Over the past month, the Rolls-Royce (LSE:RR) share price is basically unchanged. This has provided some time for investors to take a breath following the 122% gain over the past year. Yet as we start to gear up for the final quarter, many are wondering if the stock could head higher into year-end and beyond. Here’s what I found when taking a closer look.

Lower debt helps

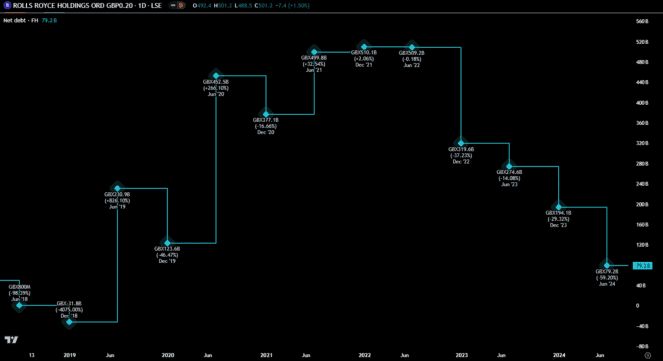

One factor that should help the share price to rise further is the continued reduction of net debt. During the early part of the pandemic, the firm was forced to take on significant debt in order to keep the business afloat. After all, there was a sharp drop in demand in the civil aerospace division with the lockdowns.

By the middle of 2021, the pile stood at over £5bn. This threatened to seriously hurt the company. Although the world started to return to normal, the interest payments on this debt were high. Yet as part of the strategy pivot and transformation, the management team has been focused on reducing its liabilities.

Net debt for H1 2024 returned to the level seen before the pandemic, as shown below.

Based on that trajectory, I believe this should continue. And it should support the stock in two main ways. One is that interest costs will fall, freeing up cash flow for other business needs. The other is that part of how we value a stock is based on the net asset value. Reducing debt (a liability) ultimately helps to increase the value of the company overall.

Rising enterprise value

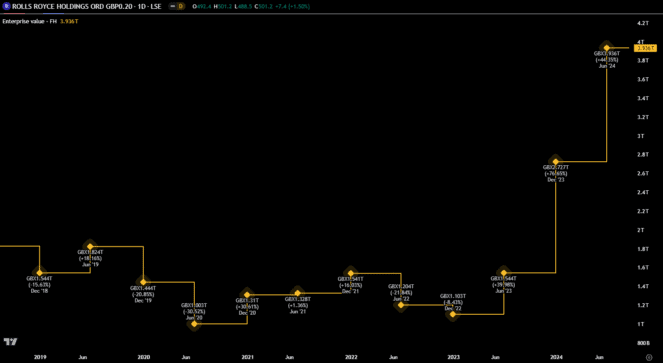

A second factor that could suggest further gains for the stock is the enterprise value. As shown below, the enterprise value for Rolls-Royce has been shooting up over the past year. This figure is an alternative way of measuring the worth of a company, instead of just looking at the market cap.

At the moment, the enterprise value is £43.44bn, with the market cap at £42.63bn. Although they are different ways of valuing a company, the two figures should be similar to each other. Therefore, if the enterprise value keeps climbing, I’d expect the market cap (and the share price) to do the same.

Relative value climbing

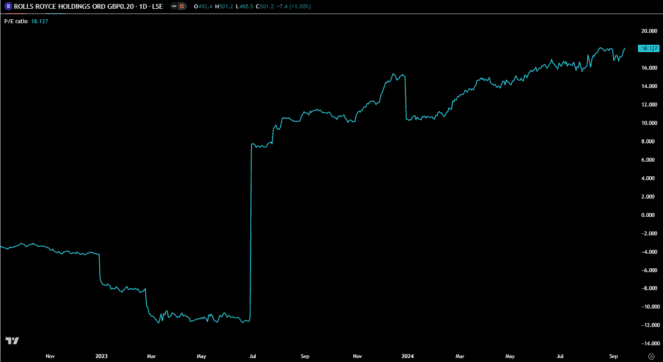

One concern some might have is that since the business flipped to being profitable, the stock is no longer undervalued. In fact, the price-to-earnings (P/E) ratio is now above 18 and has been climbing since the firm posted its profit in 2023. The chart tracking the ratio is shown below.

When considering if the stock can keep rising, the P/E ratio does become more valid. I use a ratio of 10 as a benchmark of fair value. That 18 isn’t ridiculously high, but it certainly gives me the impression that the share price is a little high. Therefore, we could see the stock continue to tread water until earning per share rise to make the ratio more balanced.

Ultimately, I do think the stock can continue to push higher in the coming year, but at a much more reasonable pace. As such, I’m not in a huge rush to buy the stock right now.