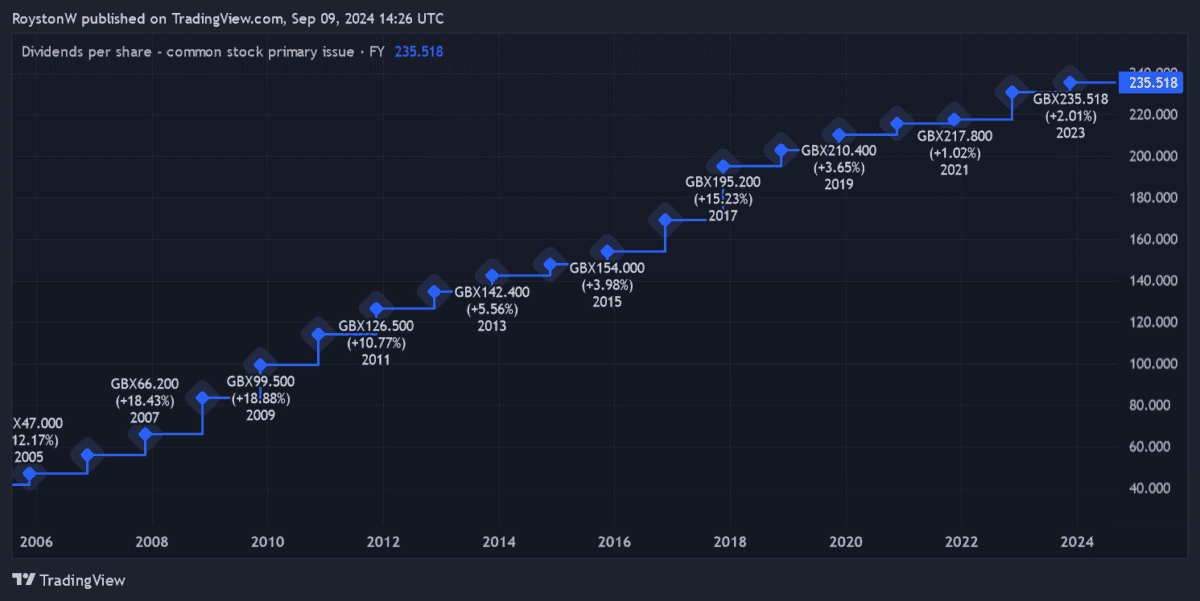

Tobacco stocks remain excellent ways to make a passive income. In the UK, British American Tobacco (LSE:BATS) shares have yielded market-beating dividends for generations.

Cigarette manufacturers are largely unaffected by broader economic conditions, such is the addictive nature of their products. This gives them the robust cash flows and the confidence to pay a large and (usually) growing dividend year after year.

City analysts are expecting British American’s proud record to continue for the next few years at least. And so the vast dividend yields the FTSE 100 firm’s famous for shoot above 8% by 2026. This is shown in the table below.

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 238.51p | 1% | 8% |

| 2025 | 248.95p | 4% | 8.4% |

| 2026 | 261.29p | 5% | 8.8% |

Having said that, investors must remember that dividends are never, ever guaranteed. So I need to consider how realistic current payout projections are, as well as other factors that may influence the returns I can expect to make over time.

Here’s my view on British American Tobacco shares today.

Dividend forecasts

The first thing to consider is how well those projected dividends are covered by anticipated earnings. I’m looking for coverage of 2 times and above to provide a wide margin of error. Unfortunately the company doesn’t fare well on this metric. Dividend cover through to 2026 is just 1.5 times.

However, this isn’t the catastrophe it may appear at first glance. As mentioned, profits and cash flows tend to remain stable regardless of broader conditions. And so dividend cover isn’t as critical in British American’s case.

What’s more, the firm has a strong (and improving) balance sheet it can use to sustain its commitment to large dividends, thanks in large part to broad restructuring.

Adjusted net debt to adjusted EBITDA dropped to 2.6 times last year, below its upper target limit of 3 times. And the business is on course to reduce this, to 2-2.5 times by the end of 2024.

A top buy?

British American, in my opinion, looks in good shape to meet dividend estimates for the next few years. But does this necessarily make it a good stock to buy?

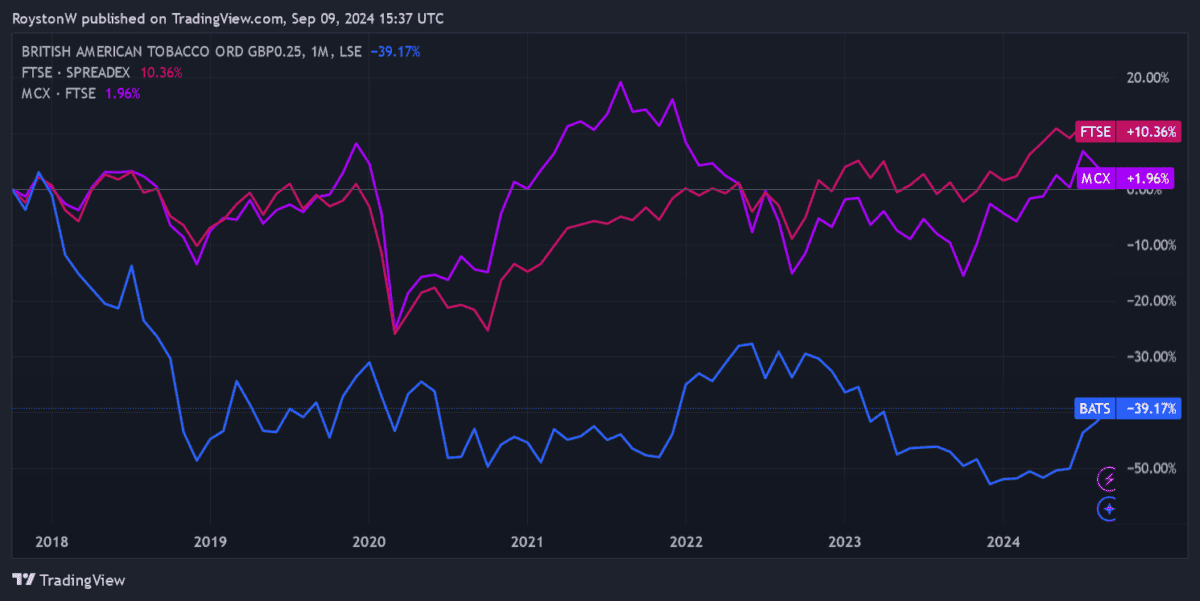

To be honest, I’m not so sure. When buying shares, it’s important to consider a company’s likely share price performance as well as its passive income prospects. And here the alarm bells are deafening.

This is because ‘Big Tobacco’ is under increasing threat as curbs on the sale, marketing, and use of cigarettes step up. It’s already had a catastrophic effect on British American’s share price in recent years as investors fear eventual industry extinction, as shown below.

In response, the business has been investing heavily in vapourisers and other non-combustible technologies to drive future revenues. It has ambitions to generate half of sales from ‘smokeless’ products by 2035.

However, legislators are taking aim at these new technologies with increasing gusto too. Restrictions are in place in many US states, and are spreading across the globe. As this continues, British American’s share price could continue crumbling.

Popular brands like Pall Mall and Camel may help the firm recover strongly. But I’d still rather buy other dividend stocks today.