Being a shareholder in boohoo (LSE: BOO) could mean plenty of tears. Over the past five years, the boohoo share price has shed 89% of its value. That is the case even after a jump of 9% yesterday (5 September)!

That is not all. The business is in much worse shape now than it was a few years ago.

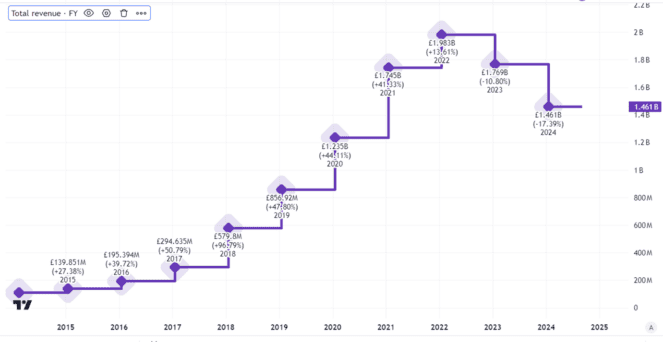

Years of revenue growth have ended and sales have been declining.

Created using TradingView

That might not bother me if it reflected the company pushing to improve profitability.

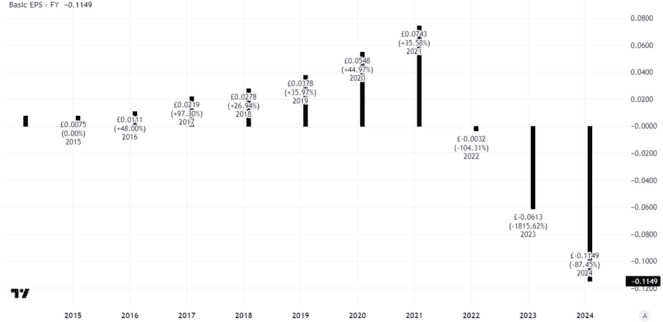

But in fact the profits picture at boohoo over the past few years has been horrible, pure and simple. Look at this chart showing basic earnings per share.

Created using TradingView

So, could the dramatic price fall indicate a share in a loss-making company that is on the march to zero? Or, given boohoo’s previously strong business performance, could now be a great opportunity for investors to get in at a bargain valuation?

Ongoing challenges equate to sizeable risk

Personally I have no plans to buy. I already hold boohoo shares and so far they have performed disastrously. In fact, boohoo has been one of my worst-performing investments as it stands.

Yesterday’s price jump did not have a specific trigger related to boohoo directly. I think perhaps it was a spillover from a market update provided by rival ASOS.

The last significant news we heard from boohoo was back in May, when it released its annual results. Overall these did not impress me, with revenues falling 17% and the pre-tax loss ballooning 69% to £160m. A slim net cash position at the end of the prior year had turned into a £95m net debt position this time around.

The company sounded an upbeat note nonetheless and says that last year it “took significant steps to reposition the group for sustainable, profitable growth”.

It points to lowered costs, more automation and a focus on core brands as drivers for future performance. Capital expenditure is expected to fall after the company has been spending money on its warehousing and distribution facilities in recent years.

boohoo expects to generate free cash flow this year. Still, there are clearly risks here.

Not a share I’d buy today

One school of thought is that if a shareholder would not buy shares they already own today, they must think they are overvalued and logically should sell them.

In fact I plan to hang on to my boohoo shares for now at least. I still like the company’s portfolio of brands and its once-proven business model, albeit that the past several years have undermined my former confidence in that to some extent. I will be paying close attention to see whether the company’s confidence for this year and beyond is borne out by performance.

If I did not already hold this share, however, I would not buy now, despite the share price being in pennies. Instead I would wait for further proof of business recovery.

For now, the risks remain sizeable and, unless performance turns around in what is a brutally competitive market made more so by growing Chinese rivals, I think the share price could ultimately go to zero.