The FTSE 100‘s one of the most followed and popular stock market indexes on the planet. Its diverse mix of large, stable companies, considerable international reach, and record of delivering impressive dividends make it very attractive to investors.

Whether I’m a growth, dividend or value investor, the Footsie offers a wealth of opportunities. And what’s more, the index enjoys high levels of liquidity, allowing investors to buy and sell shares cheaply and easily.

I hold several FTSE 100 stocks including Legal & General, Rio Tinto and Aviva. But more recently, I’ve been looking at exchange-traded funds (ETFs) to make a better return over time.

Should you invest £1,000 in S4 Capital Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if S4 Capital Plc made the list?

Past performance isn’t a guarantee of what I could make in the future. But if things continue the way they have been, a regular investment in one or both of these funds could make me a much better return than buying individual UK blue-chip shares.

Making millions

In recent months I’ve added the following ETFs to my Self-Invested Personal Pension (SIPP). As we can see, the returns they’ve delivered comfortably beat what a Footsie-tracking fund has delivered in recent years.

| ETF | 5-year annualised performance | 10-year annualised performance |

|---|---|---|

| iShares Edge MSCI USA Quality Factor UCITS ETF (LSE:IUQA) | 15.64% | N/A* |

| Xtrackers MSCI World Momentum UCITS ETF (LSE:XDEM) | 11.18% | 10.66% |

| HSBC FTSE 100 UCITS ETF | 5.74% | 6.04% |

If their average annual performances over the past five years remain the same, a £300 monthly investment in the FTSE 100 tracker would make me £286,794 over 30 years.

That’s not bad. But it pales in comparison to the £875,078 I could have made with the Xtrackers MSCI World Momentum UCITS ETF. This fund tracks the performance of “large and mid-cap companies from global developed markets with high momentum scores“.

That Footsie fund would also make me a fraction of what the iShares Edge MSCI USA Quality Factor UCITS ETF would have. This product — which tracks “US companies that have historically experienced strong and stable earnings” — would have made me a multi-millionaire.

Over 30 years I’d have made a spectacular £2,412,608.

A top tech play

In recent days I’ve actually increased my stake in the latter fund.

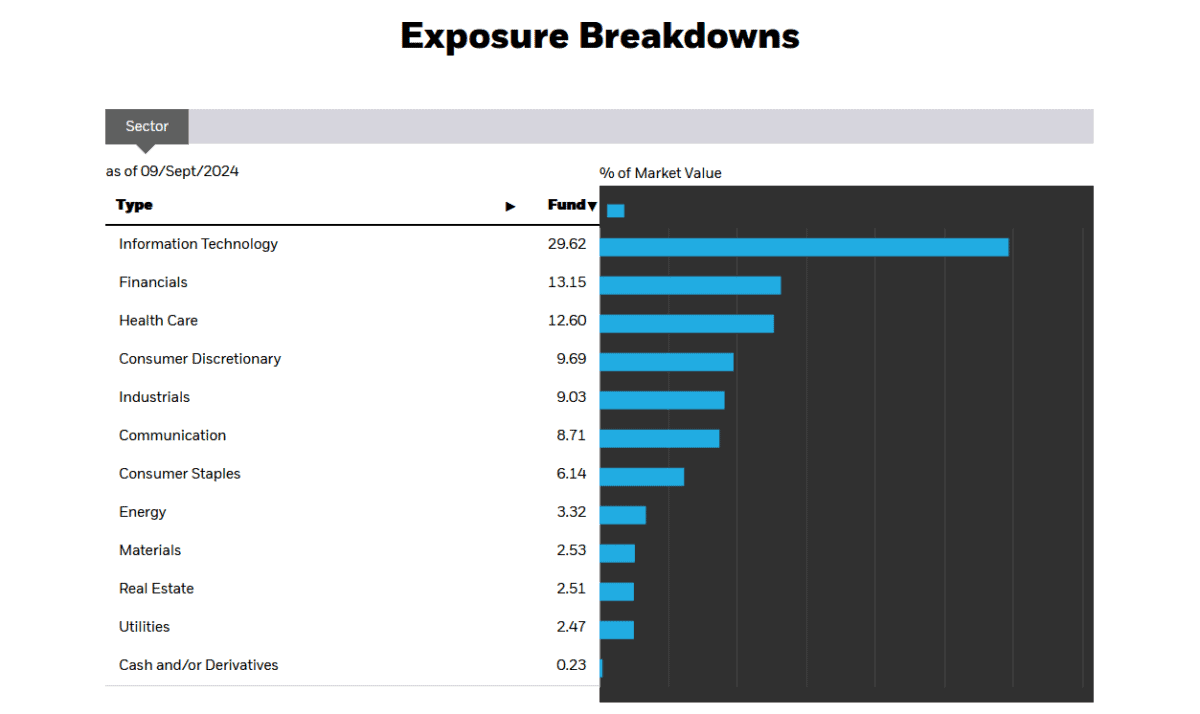

One thing investors need to know before buying is it’s deep investment in technology stocks. Almost 30% of it is tied up in information technology businesses like Nvidia, Microsoft, Apple and Meta.

The danger here is that this leaves the fund particularly vulnerable to broader economic conditions. But on the plus side, this tech focus gives investors exposure to hot growth themes like artificial intelligence (AI), quantum computing, renewable energy and autonomous vehicles.

The ETF has produced explosive returns in the past five years thanks to themes such as these. And on balance, it’s looking good to continue delivering the goods as the digital revolution rolls on.

I’m optimistic too, that the fund’s other sectors will thrive as the US and global economies grow over time.