Penny stocks tend to be risky investments. But they can generate spectacular returns at times, so they can be worth including in a diversified portfolio.

Here, I’m going to highlight two exciting penny stocks that I believe are worth a closer look today. Currently, both are trading for less than 20p.

High-risk, high-return

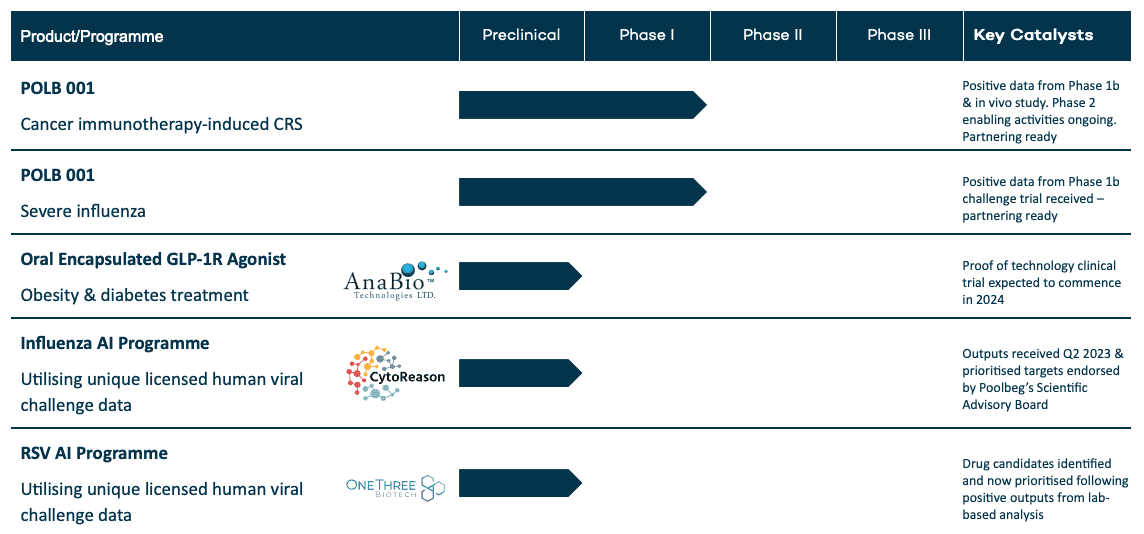

First up, we have Poolbeg Pharma (LSE: POLB). It’s an under-the-radar biopharmaceutical company that’s developing drugs (with the help of artificial intelligence) to address unmet medical needs.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Now, this is a classic penny stock in that it’s a high risk, high reward play. You see, this company doesn’t have any revenues or earnings at all today so it’s a very speculative investment.

But things could change. Currently, the company’s working on a range of drugs including products to treat cancer immunotherapy-induced Cytokine Release Syndrome (a condition that develops when an immune system responds too aggressively to infection) and obesity (it’s working on an oral weight-loss product).

If it was able to bring any of these drugs to the market, its revenues could explode. And so could its share price.

Of course, investors shouldn’t assume successful market launches will happen. Drug development’s a notoriously challenging industry in which major setbacks are the norm.

I see a lot of potential here though. I think Poolbeg Pharma’s worth considering as a speculative investment.

A high-growth industry

The other penny stock I want to highlight today is Corero Network Security (LSE: CNS). It’s a small cybersecurity company that specialises in Distributed Denial of Service (DDoS) protection solutions.

I see this stock as a little less risky than Poolbeg Pharma. That’s because the company already has revenues. Last year, these came in at $22.3m. This year, analysts expect $28m (growth of an impressive 26%).

That said, it’s still a very risky stock as the company’s profits are small. For 2024, net profit and earnings per share are only expected to come in at around $375,000 and 0.1 cents respectively.

Again though, I’m excited about the potential here. Cybersecurity’s a rapidly growing industry and this company’s having a lot of success at present, having recently signed a number of contacts with firms of different shapes and sizes.

If it can continue to do this and grow its revenues and earnings in the years ahead, I think it could turn out to be a decent investment. It’s worth noting that in July, the company said that it continues to experience high demand for its SmartWall ONETM DDoS protection solutions and that its pipeline is at record levels.

Of course, cybercrime’s always evolving. So there’s guarantee this company will continue to be successful going forward.

As a speculative investment however, I believe it’s worth a look.