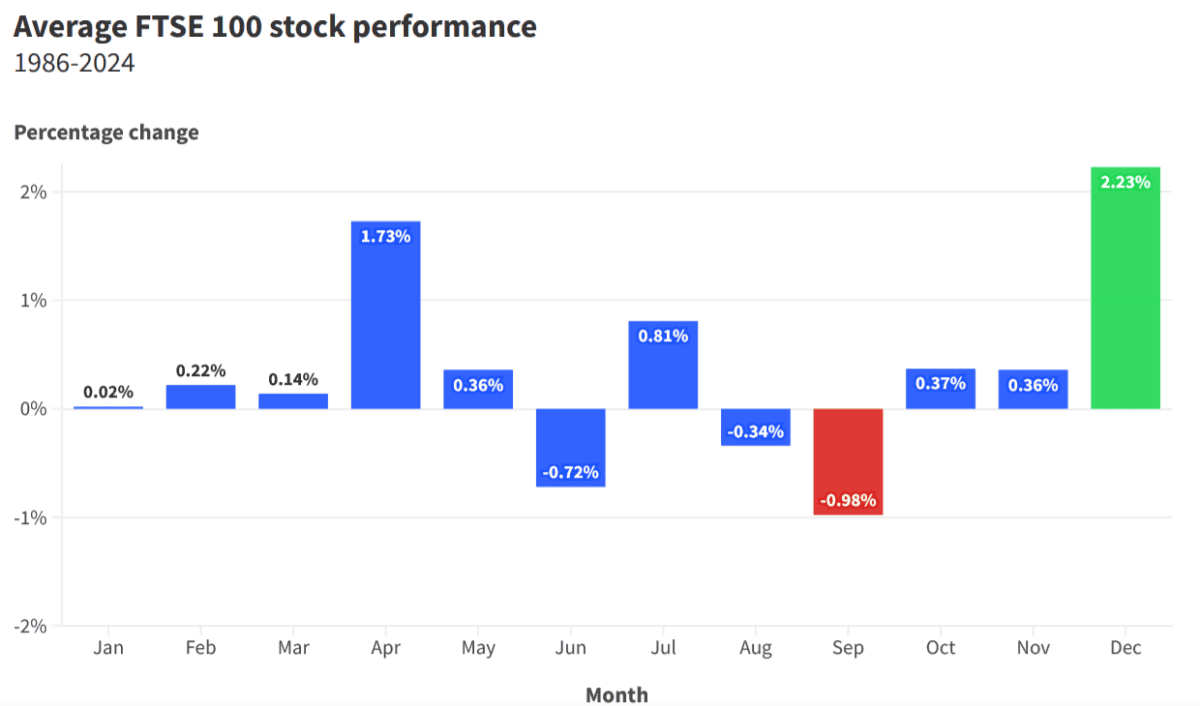

The omens aren’t good for investors who are looking to make large gains in September. Data shows that the ninth month of the year is easily the worst for UK share prices.

According to Finder.com, the FTSE 100 has fallen, on average, 1% each September going all the way back to the mid-1980s.

To be fair, other major international indexes have also historically recorded their worst performances in September. The Euro Stoxx 50 has dropped 2.13% on average, while the S&P 500 and Nikkei 225 have reversed 0.88% and 0.83%, respectively.

So what should I do now?

What’s happening?

Firstly, it’s worth considering why indexes like the Footsie fall during the first month of autumn.

Price comparison expert Finder has a few theories. These include:

- Institutional factors, like investors selling close to the end of the third quarter

- Funds exiting less successful investments before the quarter finishes

- Investors who are returning from summer holidays taking profits and offsetting gains with losses before the end of the year

- Negative market expectations for September prompting selling as part of a ‘self-fulfilling prophecy’

What next?

So the ‘September effect’ is likely a market irregularity, then, rather than a sound reason to sell up and head for hills.

As someone who invests for the long haul — I aim to hold the stocks I buy for a minimum of five years — I’m not nervous at the prospect of another poor September. I’m confident that the stocks I buy will steadily gain in value over a prolonged period.

In fact, I’ll be doing the opposite of many investors this month. I’ll be looking for oversold bargains to add to my portfolio. This way, I have a chance of making greater capital gains by buying in even lower than I would expect to otherwise thanks to September’s market anomaly.

A top dip buy

One share I’m already looking at today is Hochschild Mining (LSE:HOC).

The precious metals miner has endured a poor start to September, and now looks like it could be too cheap to miss. It trades on a forward price-to-earnings (P/E) ratio of 8.2 times.

Hochschild’s fall isn’t chiefly down to this month’s historical cool down, however. It more likely reflects a fall in gold and silver prices as the US dollar has risen. An appreciating buck makes it less cost-effective to buy and hold dollar-denominated assets.

Mining companies are naturally vulnerable to volatility on commodity markets. The good news for gold producers, however, is that the yellow metal could recover strongly in the weeks and months ahead.

Prices touched new record peaks above $2,500 per ounce last month, driven by worries over economic growth, conflict in Europe and the Middle East, and expectations of higher inflation as central banks cut rates.

So I’d expect Hochschild shares to also rebound as metal prices improve. Yet I wouldn’t just buy the miner to capitalise on this. I think it could be a great share to own for the long haul to manage risk in my portfolio.

And at current prices, it could be a very cost-effective way for me to do so.