From a statistical point of view, movements in the BP (LSE:BP.) share price are heavily correlated with changes in the price of a barrel of oil on world markets.

With Brent crude falling back 20% from its 2024 peak, it’s therefore not surprising that BP’s shares hit a 52-week low during trading on 6 September.

A buying opportunity?

In theory, now could be a good time to consider investing. Despite the global move towards net zero, the demand for oil shows no sign of slowing.

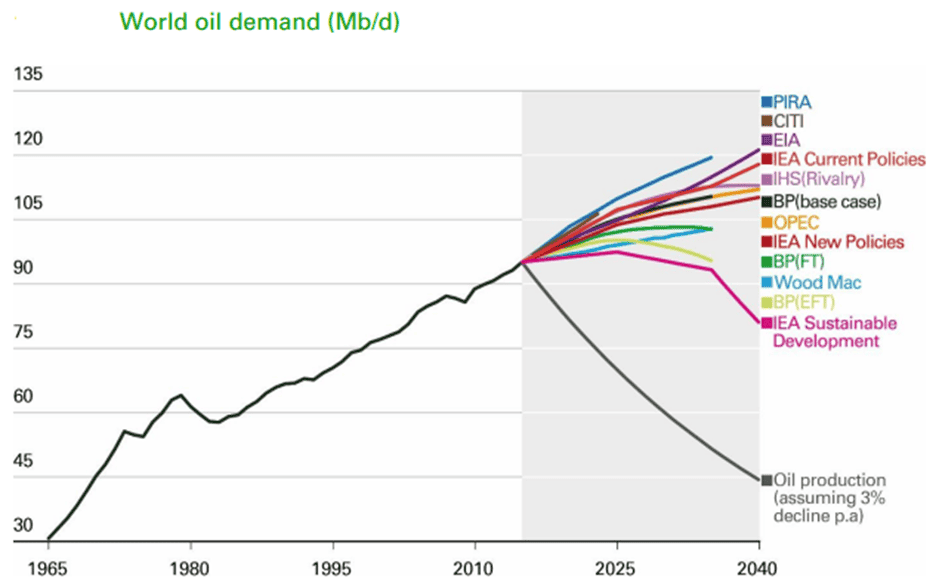

The US Energy Information Administration predicts that ‘peak oil’ will not occur until 2050. Most expect it to happen sooner but BP’s own study of forecasts (see below) shows a wide range of opinions.

The truth of the matter is that nobody really knows when the market will peak. But all agree that demand for the black stuff will continue to rise in the short term.

A bit of a lottery

It’s a similar story when it comes to predicting oil prices.

Some academic studies have shown that assuming tomorrow’s price will be the same as today’s is just as accurate as the results produced by so-called ‘experts’ using sophisticated forecasting techniques.

That’s because nobody can predict with any certainty the behaviour of OPEC, whose members adjust supply to keep prices high.

And it’s impossible to forecast accurately how the performance of the global economy will impact consumption.

If these two factors weren’t difficult enough, there’s also the issue of geopolitics to consider.

With all this uncertainty over demand, supply and prices — coupled with the industry’s lack of green credentials — it’s easy to see why some people are nervous about investing in the sector.

Not enough passive income

To compensate for this risk, I’d expect to receive a generous dividend from any energy stock that I invest in.

In respect of its 2024 financial year, it looks as though BP will declare a payout of 31.2 cents (23.74p) a share. This implies a yield of 5.8%.

Not bad. It’s comfortably above the average of the FTSE 100 of 3.8%.

However, it’s not enough for me. And it’s the only thing that’s stopping me from investing. I’d need more of a return to invest in BP even though I believe it to be a quality company.

As its former chief executive once said, when things are in its favour it can be something of a “cash machine”. During the first six months of 2024, it reported operating cash flows of $13.1bn.

And for the four quarters ended 30 June 2024, it’s recorded an underlying replacement cost profit (its preferred measure of earnings) of 69.9 cents (53.2p) a share. This means the stock has a trailing 12-months price-to-earnings ratio of 7.7.

That’s low by historical standards and below that of many of the company’s overseas peers. For example, Exxon Mobil’s shares trade on a multiple of 13.6.

For these reasons, BP’s current share price could be an attractive entry point. I just wish its dividend was higher — in cash terms its payout in 2023 was 31% lower than in 2019.