Buying undervalued growth stocks can produce solid long-term gains. Since I have decades left in my investing journey, I’m happy to have exposure to more volatile investments in my portfolio to try to beat the market.

With signs that macroeconomic conditions could improve, I’m hopeful that one FTSE 100 growth stock I own might be gearing up for a share price rally.

Scottish Mortgage Investment Trust (LSE:SMT) is the stock I’m talking about. Here’s why I’m bullish on the fund’s growth prospects today.

A discount that might not last

Baillie Gifford‘s £13.7bn managed fund invests in a high-conviction portfolio of growth shares around the world.

It’s a one-stop shop for diversification across major stock market names. These include semiconductor giants Nvidia and ASML and e-commerce titans such as Amazon and its Latin American rival MercadoLibre. It also invests in unlisted shares like Elon Musk’s venture SpaceX.

Assessing the net asset value (NAV) of a closed-ended fund’s investments is one way to calculate how cheap its share price is. It’s not dissimilar to measuring a traditional company by its book value.

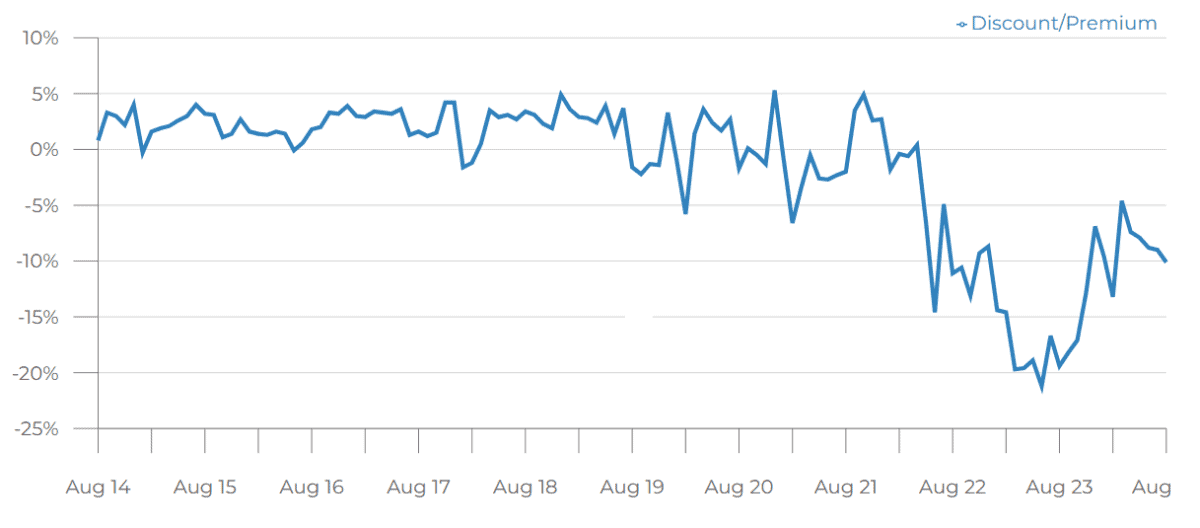

Currently, the Scottish Mortgage share price (a little above £8 today) stands at a steep 10% discount to its NAV. For most of the past decade, it’s traded at a slight premium.

However, the post-pandemic gap between the share price and underlying value of the trust’s investments has narrowed since mid-2023. It looks like time might be of the essence for investors who want to buy cheap Scottish Mortgage shares.

Share price growth

Interest rate cuts are high on the agenda for major central banks across the globe. Conventional investing wisdom suggests this could boost the performance of growth stocks like those in Scottish Mortgage’s portfolio.

That’s because the appeal of fixed-income investments like bonds falls, encouraging investors to seek out higher-risk opportunities for growth.

In addition, the management team has shown determination to revive the share price back to its pandemic glory days when it briefly changed hands above £15.

A two-year share buyback programme for at least £1bn worth of shares is the largest that’s ever been conducted by a UK investment trust. I view this as a shareholder-friendly move and an important step to tackle the current discount.

Volatility’s a concern for potential investors. Scottish Mortgage isn’t a ‘steady as she goes’ investment. The possibility of big share price slumps is an intrinsic risk of chasing higher growth.

I also have concerns about the fund’s private equity exposure. This was a factor in a boardroom bust-up that hit the headlines last year. Ultimately, it led to the departure of Professor Amar Bhidé who slammed the door on the way out in his public comments.

Unlisted shares are difficult to value. It’s worrying when those closest to the action express doubts about the trust’s strategy.

I’m an optimistic shareholder

Despite the risks, I believe the Scottish Mortgage share price is primed for growth due to a shifting economic climate and the NAV discount.

I’m not a fan of every stock in the portfolio, but I like the majority of the fund’s investments. That’s good enough for me. I’ll continue to hold my shares for the long term.