FTSE 250 retailer WH Smith (LSE:SMWH) doesn’t immediately jump out as a stock to consider buying. It trades at a price-to-earnings (P/E) multiple of 29 and there are better moats around sandcastles.

On closer inspection though, there’s a lot more than meets the eye. The business is better than initial appearances suggest and the share price is actually cheaper than it seems.

Physical retail?

WH Smith has an unimpressive physical retail operation. In a world of online shopping and fierce high street competition, this part of the business doesn’t have much to differentiate itself.

Should you invest £1,000 in HSBC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if HSBC made the list?

The most recent results bear this out – sales in the company’s high street stores are down 4% from a year ago. But there’s a lot more to the business than struggling brick-and-mortar outlets.

Around 75% of the FTSE 250 company’s revenue comes from its Travel division – outlets located in train stations, airports, and so on. And things look very different in this part of the organisation.

Travel sales are growing at around 10% a year and the firm sees opportunities to keep expanding. The result’s a reduction in the amount of the company’s revenues that come from high street sales.

It should be noted that this makes it more heavily exposed to fluctuations in travel demand – which can be cyclical. And while this may grow over time, it’s a risk investors should take note of.

Importantly though, airports and train stations are good retail locations – there’s less competition and the threat of e-commerce is practically zero. And that greatly improves WH Smith’s prospects.

Is it cheap?

The above notwithstanding, it’s natural to think 29 times earnings is a lot to pay for a stock like this. And I agree – but the company’s P/E multiple’s a bit misleading at the moment.

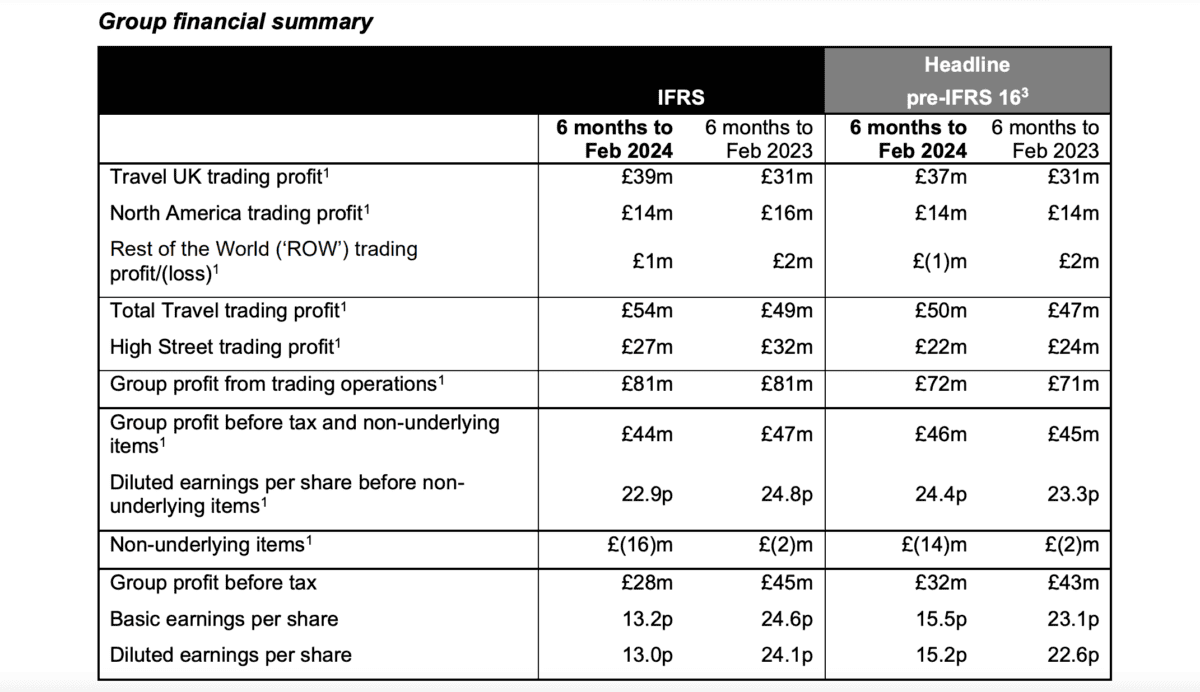

In the six months leading up to February 2024, the company generated 13p in earnings per share (EPS), down from 24.1p the previous year. That’s despite an 8% increase in revenues.

Source: WH Smith interim results 2024

The reason is the firm incurred £16m in expenses for ‘non-underlying items’ — up from £2m in 2023. These are associated with writing down the value of high street stores and ending certain contracts.

Investors should note two things about these. The first is that they’re – in WH Smith’s view – one-off and the second is that they’re generally expenses that involve no cash leaving the business.

As a result, these accounting costs arguably give a distorted picture of the company’s ongoing earning power. Leaving them aside, the company’s EPS came in at around 23p.

On this basis, its EPS over the last 12 months have been closer to 77.6p. And at today’s prices that implies a P/E multiple of around 18.

A potential bargain

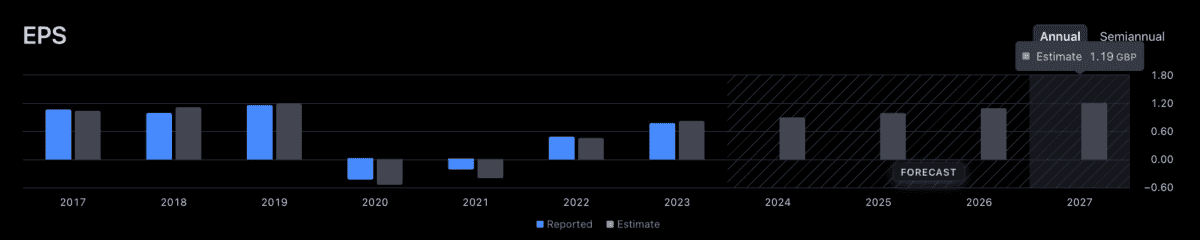

Analysts are expecting profits to grow over the next few years. The anticipated forward P/E multiple is 14 and the consensus is for EPS to reach £1.19 by 2027.

WH Smith analyst EPS estimates

Source: TradingView

Time will tell if those estimations are accurate. But investors should note that the FTSE 250 company’s significantly stronger than it looks at first sight and the stock’s almost certainly cheaper. It may be worth considering.