I believe the stock on the FTSE 100 index that’s presently offering the best value (at least in statistical terms) is Pershing Square Holdings (LSE:PSH). That’s because it has the lowest historical price-to-earnings ratio (P/E) of all 100 companies.

With a current (13 September) market cap of £6.52bn — and net income for the year ended 31 December 2023 (FY23) of $2.54bn (£1.93bn) — it has a P/E ratio of 3.4.

That’s very low (the average for the index as a whole is four times higher) and suggests the stock could be in bargain territory.

Should you invest £1,000 in Pershing Square right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Pershing Square made the list?

Or is it?

Crunching the numbers

The first thing to note is that Pershing Square is not a trading company, it’s an investment trust. Therefore, its P/E ratio is not particularly meaningful.

For investment trusts, a better measure of value for money is to compare its market cap with the net asset value (NAV) of the companies in which it’s invested. At 31 August 2024, its NAV was £50.98. At the moment, its shares are changing hands for around £35.60, meaning they trade at a 30% discount.

This is a big differential. For comparison, the Scottish Mortgage Investment Trust discount is 12%.

Again, Pershing Square looks cheap to me.

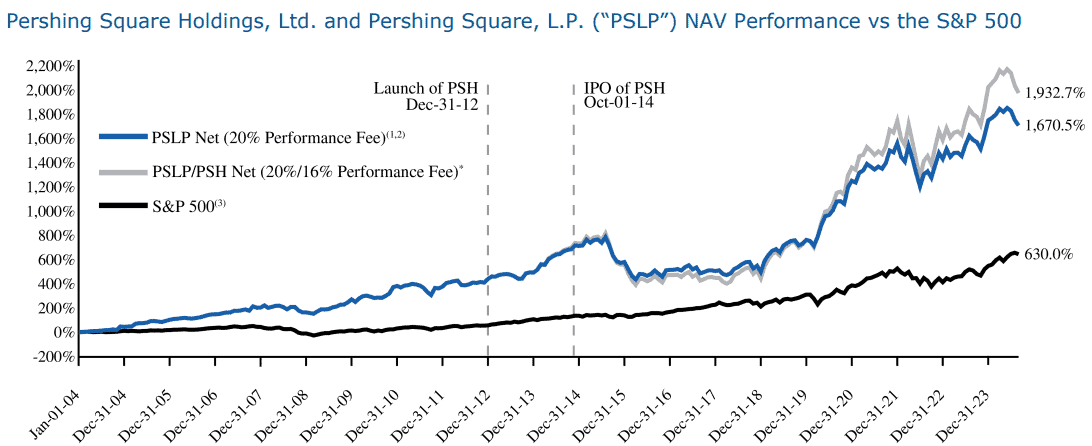

What’s more, the return on its investments has beaten the wider market since it was formed in 2004. During this period, it’s achieved annualised growth of 15.7%. This compares to a 10.1% return from the S&P500.

This performance has helped contribute to a 124% increase in the trust’s share price, since September 2019.

What’s not to like?

All this sounds very positive.

Who wouldn’t want to buy into a something that’s selling for significantly less than the value of its investments, and has a long track record of delivering growth?

Well, I do have some concerns.

First, its portfolio is concentrated in a small number of stocks.

It typically invests in eight to 12 North American companies. Current holdings include Universal Music Group, Hilton, Restaurant Brands International and Alphabet.

The principal reason for investing in a trust is to spread the risk across multiple companies through just one shareholding. This advantage is diminished with such a small number of positions.

I’m also wary that the trust is 100% exposed to North America. There’s increased speculation that a recession is coming there, which would severely impact, for example, the leisure companies that Pershing Square has in its portfolio.

Also, its investment manager charges an annual fee of 1.46%. I’m sure it will argue this is justified given its performance. But I feel this is expensive — Scottish Mortgage’s manager charges 0.3%.

What should I do?

However, taking these concerns into account, now could be a good time to invest.

The significant discount to its NAV is attractive. I’d have to pay approximately 30% more if I wanted to invest in the same companies that Pershing Square has in its portfolio.

Of course, we all know that shares can go down. But there’s presently quite a big buffer which gives some downside protection.

That’s why it’s going on my watch list for when I next have some spare cash.