What is the difference between a dividend yield of 3.1% (the FTSE 250 average) and one of 9.8%? In the short term, it is £6.70 per year for each £100 I invest.

I am a long-term investor though. Over the long term, that difference is enormous.

Imagine I invest £1,000 today and compound it at 3.1% annually for 3.1%. After 30 years, it should be worth £2,499. If I invest that £1,000 today and compound it at 9.8% annually for the same period, after 30 years it should be worth £16,522!

Should you invest £1,000 in British American Tobacco right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if British American Tobacco made the list?

Looking to the long term

Compounding partly works on the basis of the price at which I can make a share purchase in future. In practice, nobody yet knows that. But it also relies on a given dividend yield, in this case, a steady 9.8% for 30 years.

One well-known FTSE 250 share that currently offers such a yield is abrdn (LSE: ABDN). Can it maintain that payout in decades to come?

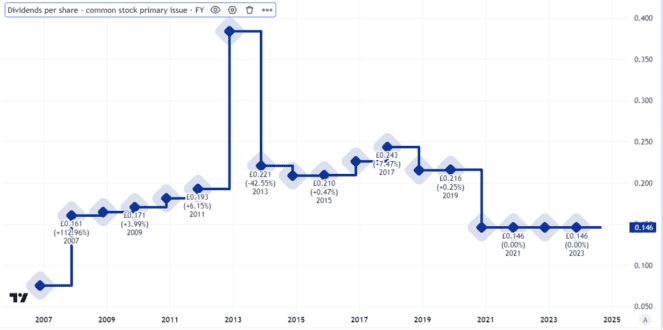

Patchy track record on dividends

Although past performance is not necessarily a guide to what may happen in future, it can provide investors with useful context.

Over the past seven years, the FTSE 250 financial services firm has not raised its dividend per share at all, but has cut it twice.

Created using TradingView

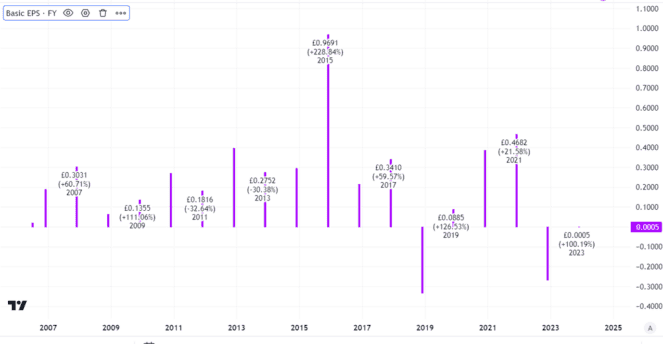

The reason? Basically, the business performance has been very inconsistent. Indeed, a quick look at the firm’s history of basic earnings per share makes the point.

Created using TradingView

Hard to judge where things might go

On one hand, earnings per share are not a great metric to use when assessing a financial services company. Factors like asset valuation changes can affect earnings dramatically, even though they may not affect cash flows.

On the other hand, such inconsistent earnings (including some notable losses) do not strike me as consistent with a successful, well-run company plotting a path to the sunlit uplands of maintaining or growing shareholder payouts. There is a reason abrdn has cut its dividend repeatedly over the past seven years.

I think that has partly reflected an underperforming business strategy that has been changed along the way. As its daft name reflects, the firm has suffered something of an identity crisis, which may not be a good way to attract clients in an industry where consistency is valued highly.

Still, the firm has a sizeable client base. In the first quarter of the year, assets under management and administration grew slightly compared to the prior quarter, reaching over half a trillion pounds. This is no FTSE 250 minnow.

A cost-cutting programme could help boost profitability (though I also see a risk it could backfire if it reduces staff productivity). The interactive investor platform could help boost abrdn’s long-term potential as more investors choose to invest digitally.

Potential for ongoing high income

A financial downturn could hurt that performance though, if investors lose their enthusiasm just like abrdn lost its vowels.

Still, although the dividend could fall again if business is weak, if the company maintains its performance, the high payout may stay.

So from an income perspective, I see abrdn as a FTSE 250 share investors should consider buying.