It’s not hard to find cheap dividend stocks at this moment in time. However, this one really looks the part on paper, offering a huge 13.2% forward dividend yield.

That means if I were to invest £1,000 today, I’d receive £132 over the next 12 months in the form of dividends. Interestingly, the company pays its dividends quarterly, which may interest investors looking for regular cash flow.

So, what is this lesser-known dividend stock? Well, it’s Nordic American Tankers (NYSE:NAT), a US-listed company that specialises in Suezmax crude oil tankers.

An overlooked sector

Nordic American Tankers operates a fleet of 19 such tankers. Suezmax vessels are designed to transit the Suez Canal at full capacity, typically carrying around one million barrels of oil.

These ships are versatile, able to serve many major ports and navigate through key shipping routes like the Suez and Panama Canals.

Ship supply has been drastically impacted over the last year due to droughts in Panama and attacks on ships in the Red Sea. This scarcity of available ships has led to an uptick in earnings for companies like Nordic. The firm reported that about 57% of its spot voyage days for Q1 2024 were booked at an average Time Charter Equivalent (TCE) of $40,690 per day per ship — that’s far above long-term averages.

Scarcity isn’t just an issue in the short term, however.

Tanker companies delayed new orders during the pandemic. The result is a much older global fleet than we’ve seen for years. And these tankers take years to build.

As such, supply shortages are expected to persist.

A dividend giant, but there are issues

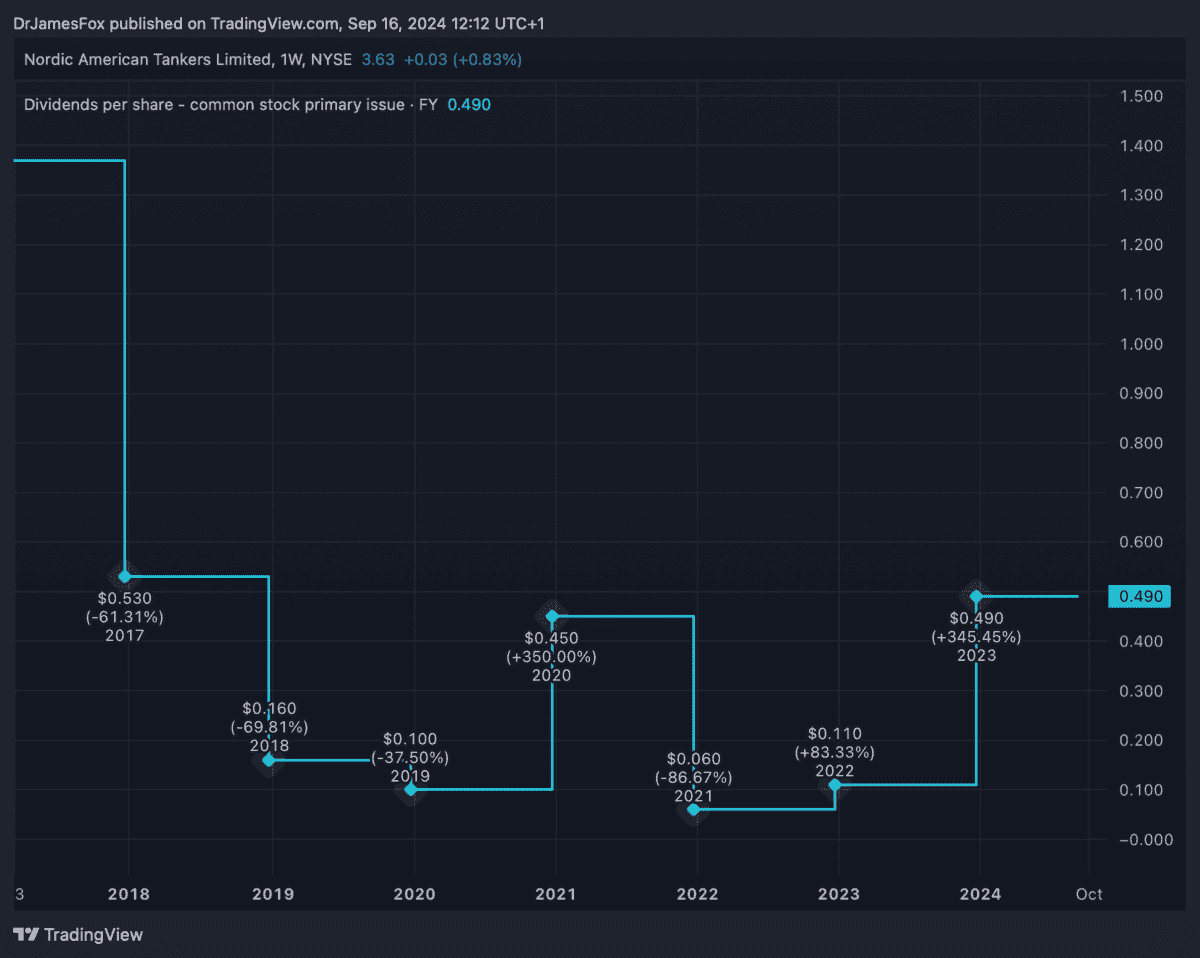

Nordic American is a dividend giant, having paid a dividend for each of the last 108 quarters. It’s a truly phenomenal record.

However, dividends haven’t always increased during the period, and sometimes the dividend payments have been fairly nominal.

This year, Nordic American is due to pay $0.48 per share in dividends, based on the current $0.12 per share per quarter.

However, the company is only forecast to earn $0.43 per share in 2024, suggesting that management is paying out more in dividends than the company earns. It also points to a forward price-to-earnings of 8.5 times — a 24% discount to the sector.

This payout ratio is a big red flag and one that suggests the dividend will have to fall.

The caveat is that financial performance is expected to improve significantly in 2025. According to analysts, Nordic will earn $0.64 in 2025 and then $0.68 in 2026.

With this in mind, it may continue with the current dividend payments. But it’s a risk.

A risk worth taking?

Personally, I believe it’s a risk worth taking. I was first made aware of this stock by one of the world’s top analysts covering the shipping and tanker sectors. His returns — around 43% per annum over eight years — have been truly groundbreaking.

He thinks this stock will perform in the long run, and so do I.