For a massive bank that earned billions of pounds in profit last year, it may seem odd that shares in Lloyds (LSE: LLOY) change hands for pennies. It was not always that way. In 2007, before it was hit by the financial crisis, the Lloyds share price was over £3.

Lloyds has performed strongly over the past year, with the share moving up in value by 32%. So, could it ever hit the £1 mark again?

Far from its former glory

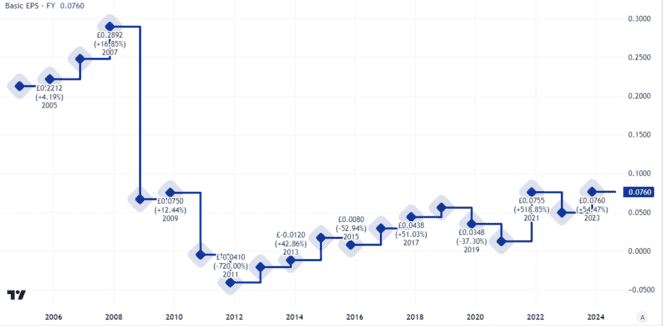

It is easy to understand why Lloyds is nowhere near the price it hit in 2007. Its basic earnings per share are far below what they were back then.

Created using TradingView

From an income perspective, too, the dividend is nowhere near what it once was.

Created using TradingView

Still, while the pandemic years saw earnings tumble, the broad trend over the past decade has been upwards, as this chart shows.

The banking giant has a lot going for it. For a start, it operates in a market that is both resilient and can be highly lucrative. Mortgages, for example, are likely to be in high demand for decades to come and potentially long beyond that.

It also has a few advantages that help aid its earning power. It enjoys economies of scale, as the country’s largest mortgage lender. Lloyds has a large customer base, well-known brands and operates in a market that has limited competition thanks to high barriers to entry.

How to value the black horse bank

Still, all of that was true back in 2007 too.

Since then, a lot has changed in how British banks are capitalised and run. I think Lloyds is better placed now than it was then when it comes to dealing with a housing market crash. That is a real risk, in my view, as the property market is cyclical and so sooner or later we will likely see a sharp downturn once more.

That helps explain why the Lloyds share price-to-earnings (P/E) ratio is a fairly cheap looking right now.

I believe investors are factoring in the risk that earnings could fall, perhaps sharply, if the economy weakens. Indeed, the first-half of this year saw profits decline 15% compared to the same period last year, though at £2.4bn they were still substantial.

Where things may go from here

Getting to £1 per share would imply a P/E ratio of around 13, which I still think could be reasonable. A lot of FTSE 100 firms trade on such a valuation. However, for that to happen, I think one of two things need to happen.

Either the risk perception needs to go down not up. That could happen in future but I do not see it any time soon as the UK and global economies both remain fairly weak.

Alternatively, Lloyds needs to grow its earnings per share. That may happen but the evidence so far this year points in the other direction – and I do not expect a big enough sustained jump in earnings in the next year or two to justify the Lloyds share price moving up around two-thirds, which it would need to do to hit £1.

I doubt Lloyds will hit £1 in the next several years and I have no plans to invest.