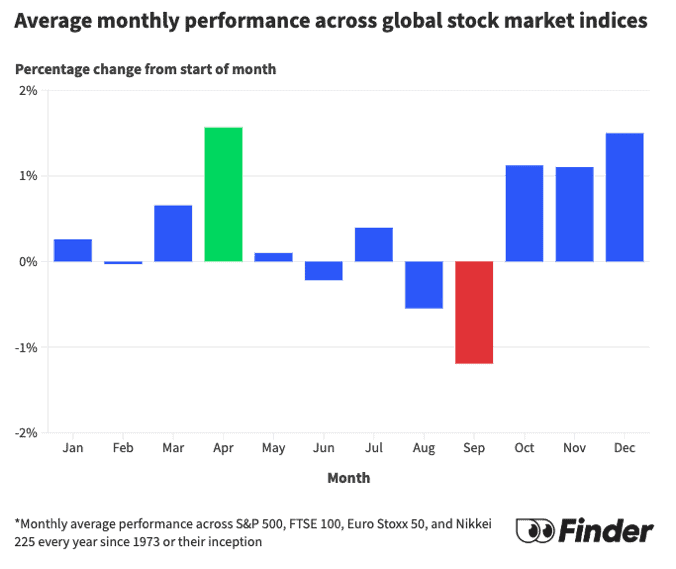

September is the worst month for the stock market, according to a recent study by comparison website Finder. Its research found that in recent decades, major global stock indexes such as the FTSE 100 and the S&P 500 have consistently underperformed in this particular month.

The good news however, is that Finder also found that October, November, and December tend to be strong months for shares. So if history is anything to go by, we may be about to see a stock market rally.

September’s a rough month for stocks

Finder analysed the monthly price performance of the FTSE 100, the S&P 500, the Euro Stoxx 50, and the Nikkei 225 indexes every year since 1973, or their inception (the Footsie was created in 1984). And it found that in September these major indexes tend to drop by about 1.2% on average.

Things get better

Yet, in the following three months, performance has historically been much better. In the past, stocks have typically risen between 1% to 2%, on average, in each of these months.

Interestingly, Finder found that December is the best month of the year for the UK’s FTSE 100 index. Since inception, it has delivered a price return of about 2.2% on average in December.

My move now

Now, while Finder’s research is certainly interesting, I’m not going to make any big moves on the back of it. Realistically, anything could happen in the fourth quarter of 2024 as in the short term stocks are notoriously unpredictable.

Having said that, I’m going to continue to drip feed money into the market when I see interesting investment opportunities. And there are always opportunities in today’s volatile markets.

One FTSE stock I’m looking at

One stock I’m contemplating buying more of right now is FTSE 250 company Alpha Group International (LSE: ALPH). It’s a leading provider of currency management and alternative banking solutions.

This stock took a big hit last week after it came to light that founder and CEO Morgan Tillbrook is going to step down from the post in the near future. Clearly, investors weren’t expecting this (I had highlighted this scenario as a risk in the past but wasn’t expecting it to happen).

Having had a few days to process the news, I think the share price weakness could be a good buying opportunity for me. The CEO position’s going to be filled by current chairman Clive Kahn, who knows the company well and has an excellent track record in the financial services/payments world.

And he has bought more shares in the company since the news was announced. This suggests he’s confident the company – which has been growing at a rapid clip – can continue to grow and generate more wealth for investors.

Of course, the loss of Tillbrook’s a big blow. Without his leadership, the company (which has a high-performance culture) may not perform as well as it did.

But I’m optimistic the business – and the share price – can continue to do well. After all, winners tend to keep winning.