FTSE 100 bank Lloyds (LSE:LLOY) often finds itself near the top of the ‘most popular shares’ list. This is thanks to its reputation as a reliable and generous dividend payer.

But this isn’t all. It’s also because of the Black Horse Bank’s enduring value for money. Even now, it trades on a forward price-to-earnings (P/E) ratio of 8.3 times. It has a market-beating 5.8% dividend yield too.

But Lloyds’ shares have fallen down the rankings more recently. According to Hargreaves Lansdown, it’s been the 15th most-purchased stock with its customers in the last seven days.

There are several other Footsie shares that have proven more popular than Lloyds in the past week. Here’s one I’d rather buy if I had cash to invest.

A hot dip buy

Rio Tinto‘s (LSE:RIO) share price continues to sink. It’s down 21% since the start of 2024 which, in turn, is bringing interest from long-term investors.

However, last week it was the fifth-most-bought stock among Hargreaves Lansdown investors. I own it in my own Stocks and Shares ISA, and I’m considering buying more.

Mining sector shares have slumped amid continued problems in China, a notorious commodities consumer. Things have been especially bad for iron ore producers like Rio Tinto too, as the country’s real estate sector worsens.

Sinking steelmaking activity recently sent iron ore prices below $90 a tonne for the first time since 2022. If a US recession strikes it could become a bloodbath.

Great growth potential

But make no mistake. The long-term outlook for commodities demand remains robust. And I’m confident that, over time, Rio Tinto’s share price will snap back from current levels as profits recover.

Iron ore sales are struggling today. But they’re expected to rebound over the long term, driven by themes such as heavy global infrastructure spending, emerging market urbanisation and the expanding renewable energy sector.

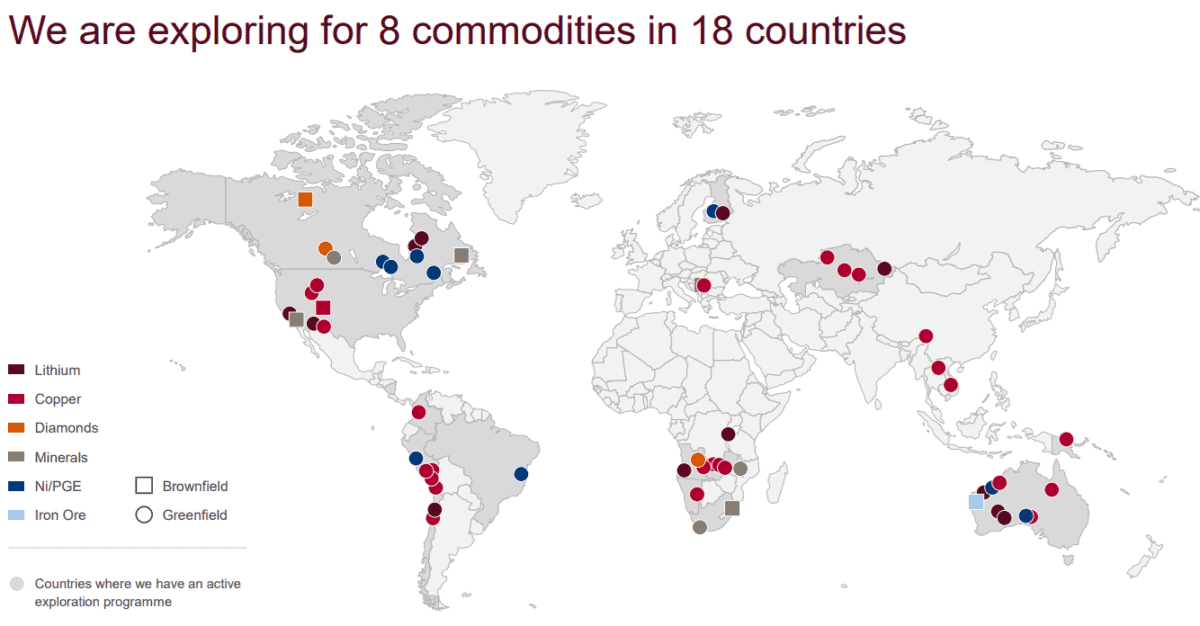

Rio Tinto also has excellent growth opportunities away from iron ore. Its large portfolio of copper, aluminium and lithium projects, for instance, give it the chance to exploit rapid growth in the consumer electronics and electric vehicle (EV) sectors.

All of this explains why Hargreaves Lansdown customers are busy dip buying its shares.

Lloyds vs Rio

Of course, miners like this face significant execution risk. Exploring for minerals, developing mines, and producing metals is highly unpredictable and always massively expensive business. Strong shareholder returns are never guaranteed.

However, Rio Tinto’s an exceptional operational record helps to soothe (if not eliminate) any fears I have on this front. It’s one of the world’s biggest mining companies for a reason (with a market-cap of nearly £58bn). And it has significant scope for further growth as it expands its asset base.

I’m convinced Lloyds doesn’t have the same earnings opportunities, and therefore the potential to grow its share price. It may also have limited scope for dividend growth as the UK economy’s long-term struggles continue and competition in the banking sector rises.

I like the fact that Lloyds provides exposure to the potentially lucrative UK housing market. But on balance, I’d still rather buy Rio Tinto.

With a forward P/E ratio of 8.2 times and 7% dividend yield, I think the Footsie mining company is a much better value stock to consider.