Investing in FTSE 250 shares can be an excellent way to make money. This prestigious UK index is packed with mid-cap companies with excellent growth potential, and annual returns here have grown by double-digit percentages on average.

Here are two top stocks and an exchange-traded fund (ETF) I’d buy to target monster wealth if I had spare cash to invest.

The fund

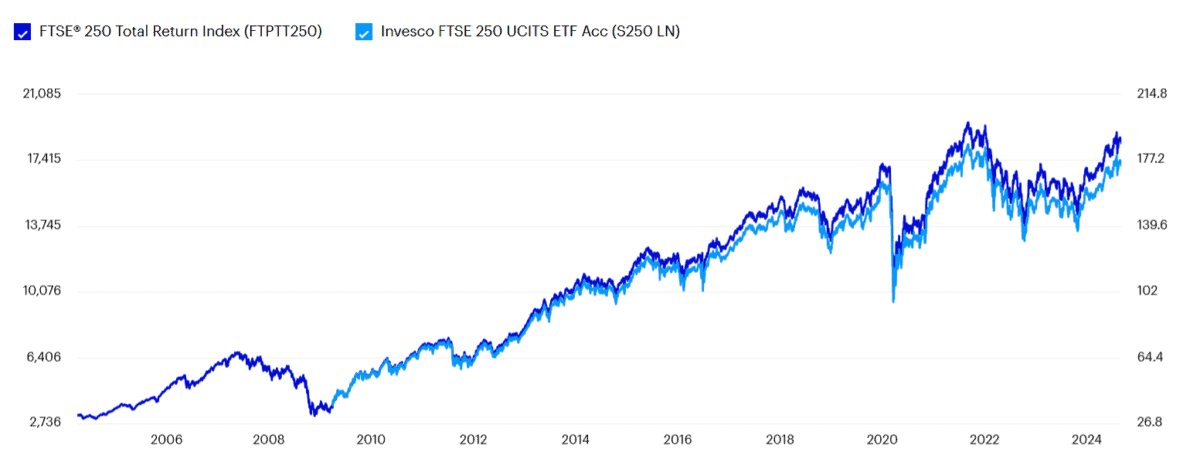

The simplest way to get exposure to the mid-cap index is by investing in an ETF. With an ongoing charge of just 0.12%, the Invesco FTSE 250 UCITS ETF Acc‘s (LSE:S250) one of the cheapest ways to go about this.

Should you invest £1,000 in Deliveroo right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Deliveroo made the list?

As you’d expect, this vehicle closely mimics the performance of the FTSE 250. However, due to issues like fund fees, tracking errors, currency fluctuations, and the timing of dividend reinvestments, it’s delivered a slightly worse return than the broader index.

This is a common risk of investing in ETFs. However, an average annual return of 10.68% since its launch in 2009’s certainly good.

Owning a fund like this gives me exposure to hundreds of growth opportunities. It also allows me to effectively spread risk.

But as with any index, the FTSE 250’s packed with duds as well as stars, and so the bad performance of some stocks can mean I make worse returns than if I’d just bought certain individual shares.

The defence star

With this in mind, I’d might consider buying Babcock International (LSE:BAB) shares to aim for index-beating returns.

This is thanks in part to its cheapness versus other major UK defence sector shares. It trades on a forward price-to-earnings (P/E) ratio of 11.4 times. By comparison, BAE System, Rolls-Royce and Chemring trade on multiples of 19.4 times, 28.2 times and 19.9 times respectively.

Theoretically, Babcock’s cheapness today could make it a great contender for solid price gains over time, as the market recognises its value and re-rates its shares.

I’d also buy Babcock as it has an excellent chance to increase earnings (and its share price) as defence spending ratchets up. An 9% improvement in its contract backlog last year shows how the business is seizing this opportunity.

Fears of growing conflict in Europe, the Middle East and possibly elsewhere mean arms budgets should continue to grow. Remember though, Babcock’s profits growth could take a hit if supply chain issues in the defence industry persists.

The fantasy hero

Games Workshop‘s (LSE:GAW) another FTSE 250 stock I believe could deliver outstanding returns. As a shareholder and a keen hobbyist, I understand the enormous growth potential with this UK share.

The fantasy wargaming giant’s share price has rocketed 1,700% over the last decade, reflecting surging demand for its fantasy wargaming products. I don’t think it’s done yet either.

Lucrative markets in North America and Asia have much further to grow, and Games Workshop’s expanding its store estate to capture this opportunity.

Products like Warhammer 40,000 are seen as the gold standard in this fast-growing hobby. It means the business enjoys stunning profit margins — its gross margin grew to 69.4% in the 12 months to May. Their high desirability also means sales remain robust even during economic downturns.

Rising competition and increased counterfeiting represent a problem. But on balance, I believe Games Workshop remains a great stock to consider.