phoenix in a nutshell

Before I dive into the numbers here, it’s worth briefly looking at what this company does because it’s not a household name.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Phoenix Group is a savings and investment company with around 12m customers. Its goal is to be the UK’s leading retirement savings and income business.

Over the years, the company – which has been around for a long time now – has grown steadily through a series of mergers and acquisitions. Its brands today include Standard Life, SunLife, and Phoenix Wealth.

At the current share price of 553p, the company has a market cap of around £5.6bn. So, it’s one of the smaller businesses in the FTSE 100 index.

Favourable demographics

Looking at Phoenix Group today, there’s quite a bit to like about the business from an investment perspective, to my mind.

For a start, there’s a long-term growth story here due to demographics. With the UK’s population ageing rapidly, demand for retirement income solutions should be quite high in the years ahead.

Second, the company is generating a fair bit of cash right now. In the first half of 2024, it generated £647m in operating cash flow versus £543m a year earlier.

Third, the valuation seems reasonable. At present, the price-to-earnings (P/E) ratio is 12.3.

Finally, we have the huge dividend. For 2023, Phoenix Group paid out 52.65p per share to investors, which translates to a yield of 9.5% today.

Several risks

Digging deeper, however, I have some reservations about the stock.

The first is that dividend coverage (the ratio of earnings to dividends) is low. This year, analysts expect earnings per share of 45p and dividends per share of 54p, giving a ratio of 0.83. Generally speaking, a ratio under one is a warning that a payout isn’t sustainable.

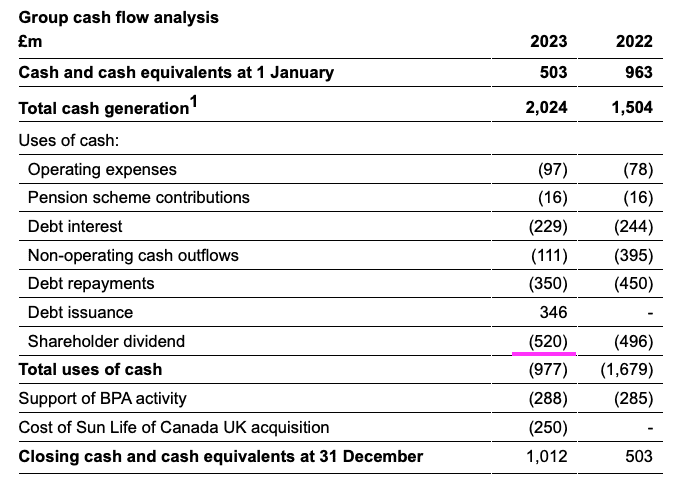

Now, this may not be an issue since the company is generating plenty of cash as I mentioned earlier. This year, it expects to generate £1.4bn to £1.5bn in cash. This should be enough to cover the dividend, which only cost the company £520m last year. Still, I see the low dividend coverage ratio as a red flag.

A second issue is that in the first half of 2024, the company posted a large loss (£646m). This could be a short-term thing but it’s not ideal – I like to invest in consistently profitable businesses as they’re less risky.

Another factor to be aware of is that there’s quite a bit of debt on the balance sheet (£3.7bn in borrowings at the end of H1). This adds risk.

Finally, the stock doesn’t have a good track record in terms of its share price. Over the last 15 years, its share price hasn’t gone anywhere.

Should I buy?

Weighing this all up, I’ve decided that Phoenix Group shares are not for me.

There could be some big dividends here in the near term.

But given the debt pile, low dividend coverage, and lack of long-term share price gains, I think there are better dividend stocks to buy for my portfolio.