The UK market is packed with high-yield dividend shares that make great options for passive income. Many pay above the 3.5% average yield. But growth is also important when considering shares for an income portfolio.

One of my favourite FTSE 250 stocks is Greggs (LSE: GRG). The popular high-street bakery chain has delivered impressive performance since 2014. Up 434% in the past 10 years, it’s beaten the wider UK market.

But past performance isn’t indicative of future results. So how much would a £10k investment today net me in the future?

Let’s have a look.

A solid foundation

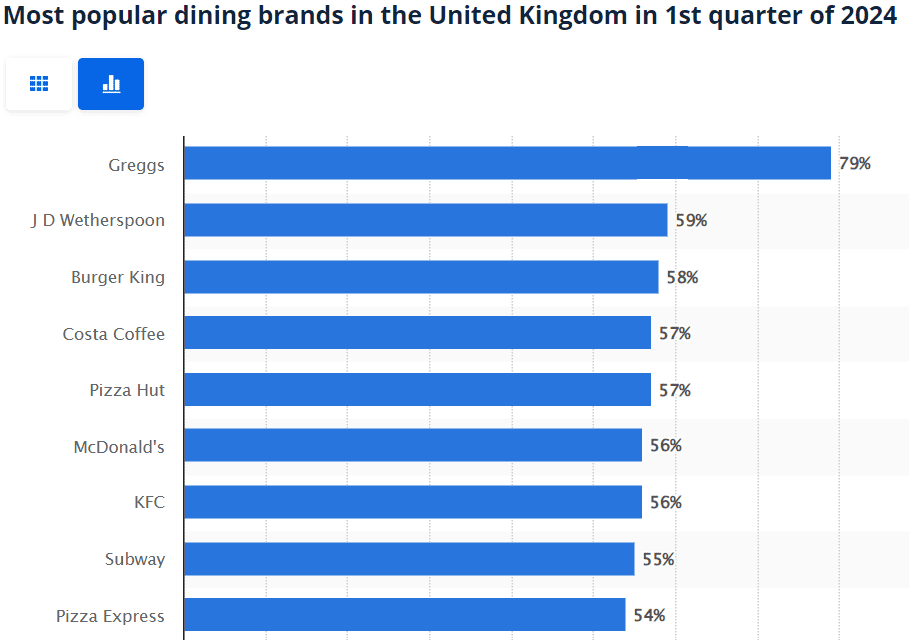

There’s little doubt Greggs is a well-loved and established British brand. It’s the go-to pie and sandwich shop of many hungry workers when lunchtime hits. According to Statista, it was the most popular dining brand in the UK in Q1 2024, beating US rivals like Burger King and McDonald’s.

What’s more, it’s one of the most prolific. Since 2006, the number of Greggs outlets in the UK has almost doubled. It now has nearly 2,500 shops on high streets and in stations and airports across the country.

With a £3.25bn market cap and £1.8bn of revenue last year, it’s fair to say the company has a decent foundation for future growth. However, its half-year 2024 results revealed a slowdown. At £55.1m, net income decreased 8.6% from H1 2023 and earnings per share (EPS) decreased from 59p to 54p.

Valuation and forecasts

Looking at various metrics, the share price might be overvalued. It’s 43% above fair value based on future cash flow estimates and the price-to-book (P/B) ratio shows the shares are 6.5 times the company’s book value. That’s not uncommon among popular stocks but could limit growth in the short term. It may need to post increasingly better results to bring in more buyers at this level.

Analysts expect revenue to increase by 22% over the next two years, with earnings growing by around 13%. The average 12-month price target is just over £33, a 4.3% increase from today’s price.

Dividends

Dividend-wise, Greggs had a good track record prior to Covid. Payments increased between 2000 and 2018, with only a brief pause in 2013. They were reduced in 2019 and cut for one year in 2020. However, they returned with a vengeance in 2021, almost doubling the 2018 payout.

Still, at 2%, the yield is low and won’t deliver much added value. It would pay only £20 a year on a £10,000 investment. However, assuming an average 5% annual price growth and reinvested dividends, the pot could grow over time.

With those figures, it could double to £20,000 after 10 years and pay dividends of £370 a month. It’s not much, but more than a typical savings account would achieve.

Final thoughts

I think Greggs is a solid and reliable value stock but not a big passive income earner. My concern is that it may have tapped out its market in the UK. I think it has potential for expansion in Europe but may struggle to find a foothold in the US.

I like my Greggs shares and I’m a regular customer so I plan to hold them. But I’m not buying more. I’m concerned about how it will grow going forward.

I trust it has a plan.