I’m building a list of the best FTSE 100 stocks to buy in 2025. Here are two I wouldn’t touch with a bargepole.

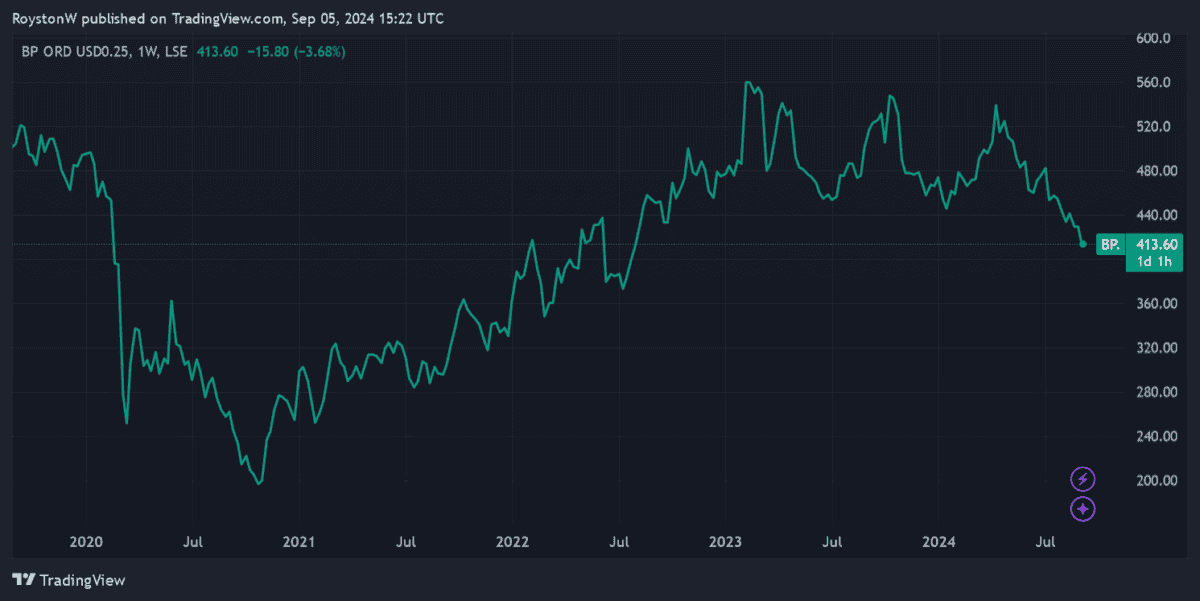

BP

It doesn’t matter how well that a commodity-producing business is run. They have no control over the market forces, and if the price of the product they specialise in sinks, so will their profits.

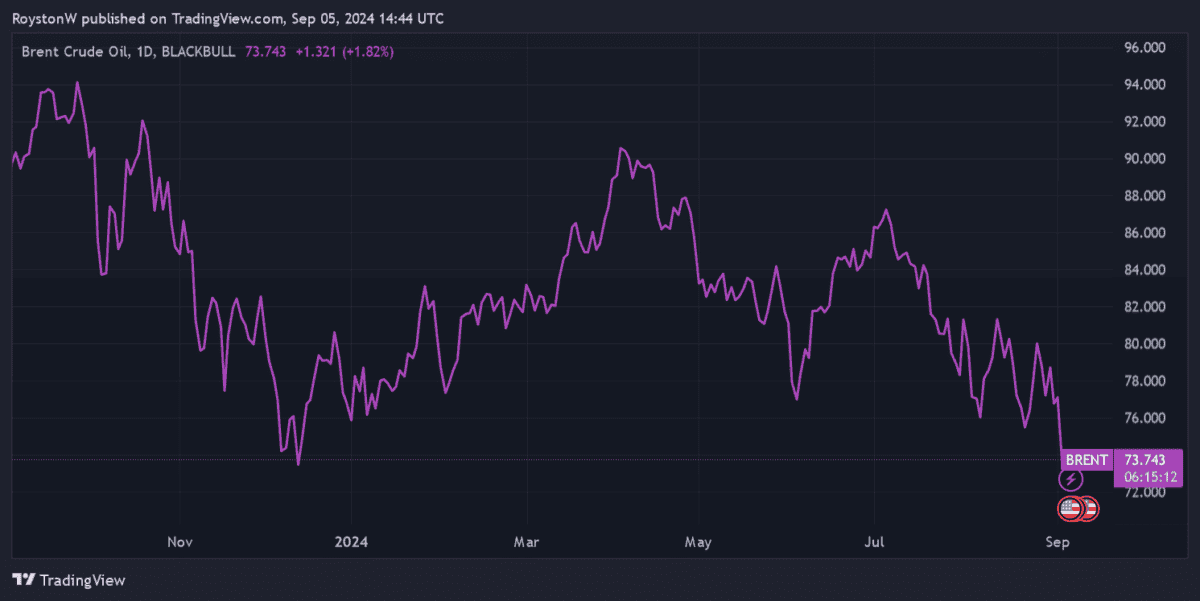

This is what makes BP (LSE:BP.) such a risky pick, in my view. With OPEC+ countries ignoring calls to cut production, and supply from outside the cartel also tipped to rise, the market could be awash with excess oil that depresses prices.

The threat of a US recession and continued economic downturn in China adds extra peril for oil stocks. And industry analysts have disconcertingly stepped up cutting their oil price forecasts for 2025 in response. The experts at Citi, for instance, even suggest they could plunge to $50 per barrel next year.

Of course, these gloomy forecasts aren’t guaranteed. Energy prices could in fact spring higher depending on, for example, OPEC+ production decisions and better-than-expected economic growth.

But the risks to the downside make BP a share I plan to avoid. Further progress in the renewable energy sector could also weigh on fossil fuel producers like this both in 2025 and beyond.

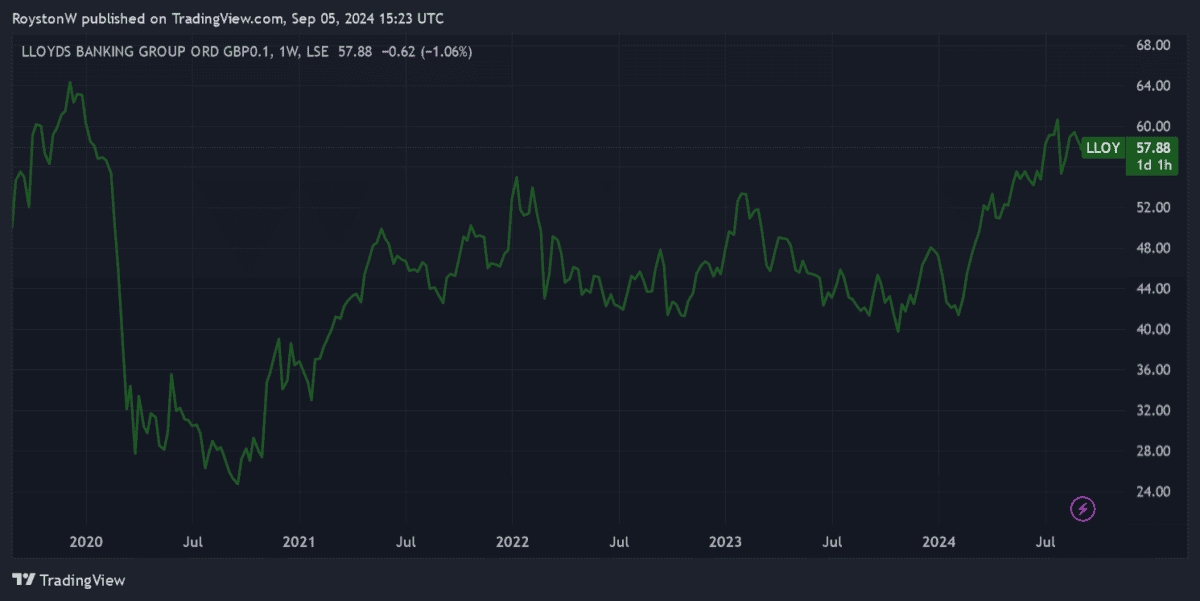

Lloyds Banking Group

Lloyds Banking Group (LSE:LLOY) is another popular Footsie share I’m steering well clear of. In fact, I think the possibility of a share price drop here might be higher than with BP in the short term.

One of my chief concerns is that net interest margins (NIMs) could slump over the next 12 months. As the Bank of England (BoE) gears up to cut interest rates, the profits retail banks make on their lending activities may be about to slide.

At Lloyds, the NIM dropped to 2.94% in the first half of 2024, from 3.18% a year earlier, as the benefit of tighter BoE policy earlier on unwound. This in turn pulled pre-tax profit 14% lower.

Traditional banks like this are also watching their margins erode as challenger banks expand their services and ramp up product investment.

Finally, The FTSE 100 bank might face billions of pounds worth of fines related to product mis-selling. The Financial Conduct Authority’s (FCA) investigating claims of overcharging for car loans, for which Lloyds has already set aside £450m. Some analysts believe the final cost could end up somewhere near £4bn.

On the plus side, Lloyds’ earnings could impress if the UK economic recovery continues, driving its share price higher. But this is by no means a certainty if inflationary pressures remain and the cooling US economy causes a broader global slowdown.

On balance, the risks of owning Lloyds shares are also too high for my liking.